Good evening. Welcome to the second issue of The Wire. This week’s stories bring to mind the many competitive races at the heart of U.S.-China relations. Whether it’s an FBI cat-and-mouse chase over economic espionage or how Huawei is outpacing the U.S. on 5G, both countries tend to view competition as winner-take-all. But in the face of a global pandemic, when power over others proves not only ineffective but also deadly, we’re reminded that power could also be a positive-sum game.

Want this emailed directly to your inbox? Sign up to receive our free newsletter. Subscribe to The Wire here. For a limited time, we’re offering one free article to users.

Operation Purple Maze

When employees of a Chinese agricultural giant tried to steal corn seeds from farms in Iowa, it set off an elaborate FBI investigation. Pulitzer Prize finalist Mara Hvistendahl recreates the epic chase in her new book, The Scientist and the Spy, which is excerpted in this week’s issue. In an interview with The Wire, she also goes deeper, asking readers to grapple with what the 2012 case teaches us today. In the past decade, combating Chinese industrial espionage has become one of the FBI’s top counterintelligence priorities, second only to fighting terrorism. But is the government overzealous in its efforts to protect the intellectual property of multinational corporations like Monsanto?

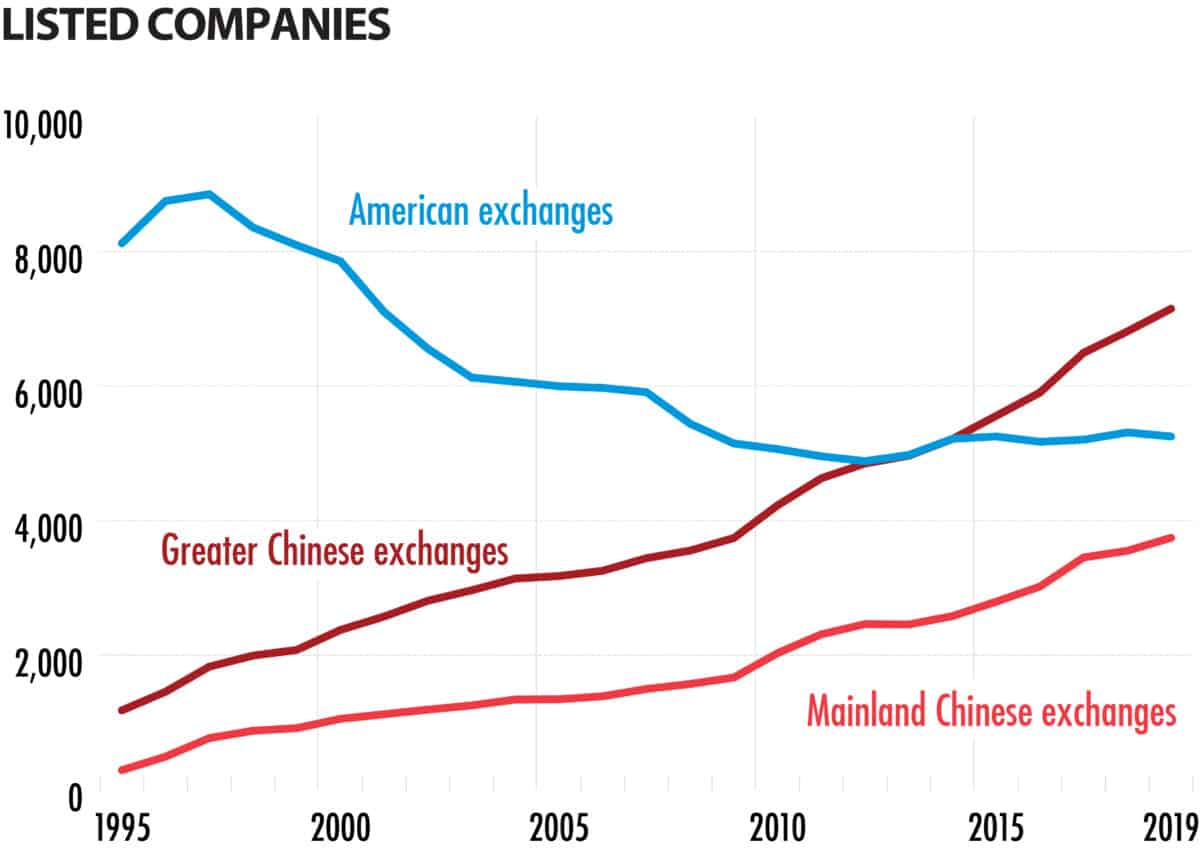

Data: World Federation of Exchanges

The Big Picture: China’s Stock Markets

In 1989, there was not a single publicly traded company in mainland China. Today, the country has close to 4,000 listed companies. The stock markets in mainland China remain deeply flawed — dogged by volatile share prices and poor regulatory oversight — but they now matter globally. If you include Hong Kong and Taiwan, Greater China is home to more listed companies than the United States. This week’s infographics show you some of the key metrics behind the rise.

China Goes on a Global Diet

In recent years, China’s global buying spree scooped up icons like New York’s Waldorf Astoria Hotel as well as stakes in Sweden’s Volvo and Wall Street’s Morgan Stanley. At its peak in 2016, outward investment crested at $196 billion. But foreign investment dropped by about 8 percent to $120 billion in 2019 — the third straight down year — signaling a major slump in the country’s overseas ambitions. In their piece this week, The Wire reporters David Barboza and Shen Lu find that China’s effort to acquire resources and technology from abroad has been hampered by its economic slowdown at home as well as growing hostility to the country’s investments in other parts of the world. And the impact of the Covid-19 pandemic is likely to further dampen Chinese outbound investments for a lengthy period of time, analysts say.

China and America Are Failing the Pandemic Test

While trade wars have set back economic globalization, Joe Nye argues in an op-ed for The Wire that environmental globalization, reflected in pandemics and climate change, obeys the laws of biology and physics, not politics. In a world where borders are becoming more porous to everything from drugs and illicit financial flows to infectious diseases and cyber terrorism, countries must use their soft power of attraction to develop networks and institutions that address the new threats. On transnational issues like Covid-19 and climate change, it is not enough to think of power over others; one must also consider power with others.

Week in Review: Decoding the Covid-19 Downturn

Each week, The Wire’s Dave Smith rounds up the most interesting China news and insights you may have missed. This week, he addresses why Wuhan’s small businesses are up in arms, how chicken feet tell a trade tale, and the big question of how angry a divorce it will be between the U.S. and China. On the latter point, Ian Bremmer and Cliff Kupchan of The Eurasia Group write that the coronavirus pandemic has dramatically accelerated and extended the separation between the two economic rivals in the manufacturing and services sectors, forcing many companies to rapidly switch supply chains, close facilities, and move staff. Trends of broader decoupling will become more deeply entrenched, they warn, while other countries will face difficulties in balancing relations with both sides.

A Q&A With Willy Shih

Willy C. Shih, a professor at Harvard Business School, is an expert on supply chains and intellectual property rights. In this interview with The Wire’s David Barboza, he explains why Huawei is at the forefront of 5G, how Covid-19 shocked supply chains, and why the U.S. needs to “run faster” in the technology race.

Willy Shih

Illustration by Lauren Crow

Subscribe today for unlimited access, starting at only $19 a month.