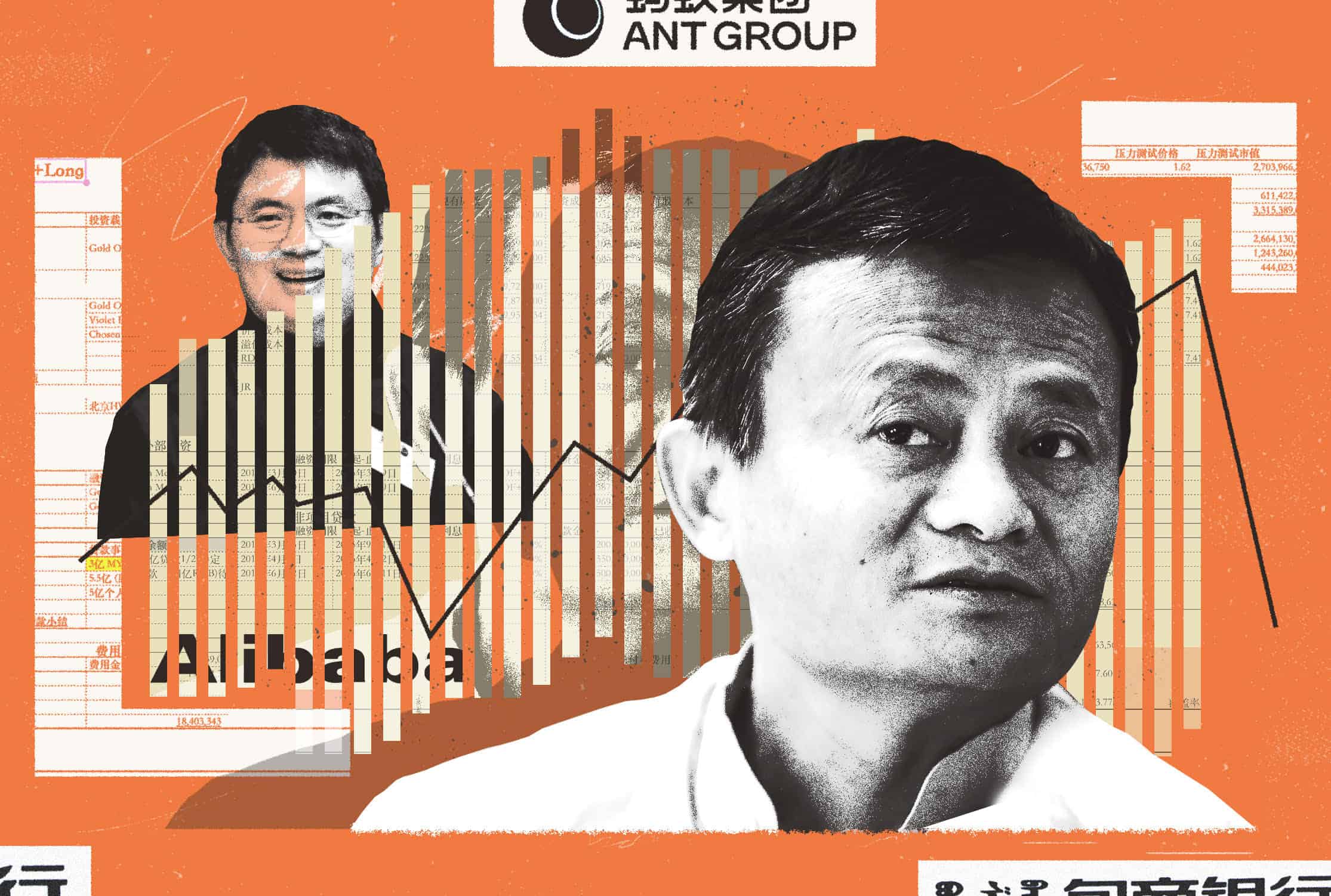

Global stock markets may be melting at the moment, but in this issue of The Wire, we introduce readers to the world of Chinese listings, publicly traded companies that are a growing part of the stock portfolio of global investors. Since most of the world’s so-called “unicorns,” or startups valued at $1 billion or more, are based in China, many of them will bolster China's stock listings. But first, let’s take you back in time.

In 1989, there was not a single publicly traded company in

Navigate China's Business Landscape with Confidence.

- Gain visibility into supplier risks

- Easily manage trade compliance

- Conduct in-depth due diligence