Good evening. C-3PO, who made his movie debut in 1977, was far ahead of his time. The humanoid robot from Star Wars could walk, talk, reason and save the day. Almost half a century later, no nation is trying harder to create a worthy 21st century successor to him than China. The country is in the midst of an industrial robot revolution and dominates the global market for drones and quadruped — or robodog — machines. But even with policy support and financial backing from the Chinese state, Rachel Cheung writes in this week’s cover story, making the leap to humanoid robots has proven extremely difficult. This is not a matter of helping an industry achieve scale in China’s massive domestic market and then exporting the resulting overcapacity to the rest of the world, as happened with relatively easy-to-master technologies such as solar panels, wind turbines and electric vehicles. The technological advancements required for truly useful — and economically viable — humanoid robots are a far more daunting challenge.

Also in this week’s issue: Stablecoins pegged to Hong Kong’s U.S. dollar-peg; It’s tip-off time in China for the NBA; Lael Brainard on dealing with Beijing for three presidents; and Stephen Roach on Trumponomics vs. China’s “all-of-government” approach.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

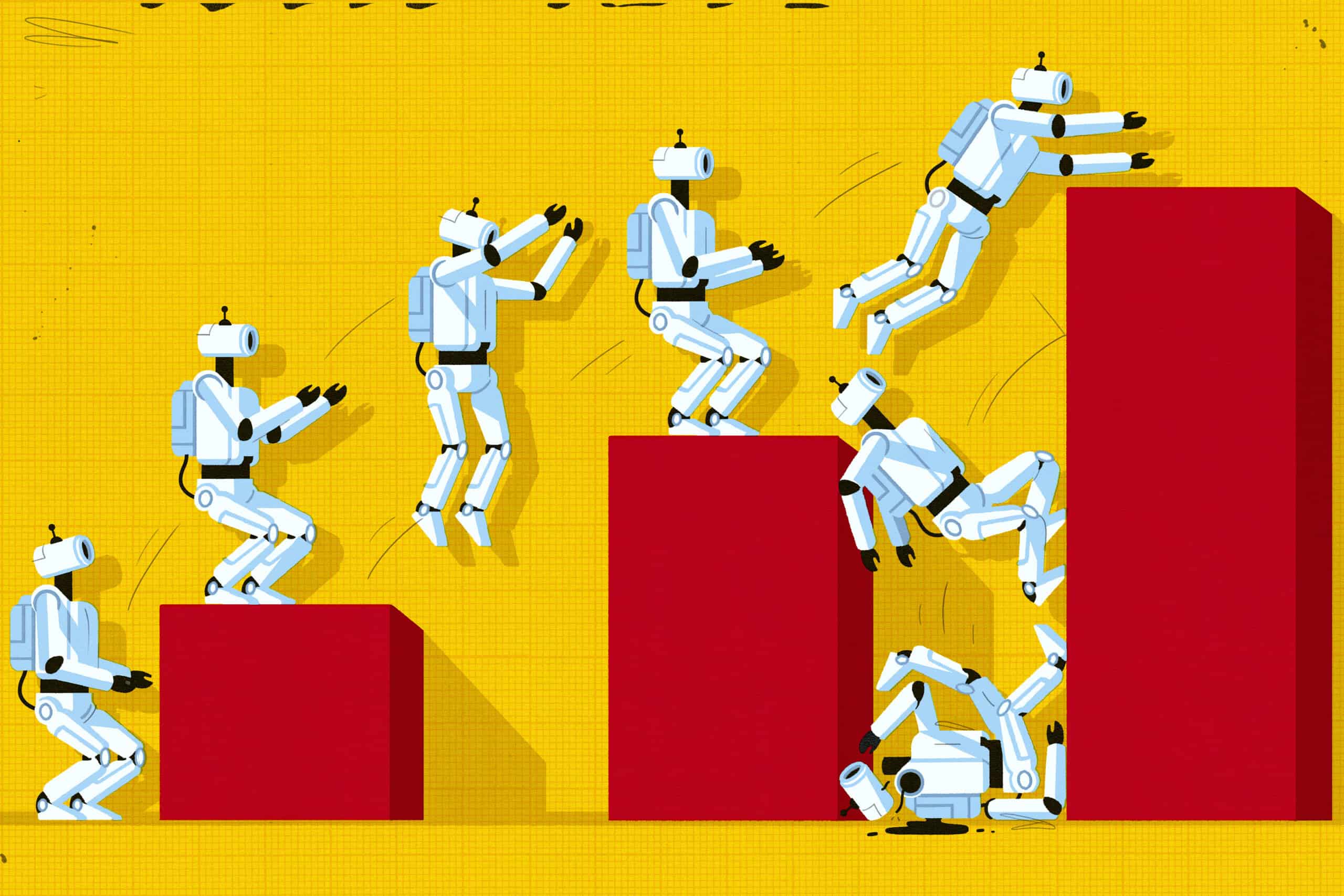

Lion Bodies, Scarecrow Brains

Humanoid robots are the hot new thing in China’s tech sector. In the first nine months of this year, Chinese startups in the sector raised 17 billion yuan ($2.4 billion) — about as much as they did over the previous three years. But is the exuberance rational or irrational? The humanoids are ever more impressive in form and function — some can even kickbox. But development of the software “brains”, which will ultimately determine whether they can perform well enough to replace human workers for various tasks, is lagging.

The Big Picture: Hong Kong Embraces Stablecoins

Once you wrap your head around the concept, stablecoins seem anything but stable. If The Wire China were to jump into this arena, we would try to sell you our make-believe WireCoins for your real money — one WireCoin for $10 please. We then invest your real money in a real security for a real return, while you try to find someone who will accept your WireCoins as payment for their products or services. The U.S. government, taking its lead from President Donald Trump, his family and his business partners, loves the concept. The fiscally conservative Chinese government does not. But could a move by Hong Kong to issue licenses for digital currencies pegged to the territory’s currency signal a future shift in Beijing’s skepticism towards cryptocurrencies?

The NBA is Back

The world’s best basketball players haven’t played on Chinese courts in six years. When they take to the hardwood in Macau on Friday, they will not only bring the NBA back to China but also close the door — for now — on a tiff with Beijing that cost the league hundreds of millions of dollars. The NBA is now set to reap the rewards from China’s half-billion basketball fans, but as Noah Berman reports, the detente is being met with criticism that a league known for its progressive values has sold out.

A Q&A with Lael Brainard

Lael Brainard, a former vice chair of the Federal Reserve, is a veteran of the Clinton, Obama and Biden administrations, who she advised on a range of China financial and economic policy issues.

In this week’s Q&A, Brainard speaks with Bob Davis about why the Almighty Dollar need not fear China’s yuan, provided the Trump administration can avoid a “Liz Truss moment” and persistently high inflation; China’s World Trade Organization accession negotiations with the U.S. in the 1990s; and President Barack Obama’s efforts to correct what his administration saw as an undervalued Chinese currency. When dealing with China, she advises, “you need to be very tough and willing to take on some costs to secure certain outcomes”.

Lael Brainard

Illustration by Lauren Crow

Plan Beats No Plan

As partisan bickering over spending bills shut down the U.S. government yet again last week, the Chinese government was working on its 15th five-year plan (2026-2030). In this week’s op-ed, Stephen Roach marvels at the contrast. Like America after World War Two, China realises the future will be different from the present and is preparing for it. By contrast, writes Roach, under Trump and like China during the Cultural Revolution, “America has neither a plan nor a strategy.”

Subscribe today for unlimited access, starting at only $25 a month.