Good evening. For much of the past two decades, Europe’s luxury market has counted on the ferocious appetite of Chinese consumers to bolster its bottom line. But like all things China these days, that trend is changing. Our cover story this week looks at China’s shifting status symbols. Elsewhere, we have a rundown of the key figures in the China-focused legal world; an interview with Jay Shambaugh, Treasury’s undersecretary for international affairs, on getting China to change course; a reported piece on if China will stymie a steel deal; and an op-ed from Paul Triolo and Kendra Schaefer on why China’s AI pioneers face a critical year. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Status Symbol

Foreign luxury brands are facing a reckoning in China. Not only is China’s economy entering a more uncertain phase, giving consumers pause, but homegrown designers and labels are also gaining ground. The questions now are which European brands can still rely on China, and how China’s domestic designers can capture a share of the pie. Rachel Cheung reports.

Who’s Who: China-focused Lawyers

In this inaugural edition of the “Who’s Who,” The Wire presents a rundown of the key figures in the China-focused legal sphere specializing in capital markets, mergers and acquisitions, and export controls and economic sanctions, as well as key China-based lawyers.

A Q&A with Jay Shambaugh

Jay Shambaugh, Treasury’s undersecretary for international affairs, leads regular meetings of U.S.-China economic working groups and recently returned from a trip to China with Secretary Janet Yellen. Prior to joining the Treasury in early 2023, Shambaugh was an international economist at George Washington University and focused on currencies, exchange rates, and macroeconomics. During the Obama administration, he was chief economist at the White House’s Council of Economic Advisers. He also spent three years as director of the Hamilton Project, an economic policy group at the Brookings Institution. In this week’s Q&A with Bob Davis — part of our ‘Rules of Engagement’ series — he gives an inside-the-room account of the latest talks, including the U.S.’s efforts to get Beijing to address overcapacity and economic imbalances; how the two countries would deal with any future financial crisis; and whether China is deliberately letting its currency devalue.

Jay Shambaugh

Illustration by Kate Copeland

Will China Stymie A Steel Deal?

Politicians say Nippon Steel’s Chinese links are a risk in its proposed merger with U.S. Steel, though the Japanese company’s presence in China is small. Eliot Chen reports.

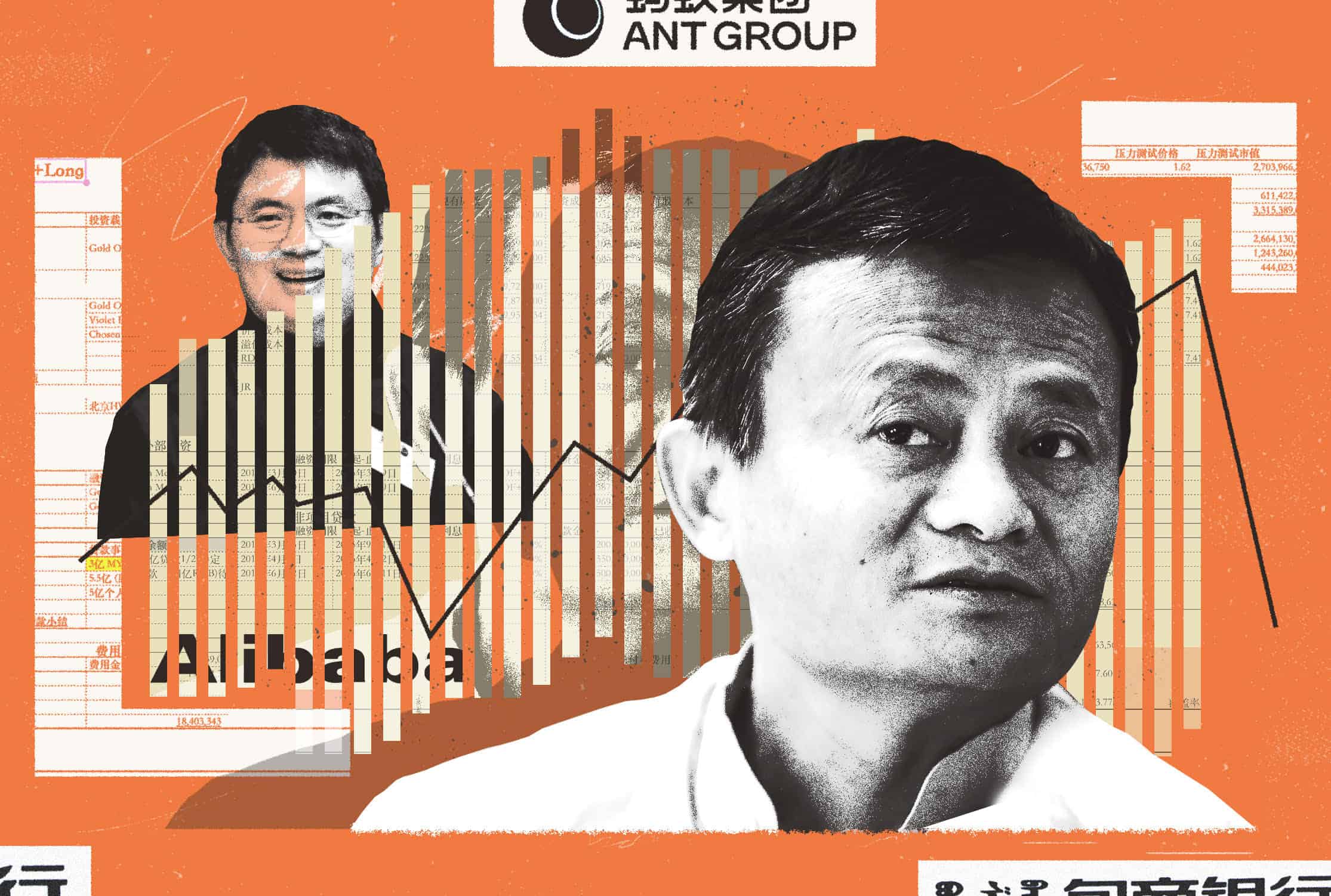

China’s AI Pioneers Face A Critical Year

Right now, China’s AI development environment is notably diffuse, with approximately 50 Chinese companies currently developing models. Paul Triolo and Kendra Schaefer look at how market leaders might emerge.

Subscribe today for unlimited access, starting at only $19 a month.