Good evening. The Xinjiang Production and Construction Corps, or the XPCC, is known as many things: the bingtuan, the paramilitary group that runs detention and labor camps for Uyghurs, or the farmer-soldiers tasked with settling one of China’s most remote regions. But our cover story this week takes a closer look because the XPCC, analysts say, is often misunderstood, and you can’t really understand Xinjiang — or what is happening there — without understanding the secretive organization. Elsewhere, we have a Q&A with Jasper Becker, the journalist whose new book looks at the context surrounding the Wuhan lab leak theories; a reported piece on the quest for law firms to better understand CFIUS and its rulings; infographics on how China’s property downturn could squeeze local governments; and an op-ed from Victor Shih about how deleveraging China’s property sector could turn out poorly for policy innovation. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Corps of Xinjiang

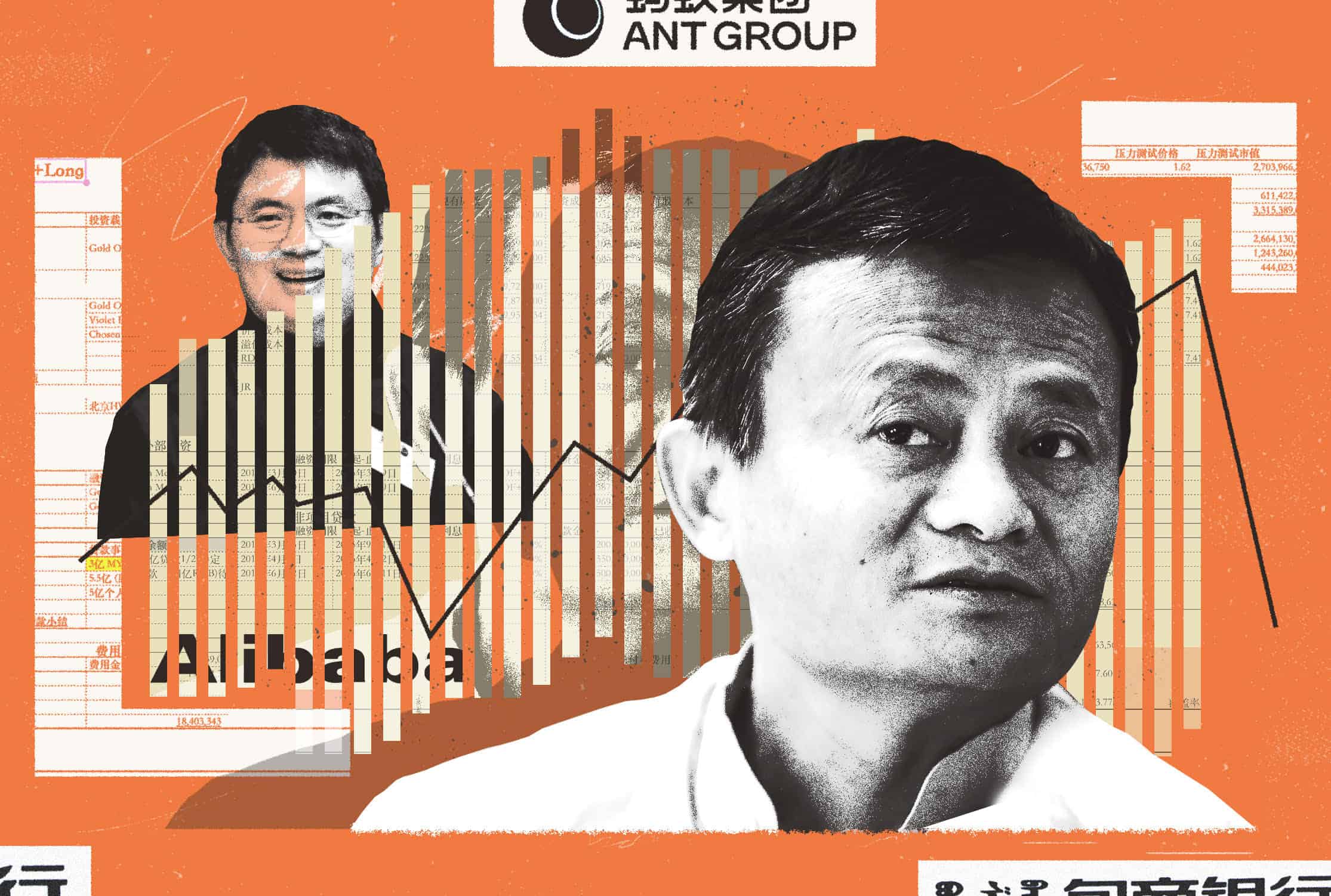

As the U.S. grapples with how to respond to the genocide taking place in Xinjiang, it is frequently turning to sanctions as its chosen policy tool. But with many of them directed towards the Xinjiang Production and Construction Corps, a paramilitary organization, are sanctions really effective? As Katrina Northrop reports this week, the XPCC is also a corporate conglomerate with close to 3,000 majority-owned subsidiaries, and it has a long and unique relationship with the central government. Indeed, it has been described as “a state-owned enterprise on steroids,” and several analysts say that you can’t separate it from the rest of China.

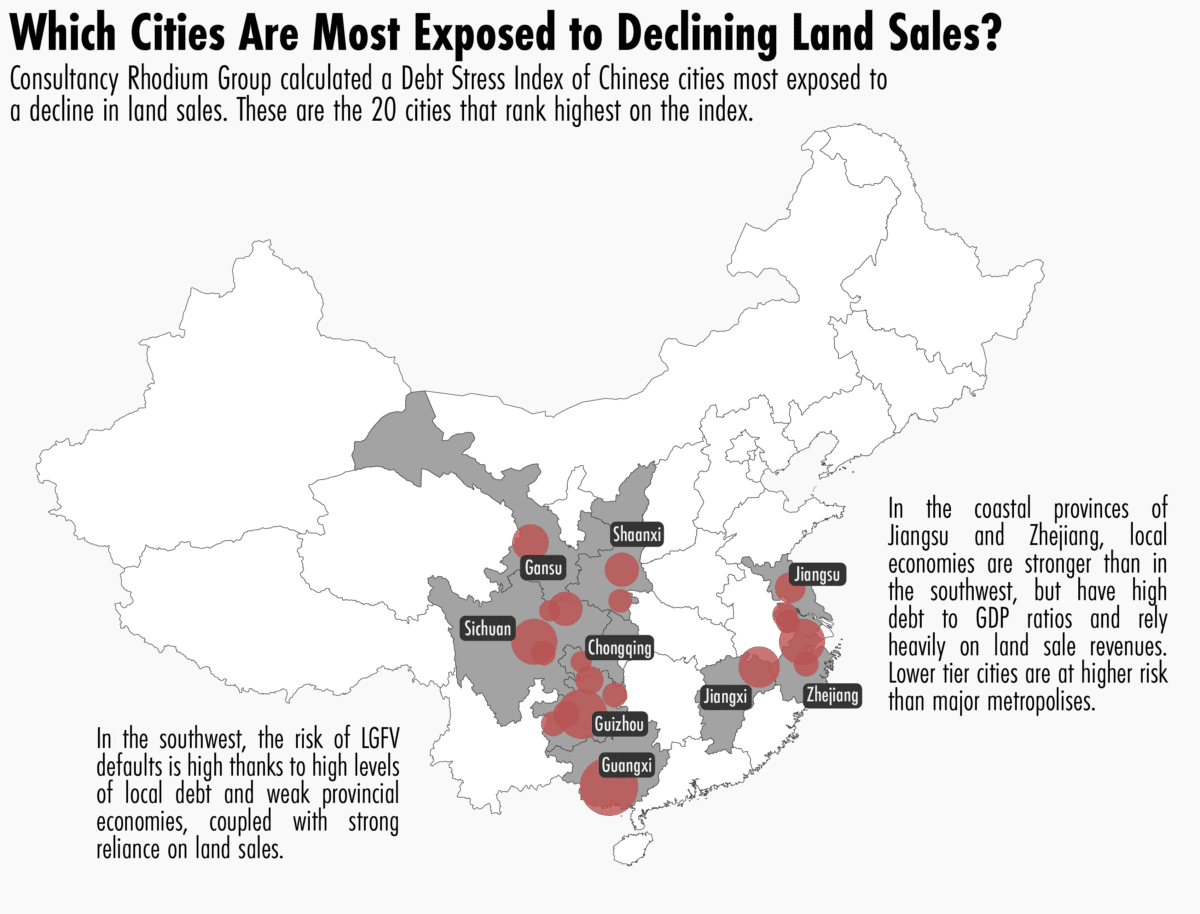

The Big Picture: The Local Government Squeeze

China’s property developers are facing a reckoning with their outsized debt burdens. Evergrande Group may have avoided defaulting on its bonds for now, but several of its peers have already done so. Nervous consumers are holding off from buying homes — property prices dropped for the first time in six years in September. This week, infographics by Eliot Chen look at how China’s property downturn could shake local governments, including which regions are most at risk and whether a controversial new property tax could help solve local governments’ fiscal woes.

A Q&A with Jasper Becker

Jasper Becker is a British journalist who has written about China and Asia for more than 30 years. He is the author, most recently, of Made in China: Wuhan, Covid and the Quest for Biotech Supremacy. In this week’s Q&A with David Barboza, he talks about his new book and how to deal with China post-Covid, including the “quite damaging” circumstantial evidence, and demanding reciprocity with China.

Jasper Becker

Illustration by Lauren Crow

Seeking CFIUS

China will likely remain an important focus for the Committee on Foreign Investment in the United States (CFIUS), and law firms are responding by staffing up. But as Katrina Northrop reports this week, despite the power CFIUS wields — with its ability to recommend the President blocks or amends Chinese investments — its deliberations are opaque and difficult to predict, even for those who have direct experience of its workings.

The Longterm Consequences of China’s Cash-Strapped Cities

Evergrande’s debt crisis has already caused some short-term pain for the international bond market. But as Victor Shih argues in this week’s op-ed, while true deleveraging is painful, it is also bad for policy innovation. The problems facing China’s property developers, he argues, will reverberate through China’s economy for years to come.

Subscribe today for unlimited access, starting at only $19 a month.