Good evening. Only three Chinese companies trading in the U.S. have a market cap that exceeds the $100 billion mark: Alibaba Group Holdings, Pinduoduo, and JD.com. But Didi — the ridesharing app that boasts investors like Apple, Toyota, and SoftBank — could become the fourth when it debuts on the New York Stock Exchange next month. Our cover story this week explores the company’s spectacular rise and why its biggest obstacles seem to be at home. Elsewhere, we have an interview with Yanzhong Huang, the global health expert, about how China handled Covid; infographics about trade and cross-border investment between Australia and China; reporting on Shein, the Chinese brand disrupting the fast fashion industry; and an op-ed about why China’s new three-child policy won’t help its declining fertility rate. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Didi’s Big Debut

When Didi Chuxing, the taxi hailing app, IPOs on the New York Stock Exchange in July, it will signify a coming of age for Chinese internet companies. Didi already controls 90 percent of the Chinese ridesharing market, but has grand ambitions both for global expansion as well as innovations for so-called smart cities. But, as Didi tries to gain command of the global mobility market, many analysts say the biggest obstacle in its way could be Beijing. Ambreen Ali reports for this week’s cover story.

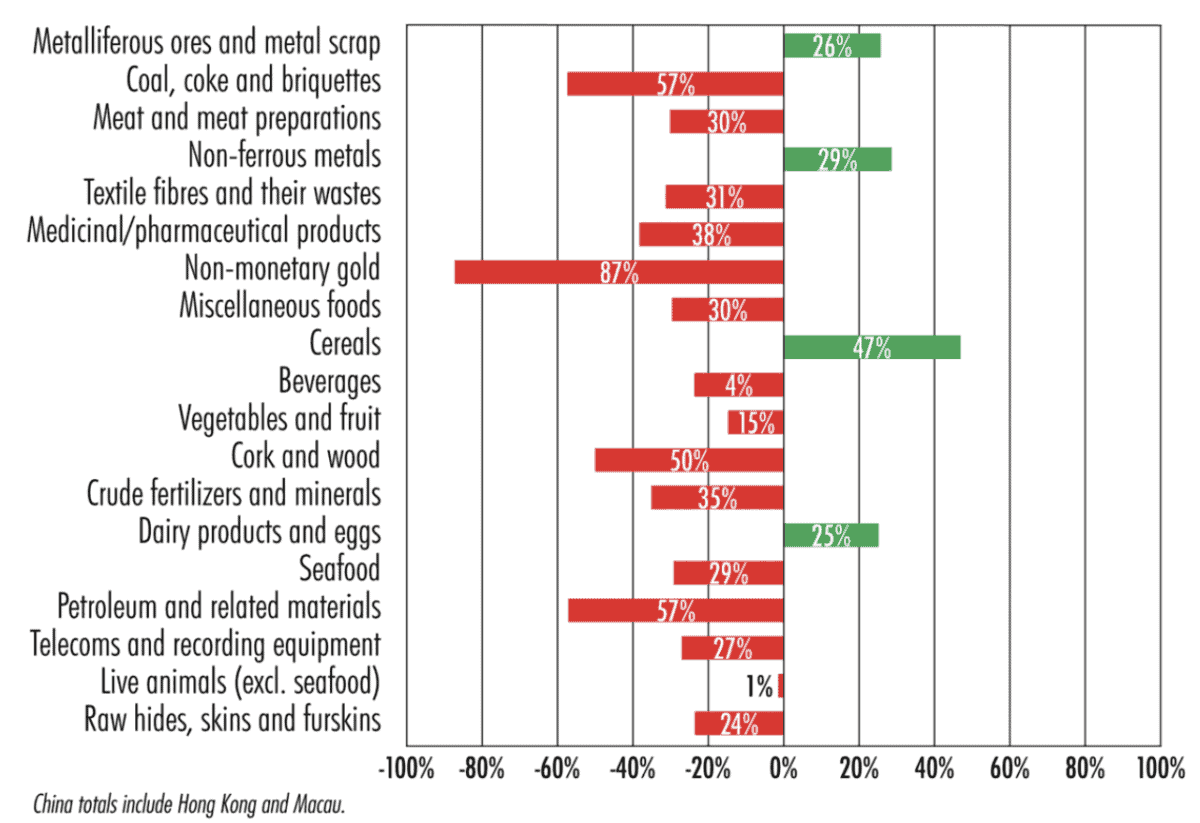

The Big Picture: Australia and China’s Downward Spiral, By the Numbers

While China’s relations with a number of countries have soured recently, the decline in its ties with Australia has been particularly sharp. And there appears to be no end in sight, which carries risks for both sides. This week, The Wire’s infographics dug into the trade and cross-border investment numbers to see where China and Australia’s mutual hostility is biting.

A Q&A with Yanzhong Huang

Currently a professor and director of global health studies at Seton Hall University’s School of Diplomacy and International Relations, as well as a senior fellow at the Council on Foreign Relations, Yanzhong Huang is an expert on Chinese and global health issues, particularly health governance and security. In this week’s interview with David Barboza, he talks about China’s handling of Covid-19, vaccines, and why — when it comes to policy implementation — China is remarkably resilient but also fundamentally flawed.

Yanzhong Huang

Illustration by Lauren Crow

Credit: Shein via Twitter

Fast Fashion, Faster Profits

Shein doesn’t own a single factory. But with 500 new clothing items introduced on its site daily (including skirts for $2.99) and a social media presence that just about every young woman in America has seen, the Chinese company is disrupting the fast fashion industry. As Lily Meier reports this week, investors like Sequoia Capital China, IDG Capital and Tiger Global Management are now betting the brand is the next e-commerce giant.

Credit: Peter Morgan, Creative Commons

China’s Three-Child Policy Won’t Help

Alarmed by new data showing that its fertility rate is now similar to that of aging Japan, China has announced that it will permit families to have up to three children. But as Nancy Qian, a professor at Northwestern University’s Kellogg School of Management, argues in this week’s op-ed, without broader reforms to address high costs of living and rural-urban divides, the new policy could make a difficult problem worse.

Subscribe today for unlimited access, starting at only $19 a month.