Good evening. At this point, everyone knows that China is guilty of some serious human rights abuses in Xinjiang. The United States government has officially determined that it qualifies as a genocide and a recent survey even showed that 54 percent of Americans knew that Uyghurs were being held in detention camps. But, as our cover story explores this week, even with this widespread acknowledgment, there has been a curious silence from the American business community. Elsewhere, we have a look at IDG Capital, as well as China’s surging demand for U.S. corn; a Q&A with Dan Wang about all things technological; and an op-ed from two scholars about why the quest for status should be divorced from the quest for hegemony. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Xinjiang Silence

The Wire surveyed the 48 largest U.S. businesses with operations in China and asked if they had a position on the well-documented evidence of the Chinese government’s systematic repression in Xinjiang — atrocities the U.S. government has deemed a genocide. The vast majority — 88 percent — did not reply or would not respond to questions. But as the U.S. government grows more forceful in its assessment of what is happening in the region, and as patience wears thin for American observers and consumers, Eli Binder and Katrina Northrop report that the business community’s “no comment” may no longer cut it.

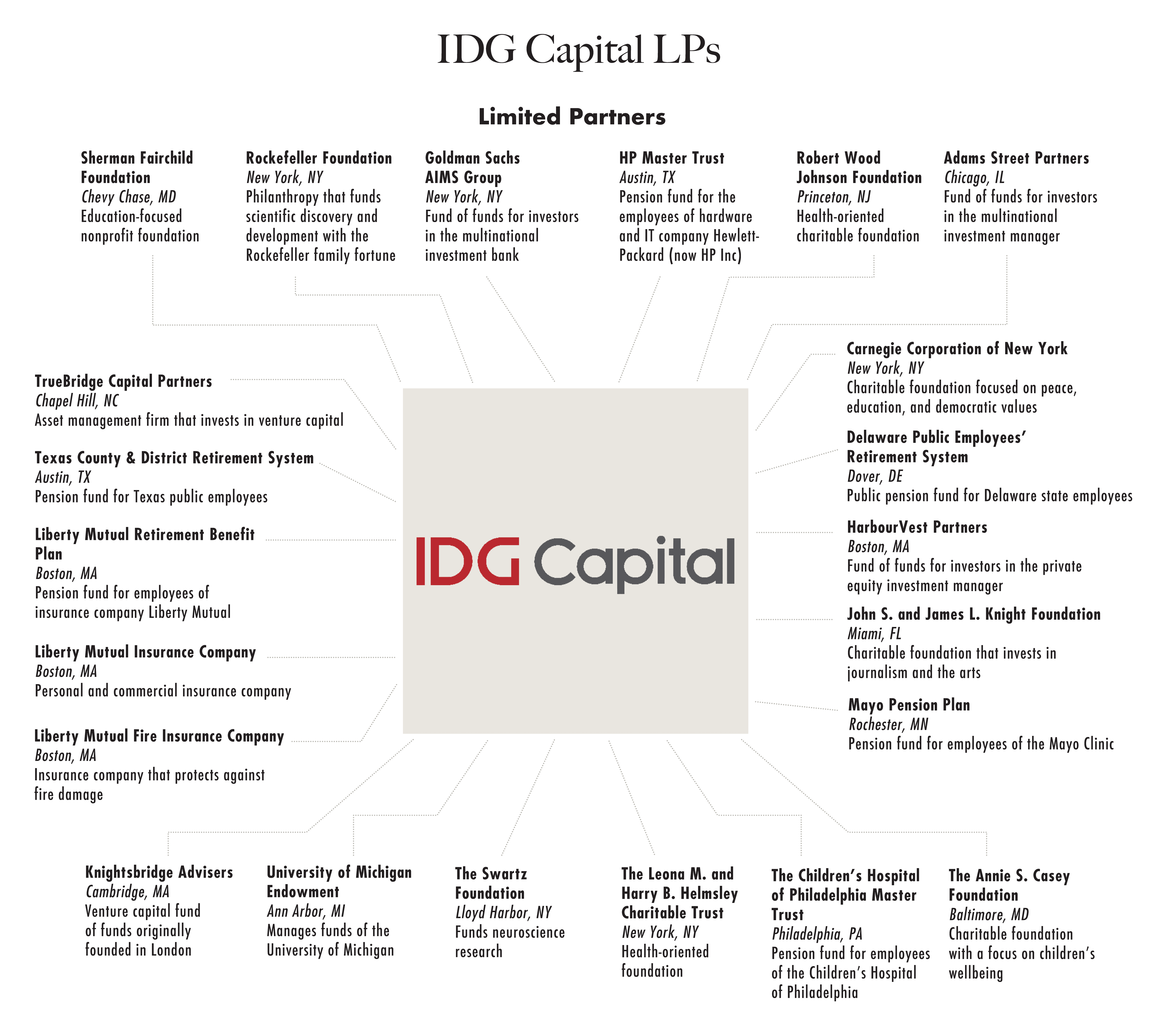

The Big Picture: Who Is IDG Capital?

Though IDG Capital was formed in the United States, its portfolio is predominantly Chinese, and the venture capital and private equity firm has backed some of China’s hottest startups. It made early bets on the Chinese search engine giant Baidu and the powerhouse social networking and gaming giant Tencent, and it has also backed Xiaomi, SenseTime, Pony.ai and the e-commerce giant Pinduoduo. Today, it has over $23 billion in assets under management, according to PitchBook. This week, our infographics break down one of China’s leading investment firms.

Credit: TumblingRuns, Creative Commons

A Kernel of Hope

In the treacherous trade relationship between the United States and China, there has been one kernel of hope: corn. During the past year, corn exports to China have reached record levels. In the last four months of 2020 alone, the U.S. shipped 124 million bushels of corn to China, up from less than one million in the same period in 2019. This year, American farmers could export as much as $31.5 billion worth of agricultural products to China — the highest number ever — driven partially by surging demand for corn. Why, exactly, is China buying so much corn? Katrina Northrop reports.

A Q&A With Dan Wang

Dan Wang is a technology analyst at Gavekal Dragonomics, a macro research firm where he specializes in Chinese technology and industrial policy, global supply chains, and U.S. export controls. In this week’s interview with Eli Binder, he discusses semiconductors and decoupling, as well as China’s subtle form of retaliation this past year and why the country is hugging foreign firms even closer than before.

Dan Wang

Illustration by Kate Copeland

The Rivals

In this week’s op-ed, two scholars argue that the many clashes in Sino-American relations mask a deeper and more dangerous rivalry: the two countries’ quests for status. This is important, Feng Zhang and Richard Ned Lebow write, because if status is wedded to hegemony or dominance, a drive for it by either America or China, let alone by both, might well end up in conflict. But such an outcome can be averted, they argue, by creating multiple pathways to status: Washington and Beijing need not seek to achieve status in the same way or in the same areas.

Subscribe today for unlimited access, starting at only $19 a month.