Good evening. The semiconductor industry is one of those highly technical things made instantly more dramatic and interesting because of the U.S.-China competition. While the broad strokes are pretty well understood — the U.S. dominates; China wants to catch up — our cover story this week offers a fascinating deep dive into EUV lithography, the most advanced technology in the industry, and how the one Dutch company that makes EUV equipment brought Europe into the U.S.-China tech war. Elsewhere, we have a look at SASAC, Aiways, and Beijing’s Alibaba regulations, and we have a Q&A with the inimitable Elizabeth Perry. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Chip Choke Point

Not many people have heard of ASML, but it is the most valuable tech company in Europe. The Dutch firm produces the only machine in the world for manufacturing cutting edge semiconductor chips — which places it squarely in the middle of the U.S.-China tech battle. As Tim De Chant reports, the technology and engineering prowess at the center of ASML’s machine borders on magic. If SMIC, China’s national champion for chip manufacturing, could secure it, it could catapult China to the leading edge of the semiconductor industry. But that’s a big ‘if.’

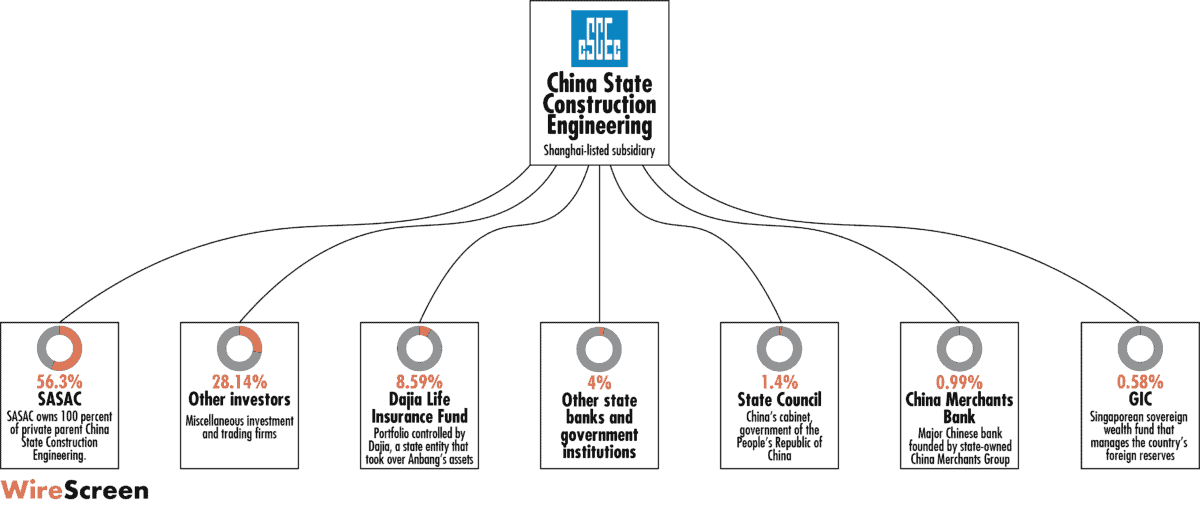

Data: WireScreen, S&P’s CapitalIQ

The Big Picture: The Long Arm of SASAC

China’s State-owned Assets Supervision and Administration Commission (SASAC) is perhaps the world’s most powerful business manager. The federal agency controls 96 of China’s biggest state-owned enterprises, acting as a so-called “nanny” for the SOEs. This week, The Wire looks at SASAC’s biggest enterprises, and zeroes in on the China State Construction Engineering Corporation. It’s a company that the U.S. government recently declared a military linked entity, and yet operates in the U.S. The massive state owned firm has won contracts to renovate the Alexander Hamilton Bridge in New York, and helped with New York City’s expansion of Subway Line No. 7.

Credit: Aiways

China’s E.V. Startup Boom

There’s a sleek, new sports utility vehicle cruising alongside Audis and BMWs on the streets of Frankfurt and Munich. The Aiways U5 is the first Chinese-made electric vehicle to be marketed in Europe, and the company intends to take on Germany’s premier brands, even on their own turf. While much of the world is just beginning to embrace electric vehicles (EVs), China has raced ahead, doling out government subsidies, setting up special charging stations and rolling out scores of EV startups. This week, The Wire‘s Eli Binder introduces readers to Aiways and the situates the three-year-old brand in the broader China EV boom.

A Q&A With Elizabeth Perry

An esteemed Harvard professor and author of more than 20 books, Elizabeth Perry’s research focuses on the history of the Chinese revolution and its implications for contemporary Chinese politics. In this week’s interview with Eyck Freymann, she explains the secrets to the CCP’s resilience, why Mao Zedong still matters, and what ‘Xi Jinping Thought’ means for the future of China.

Elizabeth Perry

Illustration by Kate Copeland

Credit: Alibaba Group

Why is China Cracking Down on Alibaba?

Since the Chinese authorities suddenly halted fintech conglomerate Ant Group’s planned initial public offering in autumn 2020, its parent company, e-commerce king Alibaba, has been facing harsh regulatory scrutiny. The mere announcement of an investigation into Alibaba wiped more than $100 billion off the firm’s market value overnight. Given the Chinese government’s huge regulatory power, investors are rightly anxious about Alibaba’s prospects. But, as Angela Huyue Zhang argues in this op-ed, the government’s sudden and aggressive move against the firm also reveals much about the regulatory regime’s weaknesses.

Subscribe today for unlimited access, starting at only $19 a month.