Good evening. China’s mastery of futuristic infrastructure — expressways, high-speed rail lines, airports and much more — is decades old. More recently it has turned its attention to industries of the future including green technologies and, as Peiyue Wu explores in this week’s cover story, automated delivery vehicles and related services. China’s ambitious ADV industry has made impressive technological breakthroughs, not least in chip development. It is also being driven not by the usual Big Tech and logistics giants, but by energetic start-ups that even readers of The Wire China are unlikely to have heard of before. But can delivery robots and systems avoid the pitfalls of the modern Chinese industrial cycle in which innovation and supportive government policy gives rise to a surge in output, lowering costs but also crushing margins. Then the resulting surplus is exported abroad. It happened before for solar panels, wind turbines and electric vehicles, and history appears to be repeating itself with ADVs.

Also in this week’s issue: Trading Canadian canola and pork for Chinese EVs; How the Chinese government meets its economic growth targets; Melanie Hart on countering Beijing’s economic coercion campaigns; and Dinny McMahon on the search for a new growth model.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Little Steps, Big Leaps

As high-profile “accidents” go, it was not much of an accident. Chinese social media lit up recently when a delivery robot failed to recognize, and promptly drove over, peanuts and corn that farmers had laid out to dry along the side of a road. In an echo of England’s 19th-century Luddites, the aggrieved farmers then attacked the robot. The incident highlighted a few things about China’s emerging market for automated delivery vehicles and services: ADVs are popping up in more and more places, in part because their developers have focused on relatively simple tasks that their technology can handle before moving on to more complex ones. In the U.S., by contrast, venture capital is more likely to be directed towards “moonshot” bets such as autonomous cars operating on public roads.

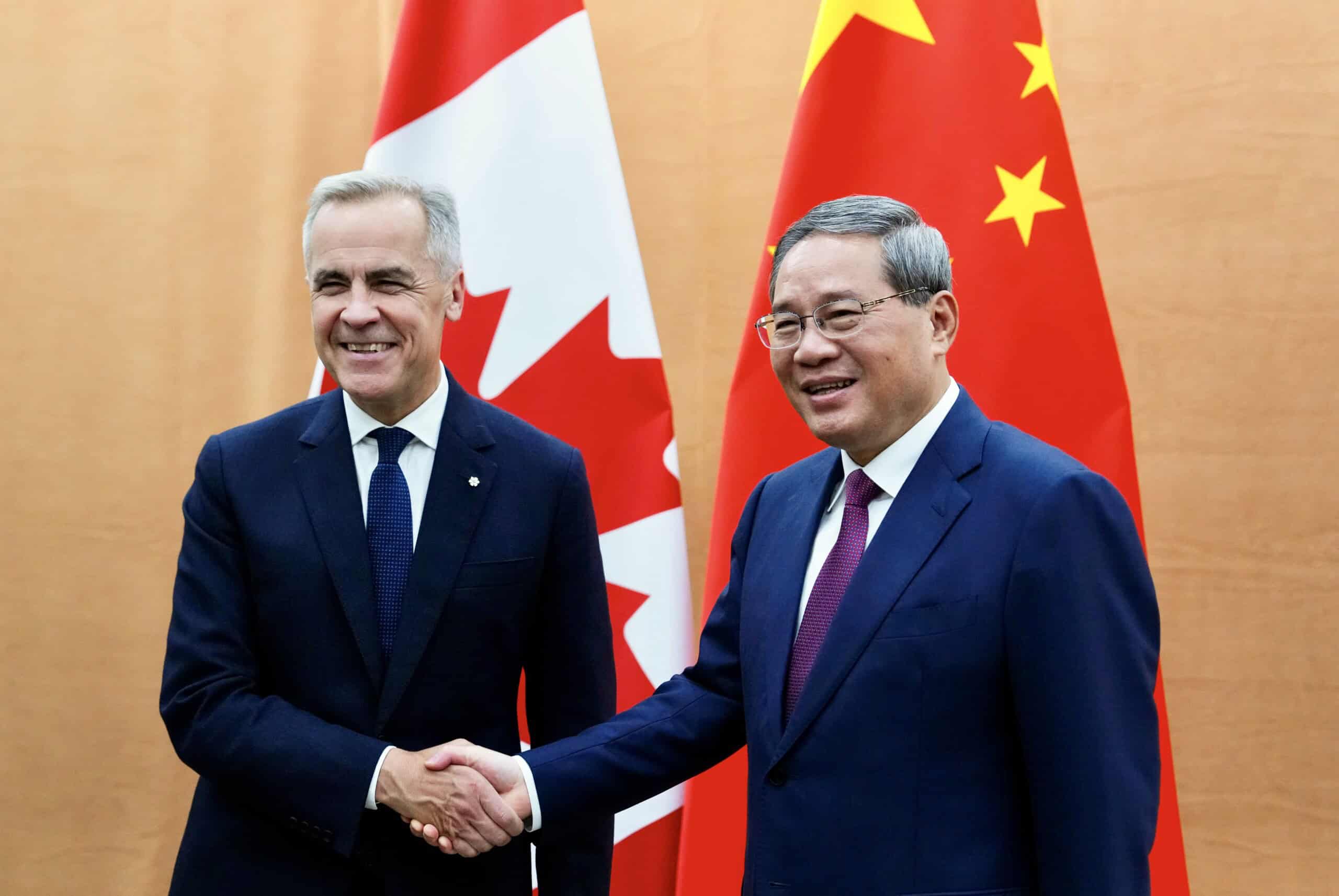

A North American beachhead for Chinese EVs?

China-Canada trade relations have been in the deep freeze for years. That could be about to change, writes Eliot Chen. China maintains high tariffs on Canadian agricultural exports, and Canada reciprocates with 100 percent duties on Chinese electric vehicles. But now that they are confronted by a suddenly hostile trading partner to their south, Canadian politicians are starting to warm to a Chinese proposal that the two countries should lower their tariffs on each other’s exports.

China’s Two-Speed Economy

For China reporters, it is one of the most boring stories to cover in one of the world’s most exciting countries — Beijing’s headline quarterly and annual economic growth figures. It goes like this: at the beginning of the year, the Chinese government issues its annual target for GDP growth. About ten months later, the Chinese government reports that it has met said growth target. The routine is so dreary that many journalists and economists got excited when China’s premier began to add the word “around” or “about” ahead of the official target of, say, 5 percent. What is far more interesting, Noah Berman writes in this week’s Big Picture, is which industries Xi Jinping’s administration leaned on to reach the target (high-tech manufacturing) and which ones it was happy to let stagnate (property). The result is an increasingly two-speed economy.

A Q&A with Melanie Hart

Australia, Japan, Lithuania, the Philippines, South Korea, Taiwan — all these countries and more have been the subject of unofficial boycotts and other forms of Chinese economic coercion after their governments did or said something to anger the Chinese government.

As an official at Joe Biden’s State Department, Melanie Hart worked on U.S. efforts to help nations targeted by Beijing. In a conversation with Evan Peng, Hart, now senior director of the Atlantic Council’s Global China Hub, reflects on her experiences, the Chinese Communist Party’s rare ability to bring Democrats and Republicans together, and future challenges. “Beijing is very good at dedicating resources to emerging tech,” she warns. “They are poised to eat our lunch, particularly when it comes to advanced robotics, AI and biotechnology.”

Melanie Hart

Illustration by Lauren Crow

Wanted, a New Economic Growth Model

Once one of China’s biggest economic engines, the property market has fizzled. Consumption is not coming to the rescue because the policies that would drive it are too expensive, Dinny McMahon writes in this week’s opinion piece. That leaves “productivity-led growth, enabled by innovation and industrial upgrading,” as the economy’s next big hope.

Subscribe today for unlimited access, starting at only $25 a month.