Good evening. Retailers in China, foreign and domestic, are suffering — but not Walmart. Its China sales are surging, thanks to the performance of its Sam’s Club outlets. Walmart’s China sourcing operations also remain indispensable, despite criticism of them from both Donald Trump and Xi Jinping’s administrations during the current trade war. As a result, Walmart is a rare multinational that is succeeding in the world’s most coveted domestic market and has also been able to merge China’s manufacturing and logistics strengths into its global sourcing network. In this week’s cover story, Rachel Cheung looks at how the retailing giant bucked the Sino-U.S. decoupling trend. But can it continue to do so for four more years?

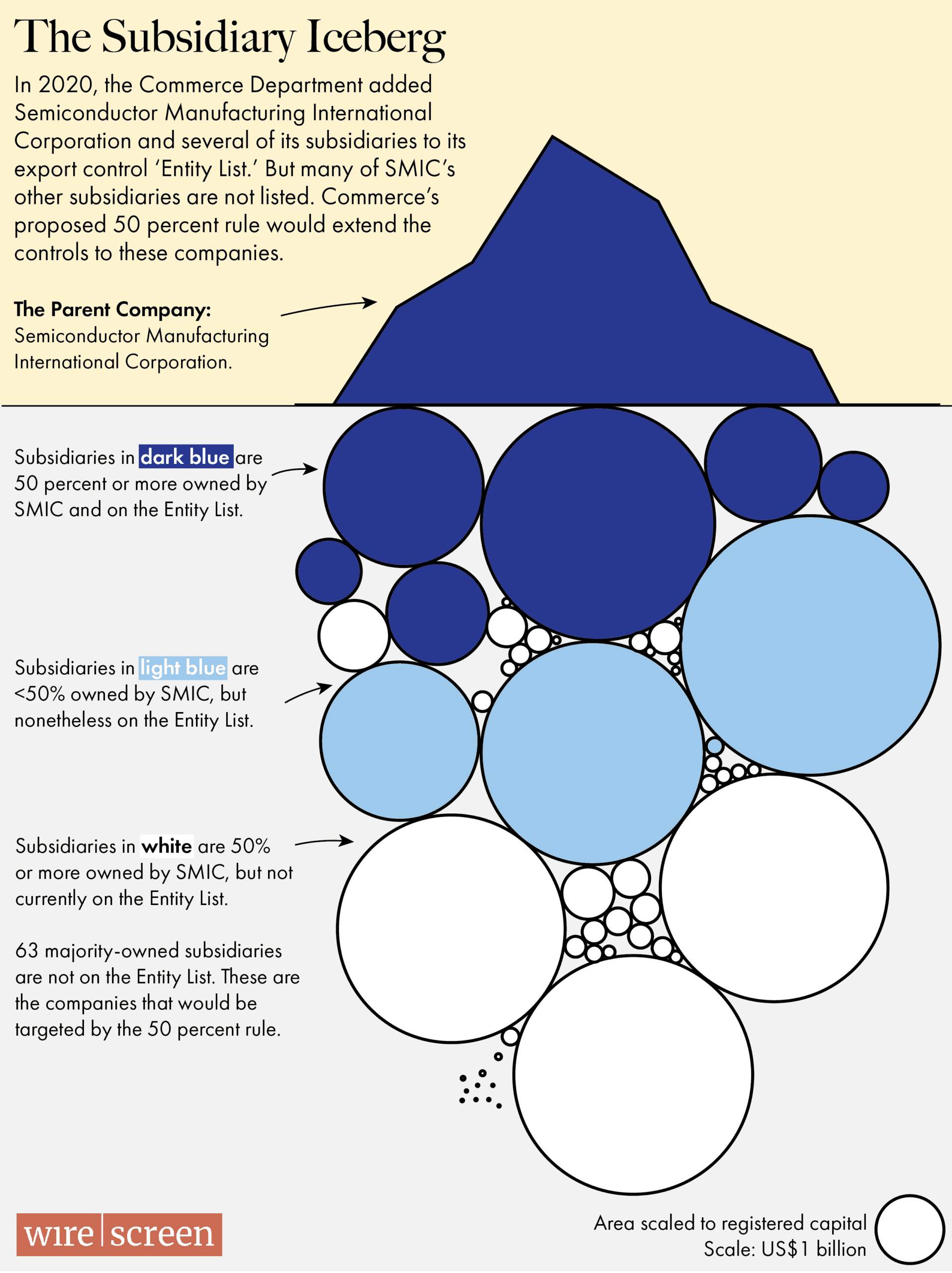

Also in this week’s issue: In this week’s Big Picture, Eliot Chen looks at the implications of a lower “50 percent” threshold for U.S. export-control enforcement; how China turns ambiguity around its export controls into a strength; a Q&A with Nicholas Borst on the Chinese economy’s Achilles’ heel; and why Victor Shih is relatively optimistic about the outlook for China-U.S. relations.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

No Decoupling for Us Please, We’re Walmart

French food retailer Carrefour had more than 300 stores in China before it sold them to Suning International Group in 2019. Today just four of them survive and are so indebted that Suning recently sold them for one yuan each. And of the 13 publicly traded Chinese supermarket operators, six lost money last year. Meanwhile, Walmart’s China sales have almost doubled to $20 billion since 2019 and eight of its Sam’s Club member outlets in the country are expected to rake in sales of $500 million each this year. What has Walmart figured out that its competitors haven’t?

The Big Picture: The 50 Percent Problem

At present, only companies on the Commerce Department’s ‘Entity List’ are subject to U.S. export controls, but a planned new rule by the Trump administration would change that. Under the ‘50 percent rule,’ all majority owned subsidiaries of listed companies would be subject to export control as well, a move that experts say could trigger a cascade of knock-on effects.

In this week’s Big Picture, Eliot Chen breaks down the complex ownership structures of Semiconductor Manufacturing International Corporation (SMIC) and Huawei, who between them have more than 130 subsidiaries that could be dragged into the export control regime under the new rule. Among them are dozens of overseas subsidiaries and two international schools.

A Q&A with Nicholas Borst

In the 1980s, Chen Yun, one of China’s top leaders, came up with the metaphor of a caged bird to define the Chinese Communist Party’s approach towards managing the economy. The cage would be big enough for the bird to stay healthy but releasing it from the cage was out of the question.

Nicholas Borst, director of China research at Seafarer Capital Partners, observes in his latest book that under Xi Jinping the cage has become smaller and smaller, and now threatens to crush the bird. In this week’s Q&A, he discusses Xi’s vision for the economy and its implications for the private sector.

Nicholas Borst

Illustration by Kate Copeland

China’s Elastic Export Controls

Like the U.S., China is embracing export controls as a way to put pressure on its adversaries. Its use of trade restrictions is becoming increasingly bold, as the recent controls on rare earths show. But as Audrye Wong, Viking Bohman and Victor Ferguson argue in this op-ed, China’s export controls possess an additional advantage: their ambiguity.

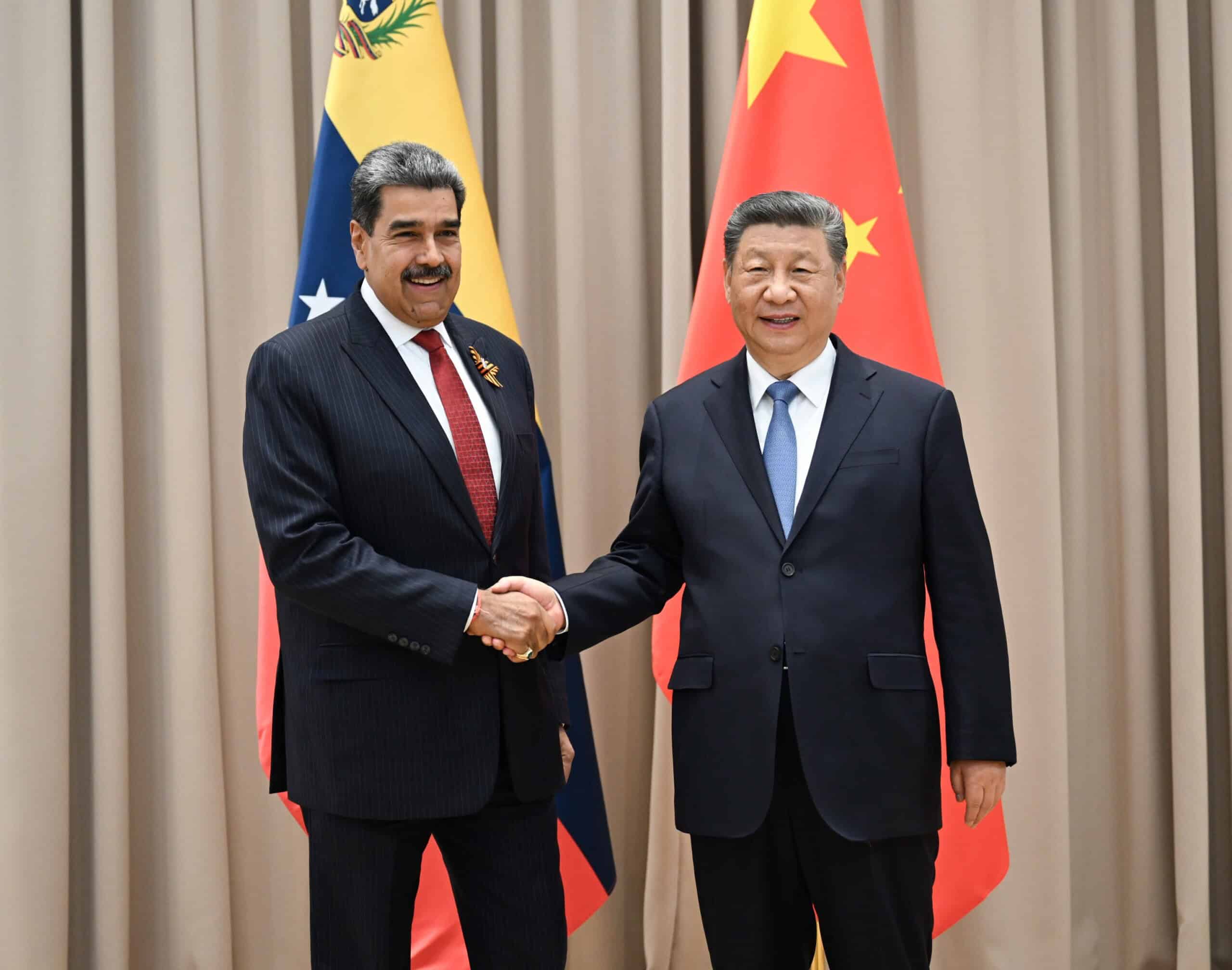

Is the Chinese Leadership Turning Inward?

Xi Jinping has seen off almost all of his rivals but there is one left that he cannot beat, Father Time. In this op-ed, Victor Shih writes that as Xi ages and inevitably becomes more preoccupied with succession issues, the Chinese Communist Party will focus more on domestic challenges. This could presage some much needed calm for China-U.S. relations.

Subscribe today for unlimited access, starting at only $19 a month.