Good evening. Taiwan’s Foxconn is barely in the semiconductor space, and India’s Vedanta Resources is mostly focused on metal and energy extraction. But the two have signed a $19.5 billion deal to make chips in India’s not-yet-developed Dholera Special Investment Region. Can they pull it off? Our cover story this week looks at India’s big opportunity. Elsewhere, we have infographics on gallium and germanium, the critical metals China just announced export controls on; an interview with Zongyuan Zoe Liu on the rise of China’s sovereign wealth funds; a reported piece on the latest trend for Chinese companies; and an op-ed about how sanctions would work in the event of a Taiwan Strait crisis. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

India’s Chance for Chips

India wants to capitalize on over-concentrated supply chains and the Washington-Beijing chip war to burst onto the global semiconductor stage. Its great hope? Vedanta Resources, a mining firm. Sean Williams reports.

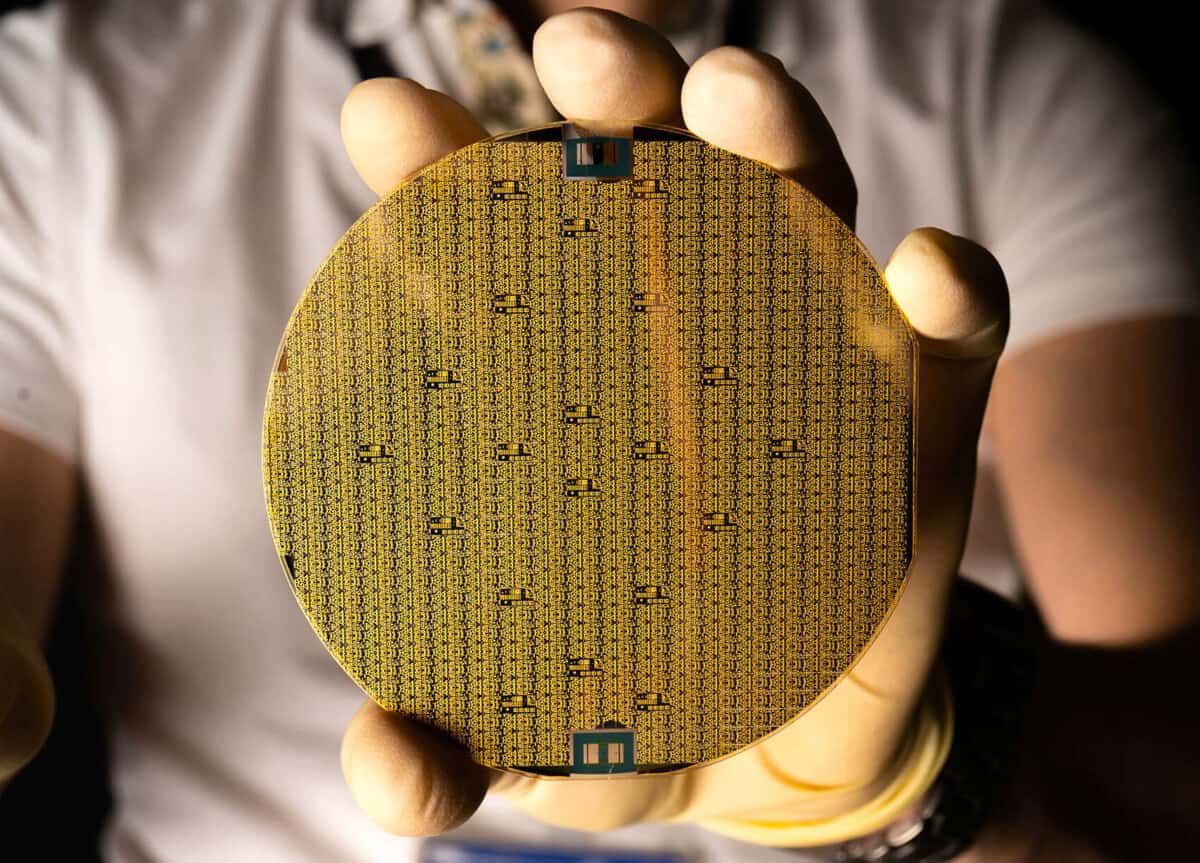

The Big Picture: The New Metal Battleground

China has announced export controls on two little-known metals that are key to chipmaking and other advanced technologies. This week’s infographics by Isaiah Schrader and Aaron Mc Nicholas explore gallium and germanium, the two elusive, yet crucial, elements and the potential effects of China’s export controls on global supply chains.

A Q&A with Zongyuan Zoe Liu

Zongyuan Zoe Liu is Maurice R. Greenberg Fellow for China studies at the Council on Foreign Relations where she specializes in Chinese studies, with a focus on international political economy. Her new book, Sovereign Funds: How the Communist Party of China Finances its Global Ambitions, explores the history and impact of the enormous investment funds China has set up over the last two decades in order to utilize its huge pile of foreign exchange reserves. In this week’s Q&A with Andrew Peaple, she talks about Beijing’s evolving ambitions for its sovereign wealth funds, their controversial investments in the U.S. and elsewhere, and their future in a world growing more skeptical towards Chinese capital.

Zongyuan Zoe Liu

Illustration by Kate Copeland

The New Trend for Chinese Companies — Dropping China

Some of China’s fastest-growing companies are doing their best to portray themselves as coming from somewhere else. Eliot Chen reports.

The Sanctions Option

A repeat of the measures imposed on Russia will be hard to achieve if China were to invade Taiwan, argues a new study by Rhodium Group and the Atlantic Council. As Charlie Vest writes this week, while G7 countries have begun proactively discussing sanctions options, there are many challenges to establishing deterrence through sanctions in the context of a Taiwan Strait crisis.

Subscribe today for unlimited access, starting at only $19 a month.