Good evening. China’s re-opening has inspired lots of talk about pent-up demand and “revenge” traveling and spending. And for good reason: Before the pandemic, more than 155 million Chinese people were traveling abroad annually and spending the equivalent of Portugal’s GDP. But as our cover story and our reported piece this week show, it might actually take a while for things to rebound. Chinese travelers and Chinese luxury shoppers seem to be entering a new phase. Elsewhere, we have infographics on miHoYo, the up-and-coming Chinese gaming company; an interview with Meg Rithmire on the unhappy equilibrium of China’s markets; and an op-ed on China’s tech rectification. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Tripped Up

When China announced it was ending quarantine requirements for incoming travelers, Chinese people collectively picked up their phones to search popular travel apps like Ctrip and Qunar. Owned by travel giant Trip.com, these apps helped Chinese travelers explore the world pre-pandemic and facilitated the human-to-human interactions that drove China’s rise. But, as Simina Mistreanu reports, many of today’s travelers seem to be sticking closer to home, and their hesitation to get back to the jet-setting habits of the past 20 years has far-reaching implications — especially for Trip.com.

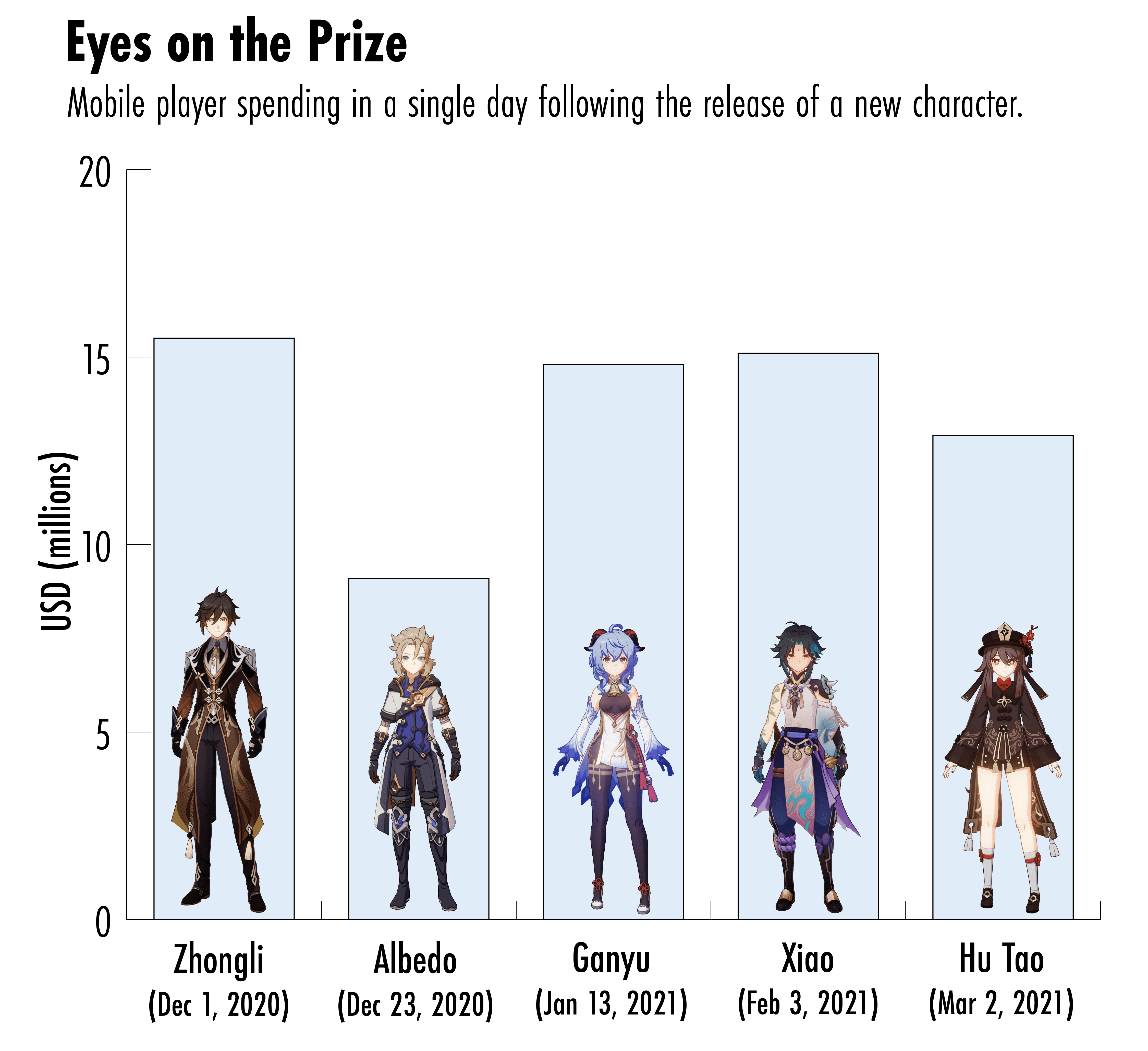

The Big Picture: miHoYo Isn’t Playing Games

If anyone can take on Tencent’s grip on video games in China, it might just be miHoYo, the Chinese gaming company that appeals to the so-called “otaku” population — people who are obsessed with Japanese anime, manga, video games and culture. This week’s infographics by Ella Apostoaie look at miHoYo’s history, how it became a serious competitor on the global scene, and what the future has in store.

A Q&A with Meg Rithmire

Meg Rithmire is the F. Warren MacFarlan associate professor at Harvard Business School, where she focuses on China’s political economy, including real estate, outbound investment, and government discipline of business. She is the author of Land Bargains and Chinese Capitalism (2015), and a forthcoming book, Precarious Ties: Business and the State in Authoritarian Asia. In this week’s Q&A with Katrina Northrop, she talks about China’s real estate bubble; if China can develop a modern financial system without rule of law; and why it’s not China that’s reshaping the global order, but the world’s response to it.

Meg Rithmire

Illustration by Kate Copeland

The New Lap of Luxury

Before the pandemic, roughly 70 percent of Chinese luxury shopping occurred abroad. But as Katrina Northrop reports this week, even though China’s borders are now open again, allowing those luxury shoppers the opportunity to travel abroad, many brands are still choosing to meet them where they are.

China’s Tech Rectification

What have we learned from the so-called tech crackdown? In this week’s op-ed, Rogier Creemers offers an examination of what has really changed in the last few years as well as the all-important question: what now?

Subscribe today for unlimited access, starting at only $19 a month.