Good evening. Suning, the retail giant, has $4.3 billion worth of bonds maturing soon, with the largest payment approaching in December. And — as with Evergrande and other cash-strapped Chinese companies — it’s not clear Suning will pay up, especially to its offshore creditors. As our cover story this week shows, these high profile defaults may reveal larger, more systemic problems about the way private Chinese companies borrow from foreign creditors. Elsewhere, we have a Q&A with Nathan Law, the Hong Kong pro-democracy activist, on what the Hong Kong protests mean two years later; infographics on Haier, the appliance giant that launched a thousand management case studies; and two thought provoking op-eds: one from Shang-Jin Wei on why China’s growth rate is falling so fast, and one from Dani Rodrik on economists’ approach to great power competition. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Trust Games

With its onshore/offshore structures and inclusion of gentlemen’s agreements called ‘Keepwell obligations,’ the Chinese bond market is pretty unique. The system, as Anastasiia Carrier reports, was designed for lending convenience, not the legal practicality of retrieving money if an issuer defaulted. While these risks have always been known, the potential default by retail giant Suning and other reputable Chinese companies is testing the market like never before. And offshore creditors hoping to get their money back, analysts say, face an uphill battle.

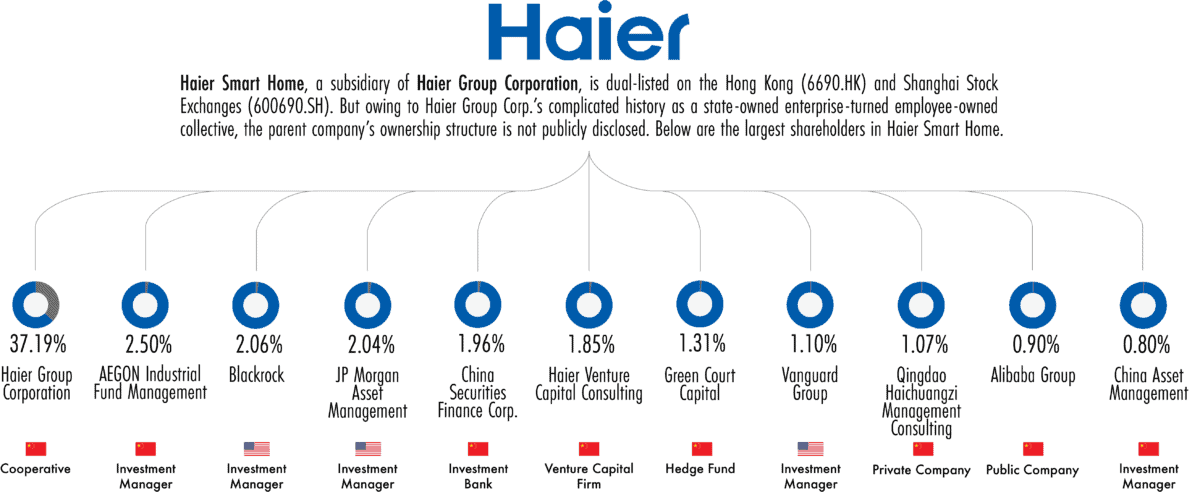

The Big Picture: The Refrigerator Revolution

Last week, Zhang Ruimin announced he was stepping down from Haier Group, the electronics giant he founded and turned into management case study darling. This week, infographics by Eliot Chen look at Haier Group and its rise as well as how Chinese companies have come to dominate the appliances industry.

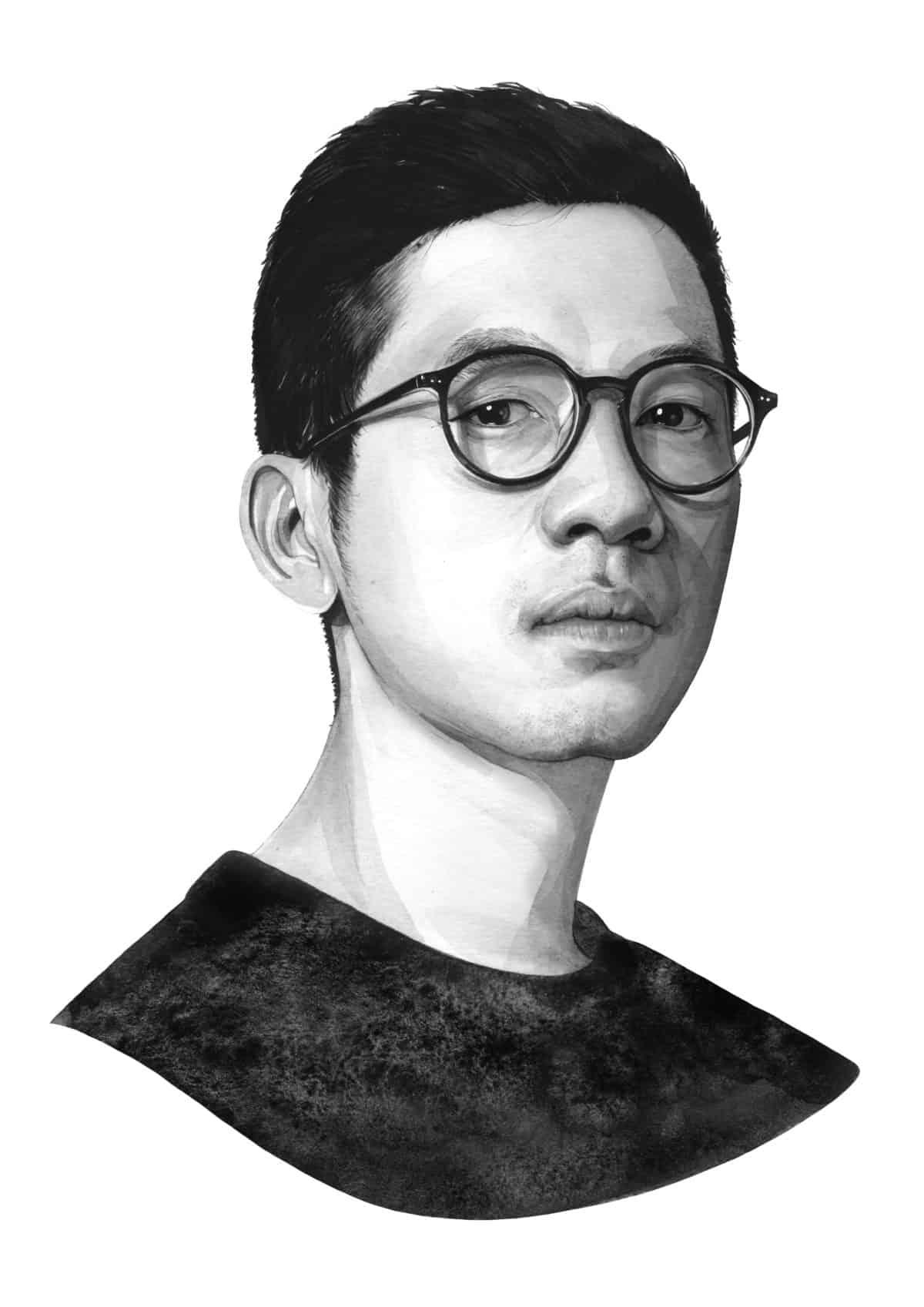

A Q&A with Nathan Law

Nathan Law is a pro-democracy activist from Hong Kong. He was one of the student leaders of the 2014 Umbrella Movement and co-founder of Demosisto, a now-disbanded political party. In this week’s Q&A with Eliot Chen, he talks about how the Hong Kong protests changed international sentiment about China, why the right to self-determination still matters, and how he plans to keep Hong Kong relevant, even from exile.

Nathan Law

Illustration by Kate Copeland

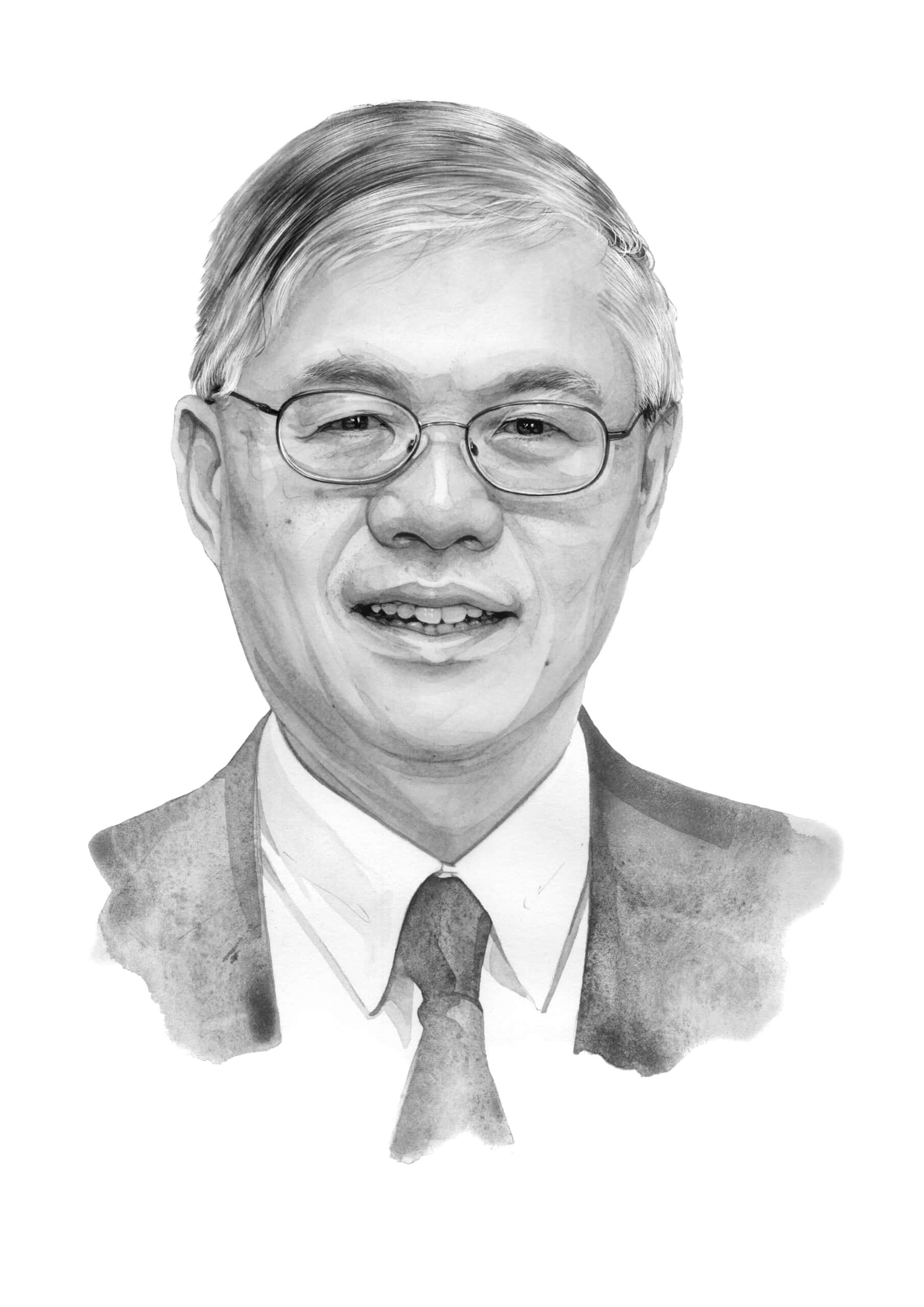

Why Is China’s Growth Rate Falling So Fast?

Although China’s economy remains on track to post strong growth for 2021 as a whole, its recent deceleration is striking. Reversing the slowdown, argues Shang-Jin Wei, a former chief economist at the Asian Development Bank, in this week’s op-ed, will require policymakers to reform the ways in which they debate, vet, and implement new regulations and pandemic-control measures.

The Resistible Rise of U.S.-China Conflict

For many economists, who tend to view the world in positive-sum terms, the widespread hardening of U.S. attitudes towards China is a puzzle. Countries can make themselves and others better off by cooperating and by shunning conflict, after all. As Harvard economist Dani Rodrik argues in this week’s op-ed, the structure of great-power rivalry may exclude a world of love and harmony, but it does not necessitate a world of immutable conflict.

Subscribe today for unlimited access, starting at only $19 a month.