Good evening. We did a double take earlier this month when it was reported that many of the Capitol rioters were using the app DLive to livestream their insurrection. DLive is Chinese-owned, after all, and many of the rioters are — to put it mildly — anti-China. Our cover story this week looks into DLive as well as its flashy owner, Justin Sun. Elsewhere, we break down China’s giant retail market and the curious case of Huawei’s Honor sale; and we hear from some prominent economists about the prospect of the Renminbi as a global reserve currency as well as why the U.S. should stop its China finger pointing. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Crypto Kid

Earlier this month, the Capitol rioters periodically paused their insurrection to join together in anti-China chants. Many of them broadcast their efforts over DLive, a live-streaming app where viewers at home could “tip” the rioters with the app’s built-in cryptocurrency. But while DLive is a favorite among far-right extremists with anti-China sentiments, it is actually a China-owned platform. Justin Sun, a 30-year-old Chinese cryptocurrency entrepreneur, has quickly made a name for himself by founding and acquiring a series of blockchain-related companies around the world, including DLive. And, as Eli Binder and Katrina Northrop report, his vision of the internet has a surprising overlap with the far right.

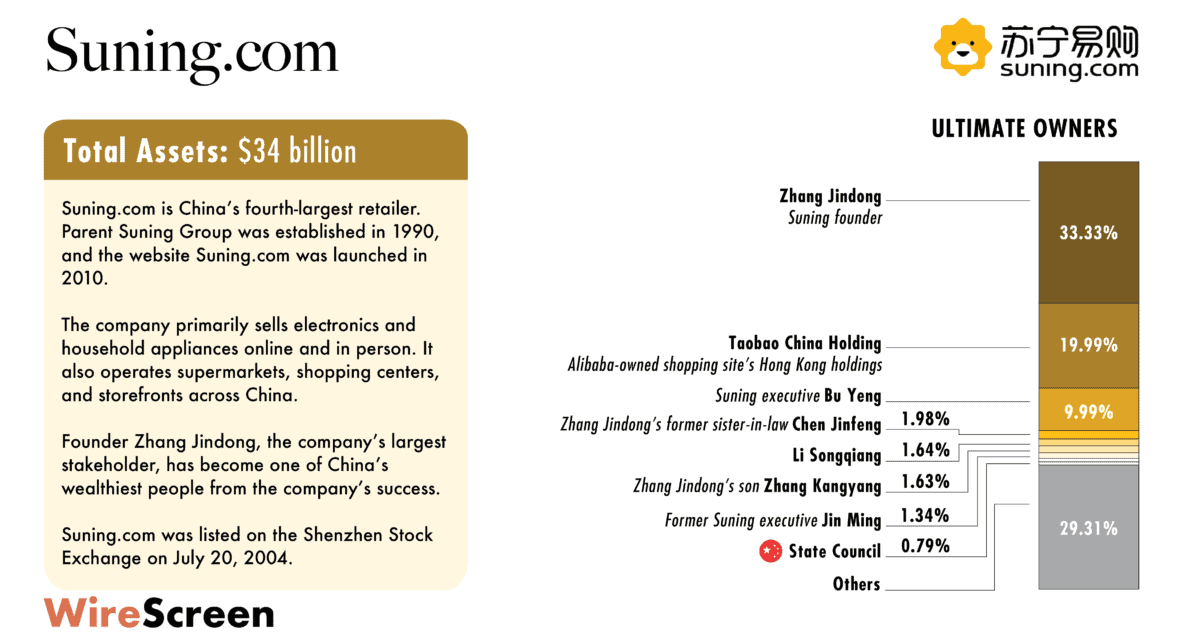

Data: WireScreen

The Big Picture: China’s Biggest Retailers

Retail in China has been defined by two trends: the rapid growth of e-commerce and market consolidation. The share of the market controlled by the country’s 10 biggest retailers has nearly doubled since 2008, and the three largest retailers all run operations that are primarily online. Though the United States remains the world’s biggest market for retail sales, China is the largest e-commerce market, accounting for nearly half the world’s retail e-commerce sales. This week, our datagraphics look at the evolution of China’s retail market, how it stacks up to the rest of the world, and we zero in on the ownership structure of Suning.com, one of the nation’s biggest e-commerce firms.

Credit: Kārlis Dambrāns, Creative Commons

What’s Behind Huawei’s Deal?

Last November, Huawei announced that it had sold its budget smartphone brand called Honor to a consortium of state-backed investors. The deal, which Reuters said brought Huawei $15 billion, came just after the U.S. government tightened sanctions against the Chinese telecom giant. This week, as part of an occasional feature, The Wire’s David Barboza breaks down the Huawei transaction and the broader implications of the deal, with Scott Livingston, a former analyst at the Office of the United States Trade Representative who is currently at the Center for Strategic and International Studies, the Washington think tank.

A Q&A With Jeffrey Sachs

Jeffrey Sachs is an American economist and UN stalwart who currently runs the Center for Sustainable Development at Columbia University. In this week’s interview with The Wire’s Katrina Northrop, he talks about potential U.S.-China collaboration on environmental goals, human rights in the U.S. vs. China, and why he thinks the U.S. should stop trying to gang up on or destabilize China.

Jeffrey Sachs

Illustration by Lauren Crow

Credit: Bruce Detorres

The Year of the Renminbi?

When the billionaire investor Ray Dalio recently predicted that the Chinese renminbi will become a global reserve currency, the world took notice. It’s a prediction that the Chinese government has encouraged through its own efforts. But as Arvind Subramanian and Josh Felman argue in this week’s op-ed, the contest for reserve-currency status is one of relative attractiveness. International traders and investors must decide which among the currencies available to them is most convenient to use, is supported by the strongest financial system, and — perhaps most important — enjoys the backing of a trustworthy sovereign. What is new today is that both of the world’s major sovereigns also seem to be competing to reduce their own trustworthiness.

Subscribe today for unlimited access, starting at only $19 a month.