Good evening. No one can lead forever, but that doesn’t stop ’em from trying. In our cover story this week, we look at the ups, downs and unique challenges of Samsung’s business in China — an interesting examination since the company’s chairman, Lee Kun-hee, just passed away last Sunday. We also use data from our sister site, WireScreen, to look at how effective a tool the U.S. Entity List is in punishing foreign entities, especially those in China whose complex organizational structures seem designed to thwart such efforts. And our Q&A with former PLA colonel Lyu Jinghua offers a really unique perspective, especially since China just released its 14th Five-Year Plan, which Victor Shih analyzes for us this week.

If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Samsung Sandwich

Samsung, the Korean electronics giant, was one of the first multinationals to build a huge presence in China. Its first factory in China opened just days after the two countries resumed normal relations in 1992, and Samsung has pumped more than $20 billion into the country since, eventually dominating the China consumer market. But now, as Geoffrey Cain reports for The Wire, the company is closing factories and “diversifying” its business operations there. What happened?

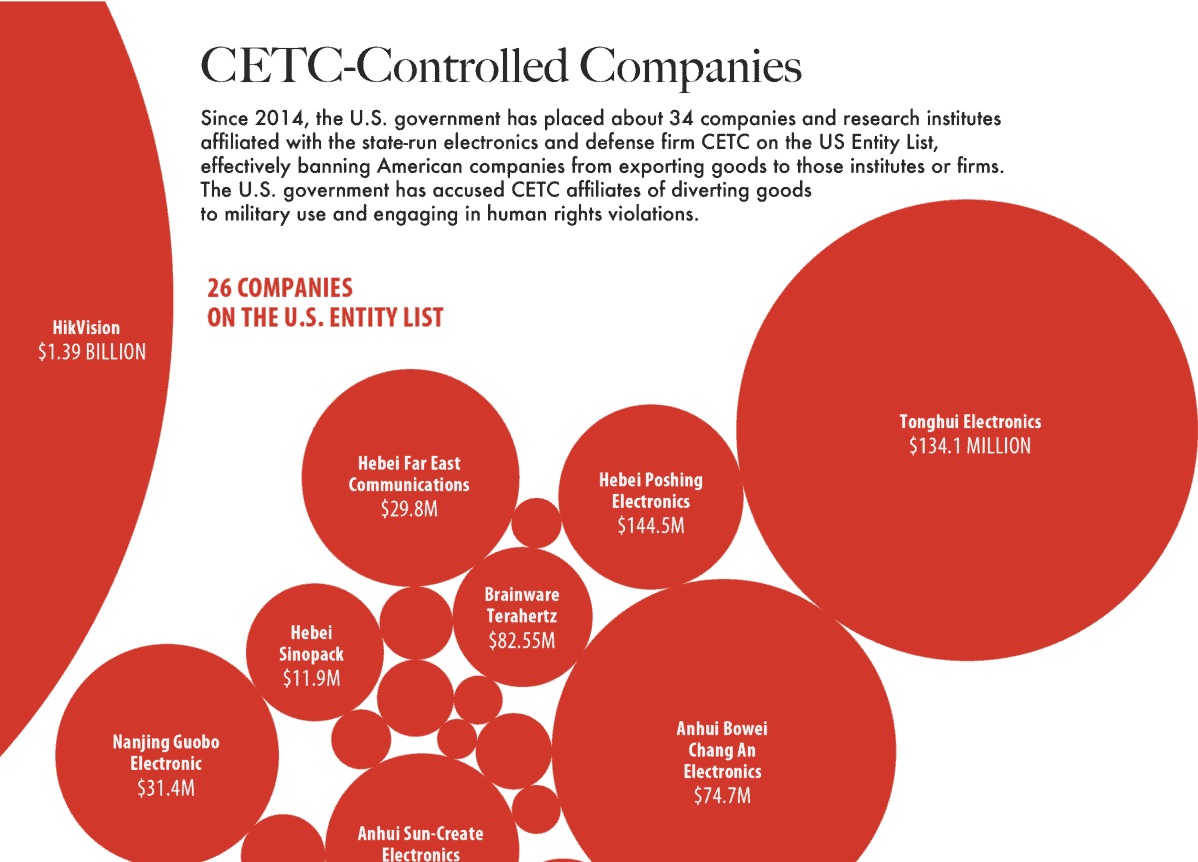

The Big Picture: China and the U.S. Entity List

During the past few years, the U.S. government has placed hundreds of Chinese companies like Huawei and SenseTime on the U.S. Entity List, effectively barring American firms from exporting goods to them. But how effective is this economic punishment? This week, our datagraphics use the case study of China Electronics Technology Corporation Group (CETC) to look at what it’s like to target a foreign entity, and why analysts say that the complex ownership structures of many large Chinese firms makes it difficult to enforce sanctions against them.

Credit: Tony Webster, Creative Commons

Clouded Judgement

American cloud service providers like Amazon and Microsoft are clamoring for a piece of the Chinese market, which is expected to balloon in the coming years. But as The Wire‘s Katrina Northrop reports, the decision to enter the market isn’t exactly easy since foreign firms operate under strict government oversight, are required to form a joint venture with a Chinese firm, and are vulnerable to IP theft and security breaches. Now, complicating the American calculus is a new infrastructure plan in China that will shell out $1.4 trillion on digital infrastructure and could help Chinese cloud firms like Alibaba and Tencent expand overseas.

A Q&A With Lyu Jinghua

Lyu Jinghua is a retired colonel in the People’s Liberation Army and a visiting scholar at the Carnegie Endowment for International Peace in Washington, D.C., where she researches cybersecurity and U.S.-China defense relations. In this week’s interview with The Wire’s Eli Binder, she talks about the U.S. presidential election, helping the U.S. and China understand one another, and where there is — and isn’t — room for negotiation.

Lyu Jinghua

Illustration by Lauren Crow

Credit: The U.S. Army Band, Creative Commons

China’s Techno-Dictatorship

On the face of it, there is much to like about China’s recently released 14th Five-Year Plan. China finally will boost domestic demand, potentially increasing the world’s export to China. Scientific progress in China also will have positive spillovers around the world. Yet, as Victor Shih writes in this op-ed, the recent plenum also made clear that the Party is firmly committed to keeping a closed political system and rejecting liberalization. Thus, he argues, a small, nationalist elite in Beijing likely will continue to shape policies in a way that mainly benefit them.

Subscribe today for unlimited access, starting at only $19 a month.