Good evening. China’s strong central planning is often derided as authoritarian, but when it works — especially to stop the outbreak of a horrible virus or to usher in a potentially revolutionary new industry like electric vehicles — some observers take a second look at its efficiencies. This week’s issue explores the “China Model” from a variety of economic and political angles, revealing how nuanced and layered this debate really is. We also want to introduce readers to a new feature on The Wire: our daily news roundup of the top China finance, business and economy stories — available every weekday by 11am. Bookmark our News Feed section to quickly digest the China headlines from the top publications. And remember, if you’re not already a paid subscriber to The Wire, please sign up here to read the full issue, to access our daily news roundup, and to get a curated, weekly reading list in your inbox from David Barboza.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

China’s New Energy Car Quest

By 2040, more people worldwide are expected to purchase an electric vehicle than an internal combustion one, and China seems determined to be the country making them. After watching the country struggle for years to produce world-class cars, China’s government has given generous subsidies and incentives to encourage EV companies to leapfrog traditional automakers. But out of the hundreds of Chinese EV companies that emerged, The Wire‘s Dan Xin Huang reports, NIO has established the highest profile. Dubbed “the Tesla killer” and listed on the New York Stock Exchange, NIO seemed to many observers like China’s best chance to crack the global industry. So, when it looked like the young company was about to crash this year, Beijing grabbed the wheel.

Data: CB Insights, numbers are mid-year values, with most recent data as of June 11, 2020.

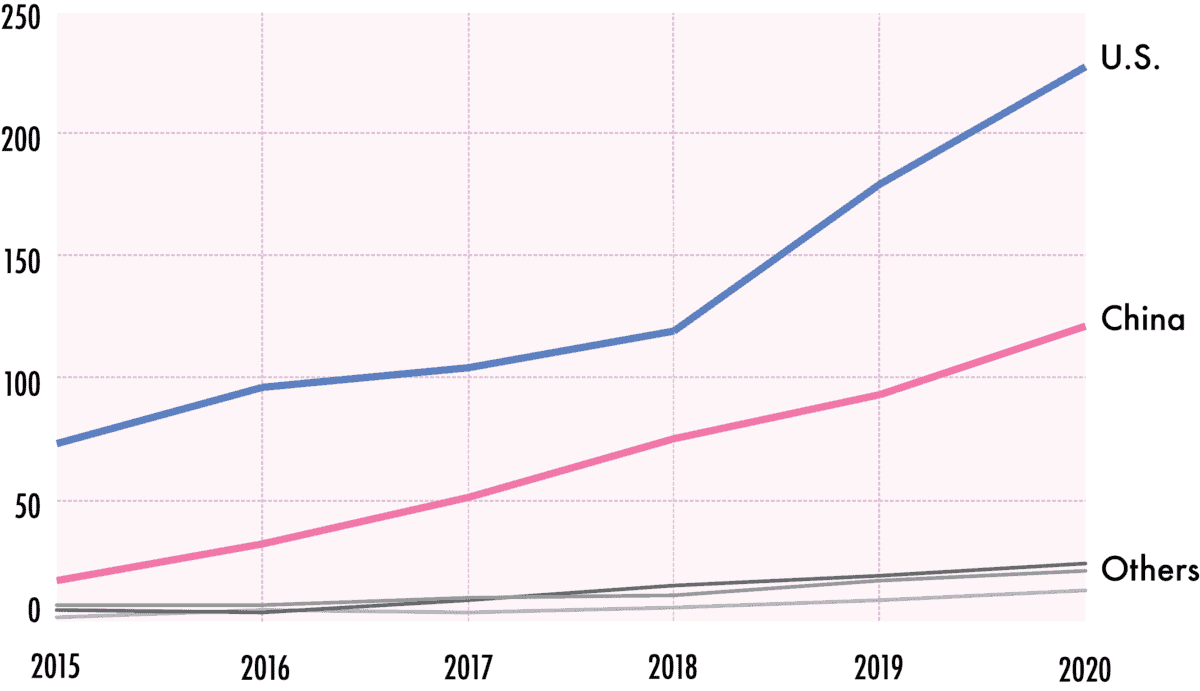

The Big Picture: Racing ‘Unicorns’

Unicorns — privately held startups valued at more than $1 billion — have become a symbol of innovation and the entrepreneurial spirit. The United States still leads in number of unicorns, but China is home to the world’s most valuable ones, according to recent data from PitchBook. In this week’s Big Picture, we show the narrowing race between U.S. and Chinese unicorns, and introduce readers to the Chinese unicorns leading the herd, as well as the VC firms backing their rise.

Credit: REUTERS/Amir Cohen

PayPal Picks Up the Crumbs in China

Paypal, the first foreign firm licensed to provide digital payment services in China, is finally getting a crack at a market that has been experiencing explosive growth. The payments market in China is effectively a duopoly, with Wechat Pay and Alipay processing about 90 percent of all mobile payments in the country. But Paypal’s entrance into the Chinese market is still significant, both for its size and for what it means for foreign companies seeking access, The Wire‘s Katrina Northrop reports.

Credit: Estial, Creative Commons

When Financial Security Means National Security

Last month, China announced plans to enact a new national security law in Hong Kong, giving Beijing broad, new powers over civil liberties in the special administrative region. Soon after, the United States vowed to strip the semi autonomous region of its special status. Hong Kong’s financial markets hardly flinched. But in his op-ed, The Wire columnist Victor Shih argues that what investors fail to understand is that once that new law goes into effect, there’s a high likelihood that it will fundamentally alter Hong Kong’s banking system, shifting power from the local officials in a system that prides itself on the rule of law over to China’s powerful state security apparatus, which operates without any checks outside of the Chinese Communist Party.

A Q&A With Daniel Bell

Daniel Bell is a political theorist who sees the best in China. Often called a Beijing apologist by his critics, he argues that the West too often fails to evaluate China on its own terms, therefore failing to see why China’s political system is one that we should admire. In this week’s interview, with The Wire‘s David Barboza, he discusses China’s “political meritocracy” and what to make of the gap between the ideal and the reality.

Daniel Bell

Illustration by Kate Copeland

Credit: Shealah Craighead, Official White House Photo

How the Trade Deal Fell Apart

In April 2019, after a year of pressure on Beijing, the American trade team thought it was closing in on a deal that would remake relations between the world’s two economic superpowers. Although China still hadn’t agreed to many U.S. demands, the two sides had already started discussions about where to hold a signing ceremony. Trump’s Mar-a-Lago estate in Florida? Washington, D.C.? But, as Wall Street Journal reporters Bob Davis and Lingling Wei show in this excerpt of their new book, both sides made serious miscalculations over the next month that would unravel the agreement, embitter both sides, and deepen the economic cost of the trade war so much that it threatened to drive the global economy into recession.

Subscribe today for unlimited access, starting at only $19 a month.