Good evening. This is a bit of a unique issue of The Wire. As the 31st anniversary of the Tiananmen Square massacre resonated with America’s own protests — as well as Hong Kong’s vigil — we felt compelled to take a strategic pause in order to reflect on the history, narratives and policies that brought us to this moment. As such, this week we’re featuring an historical essay by Orville Schell that will inform and engage even the most well-read China watchers. We also have this month’s book recommendations, an interview with Bob Davis and Lingling Wei on the trade war, and analyses of what happens to both capital flows and pork productions caught in the U.S.-China crossfire. If you’re not already a paid subscriber to The Wire, please sign up here to read the full issue.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Credit: Bettmann/Contributor

The Death of Engagement

In 1967, as race riots spread across the United States and as the Vietnam War raged, an astounding 70 percent of Americans agreed on one thing: the greatest threat to U.S. security was the People’s Republic of China. It was against this backdrop that then-candidate Richard Nixon first tested the waters on a policy of “engagement” with China — a policy that went on to survive, at times miraculously, for seven presidential administrations (Republican and Democrat!). But today, as we find ourselves in a world that eerily echoes 1967, the great hopes of engagement might seem naive, if not doomed. In his essay for The Wire, longtime China watcher Orville Schell takes a step back to ask: If engagement has failed as a policy, was it fallacious from the outset?

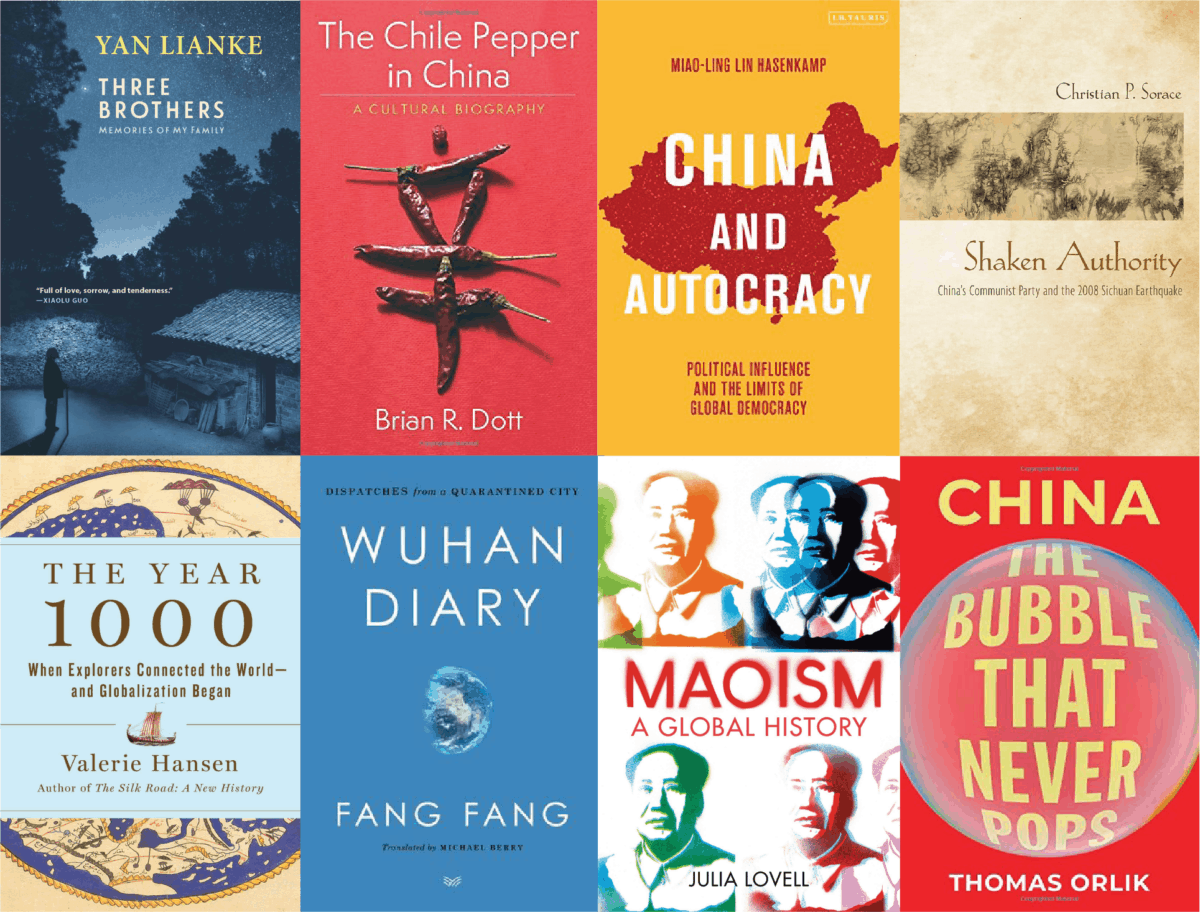

Reading When Everything Has Changed

The pandemic spread of Covid-19 will slow and end, yet the aftermath — financially, politically, socially — will linger for years. Which is why the top pick in this month’s book column is Wuhan Diary, an account of the beginning of the outbreak that was rushed to translation and digital publication. Alec Ash, The Wire‘s Books editor, says Fang Fang’s account puts bigger questions about the virus in the human contexts we are all living while the rest of his recommendations — whether prognosticating China’s future or narrating its past — can also be read through the lens of our swift-changing times.

Credit: REUTERS/Brendan McDermid

Holding Back The Torrent

As the U.S. continues to take steps toward “decoupling,” what will become of the massive dollar capital flow from the U.S. to China? Capital, The Wire columnist Steven Davidoff Solomon argues, is like water flowing down a hill. You can divert it, but it often just ends up flowing elsewhere. Because China’s export-driven economy naturally accumulates dollars, those dollars need to flow somewhere. So, if capital investment by China is shut off, then China will have to invest more of its $3 trillion in reserves into other dollar-based assets.

A Q&A With Bob Davis and Lingling Wei

Bob Davis and Lingling Wei, the Wall Street Journal reporters who have excelled at covering the trade war, have a new book out: Superpower Showdown: How the Battle Between Trump and Xi Threatens a New Cold War. This interview, with The Wire‘s David Barboza, covers everything from Wei’s personal journey out of China (she was recently expelled), to how they cover the CCP’s top leadership, to why Xi Jinping’s “China Dream” and Donald Trump’s mercantilist leanings are key to understanding the trade negotiations.

Bob Davis and Lingling Wei

Illustration by Lauren Crow

Credit: REUTERS/Bobby Yip

China’s Pandemic Pork Haul

With the recent trade war raging between the U.S. and China, Chinese tariffs on U.S. pork reached a high of over 70 percent, according to the U.S. Meat Exporter Federation. But as the “Phase One” trade deal between the countries came into sight in November 2019, China began granting tariff waivers, and, as The Wire reporter Eli Binder reports, U.S. pork exports to China exploded — even as Covid-19 hit pork production plants in the U.S. especially hard, causing many to close. While some warned of a shortage of domestic supply, U.S. pork exports to China jumped more than 500 percent the first quarter of 2020 compared to the year before.

Subscribe today for unlimited access, starting at only $19 a month.