Good evening. So much in the U.S.-China arena comes down to trust — who deserves it, who doesn’t, and how to tell the difference. This week’s stories explore this theme from a variety of angles, including our cover story on the tumultuous career of Jia Yueting, one of the most successful entrepreneurs to come out of China in the past 20 years, and our interview with the researcher Elsa Kania, which explores where the line is between legal and illegal tech transfers. We hope you enjoy the fifth issue of The Wire.

For a limited time, we’re offering one free article per month to users. Please subscribe to The Wire here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Nine Lives of Jia Yueting

Jia Yueting was once hailed as a visionary entrepreneur and one of China’s richest men. He founded one of China’s biggest video-streaming services, and built a business empire known as the LeEco group, which made smart TVs, cell phones, and electric cars. But Jia’s fall from grace and wealth has been spectacular. He owes creditors billions, and he has defied an order from Beijing to return to China. Now living in California, he’s hoping to turn around his U.S. electric car company, Faraday Future, which has yet to sell a single car. Can his latest crazy pitch keep him from ruin? In this piece, we cover the epic rise and fall of Jia’s empire, and provide a timeline of key moments in his career.

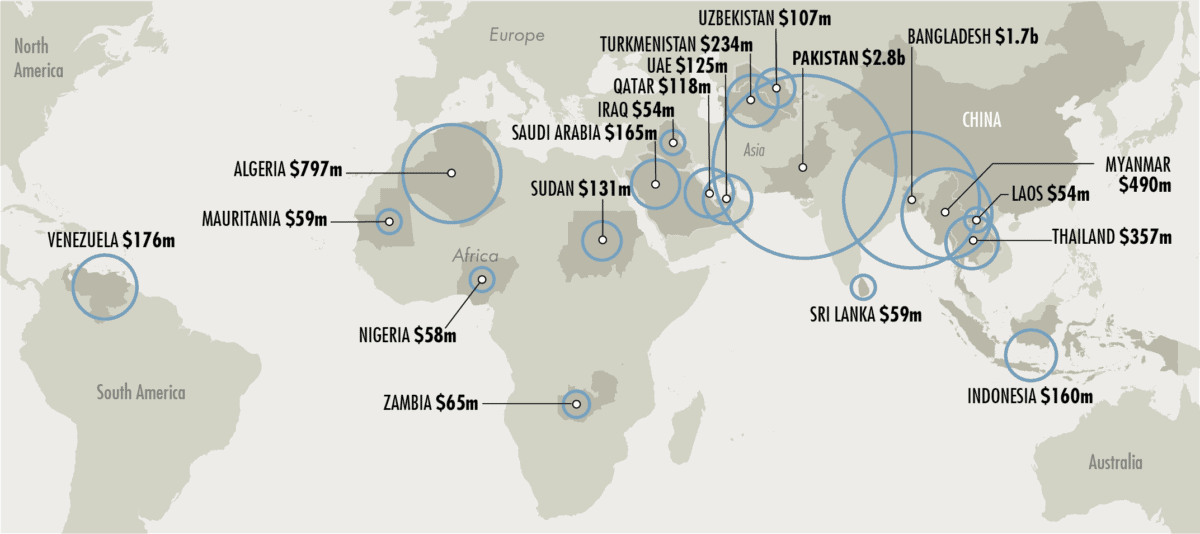

Data: SIPRI Arms Transfers Database

The Big Picture: The Rise of China’s Arms Sales

In global arms sales, the U.S. and Russia are the world’s dominant exporters. But in the past few years, China has gained a substantial foothold. Some estimates project that Chinese firms could compete with the West for $275 billion in arms sales over the next decade. In this week’s Big Picture, we delve into how China became a major arms seller, which Chinese companies now rank among the world’s most competitive defense contractors, and which countries are its biggest customers.

Luckin Scandal Exposes Risks In U.S.-China Rift

The Luckin Coffee scandal carries the flavor of a familiar all-American scam: a high-flying Nasdaq stock with a technology hook collapses after accounting fraud is exposed. But Luckin is a Chinese company — and that highlights a unique set of risks too often ignored by U.S. investors. In this week’s column for The Wire, law professor Steven Davidoff Solomon explains how the VIE structures employed by Luckin and other Chinese companies listed in the U.S. exist in a “legal netherworld” of enforceability.

Making Sense of a Multipolar World

If, over the last centuries, the global center of power has shifted West from Europe to America, it kept on moving and now hovers somewhere over the Pacific. Instead of a hegemonic Empire dominating as superpower, we have a multipolar world. For all of the op-ed column inches out there trying to make sense of this shift, books like the eight highlighted here can offer a lot more context. From the history of Russian espionage in China to the role of women in China’s revolutions, these books offer essential insights and ask often overlooked questions, including the big one: Has China already won?

Credit: Shealah Craighead for The White House, Flickr

When Is a Deal a Deal?

Each week, The Wire’s Dave Smith rounds up the most interesting China news, numbers and insights you may have missed. This week, he looks at clean energy subsidies, investors in China’s pharma market, and Zoom. Now that U.S. and Chinese negotiators have agreed to tamp down the very tense atmosphere around their trade war, he also examines how long will the good will last.

A Q&A With Elsa Kania

If you don’t already know Elsa Kania, you should. A Ph.D. candidate at Harvard and an adjunct fellow at the Center for a New American Security, Kania is a rising star in the world of U.S.-China relations, especially when it comes to analyzing Chinese military strategy. In this interview with The Wire’s Shen Lu, she talks about the dynamics of technological innovation and how the U.S. can mitigate risk responsibly.

Elsa Kania

Illustration by Kate Copeland

Subscribe today for unlimited access, starting at only $19 a month.