When Hou Xiaodi founded the autonomous trucking company TuSimple ten years ago, he was optimistic about launching a U.S. tech firm with Chinese roots — and for good reason.

Jack Ma had just celebrated Alibaba’s record $25 billion IPO on the floor of the New York stock exchange and had plans to expand his group’s U.S. presence. Chinese search engine Baidu had opened a $300 million AI research lab in Sunnyvale California, and companies like Huawei, Tencent, and autonomous driving start-up NIO were all opening offices and investing in the U.S.

TuSimple also straddled the Pacific. It was headquartered in San Diego, received seed funding from Chinese tech firm Sina, and later opened offices in Beijing.

“[Operating between the U.S. and China] was pretty trendy for a lot of companies,” Hou said in an interview with The Wire China. “[It] was still a bonus.”

The zeitgeist of how people feel about these companies is vital, right? The thing that changed is the sentiment around robotics became a component of national security policy, and that pivot point happened somewhere around 2020.

Reilly Brennan, co-founder and partner at the venture capital fund Trucks

Hou, a Shijiazhuang native who grew up in Beijing, was himself a product of what was then a much more collaborative era for the U.S. and Chinese tech sectors. Having grown disillusioned with China’s university system, he pursued a PhD in neuroscience and engineering at the California Institute of Technology’s renowned Koch Lab.

“[The U.S.] was wide open, welcoming, optimistic, and things were bullish for Chinese entrepreneurs moving into California,” said Michael Dunne, CEO of the auto consultancy Dunne Insights and a former China and Indonesia-based executive for, respectively, JD Power and GM. “It was before we got into this era of, oh, by the way, we’re actually totally separate from that group back home.”

TuSimple built what many regarded as an industry-leading autonomous driving technology and, even after U.S.-China ties soured during President Donald Trump’s first term, it debuted on the Nasdaq in 2021.

“TuSimple started off with a bang,” said Patrick Penfield, a supply chain management professor at Syracuse University. “A lot of people were very enamored with what TuSimple could do for autonomous trucking.”

Credit: TuSimple via X

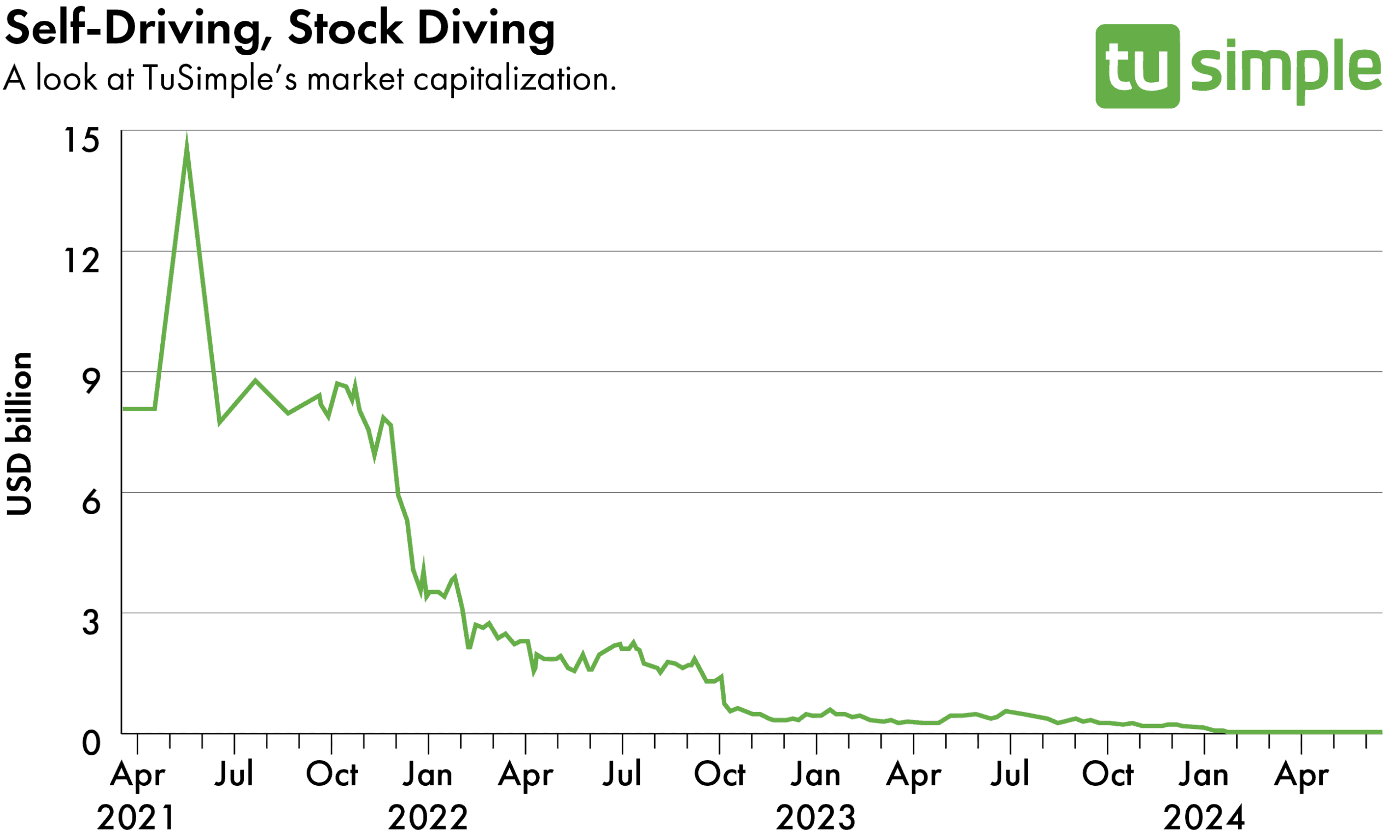

But TuSimple would fall even faster than its rose. In the year following its IPO, a high-profile accident involving one of its vehicles, multiple U.S. government national security investigations into its ties to China, and a bitter years-long dispute between Hou and other TuSimple executives left the company in shambles. Investors fled. By November 2022, just 19 months after its IPO, TuSimple’s market capitalization had fallen from a peak of $15 billion to below $500 million.

“The zeitgeist of how people feel about these companies is vital, right?” says Reilly Brennan, co-founder and partner at the venture capital fund Trucks, which focuses on transportation startups. “The thing that changed is the sentiment around robotics became a component of national security policy, and that pivot point happened somewhere around 2020.”

TuSimple’s U.S. IPO, says Tu Le, Managing Director of consultancy Sino Auto Insights, was one of the last successful exits by a Chinese tech start-up “before the door closed.”

“A JUST WAR”

Despite TuSimple’s failure Hou, now a 40-year-old naturalized American citizen, is attempting a comeback in his adopted country. Last year he launched a new company, Bot Auto, which also aims to deliver a driverless future for the American trucking industry.

The $1 trillion American trucking industry is poised for disruption. The U.S. freight industry currently loses an estimated $95 million each week due to driver shortages. In 2021, the U.S. trucking industry needed an extra 80,000 drivers to fill all potential orders, a figure that is projected to double by the year 2030.

Video footage from TuSimple’s “Driver Out” pilot program conducted in the U.S. between December 2021 and January 2022. Credit: TuSimple

Raj Rajkumar, an engineering professor at Carnegie Mellon University, notes that autonomous trucks can operate 24 hours a day, more than twice the daily driving limit set for truckers under federal law.

“The business model is very strong,” said Rajkumar. “So whoever actually gets the technology right, gets the deployment right, has a lot of upside.”

Hou, however, has not yet escaped the controversies surrounding TuSimple’s failure.

Following his departure from TuSimple in 2023, the company left the U.S. market and moved operations to China, changed its name to Create AI, and changed its focus to AI for animation and video games.

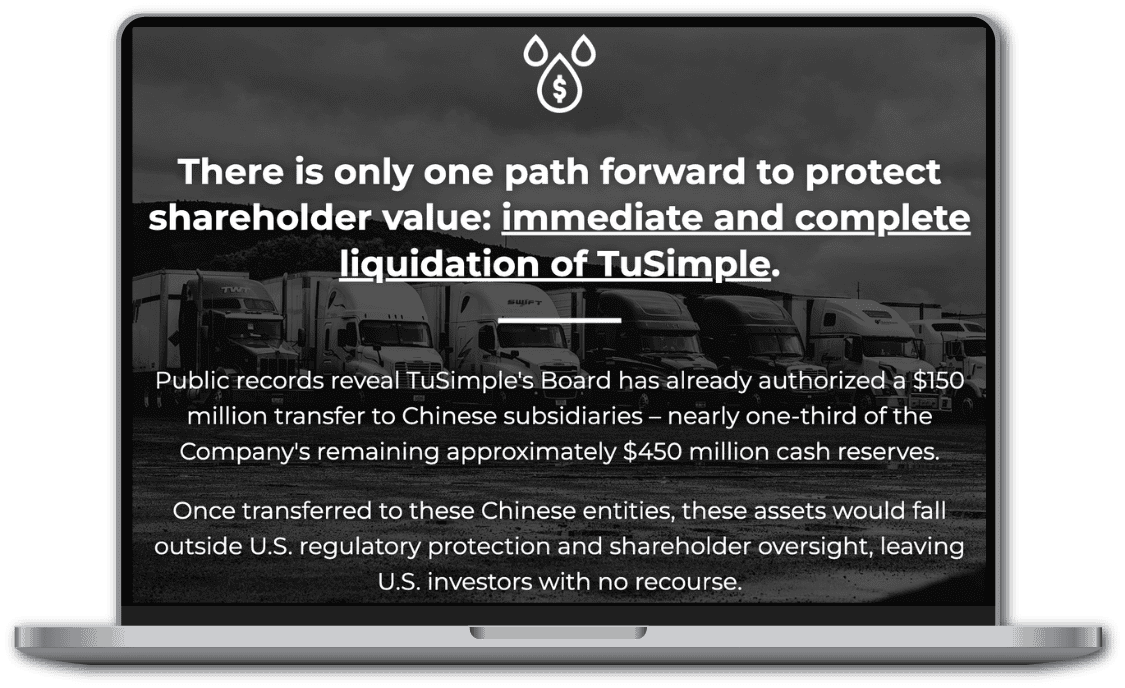

Hou is suing his former colleagues for control of TuSimple’s $450 million cash reserve. If successful, he plans to liquidate the company and redistribute it to shareholders.

A spokesperson for Create AI told The Wire China that Hou’s lawsuit “is part of an ongoing campaign to smear the Company and to prevent the Company from moving forward.” Create AI also accuses Bot Auto of using its technology – a dispute that is the subject of a separate court case in Texas. Hou has denied that Bot Auto is using any of TuSimple’s proprietary technology.

In every generation, people are fighting against improper discrimination. This is my mission. I’m fighting a just war.

Hou Xiaodi

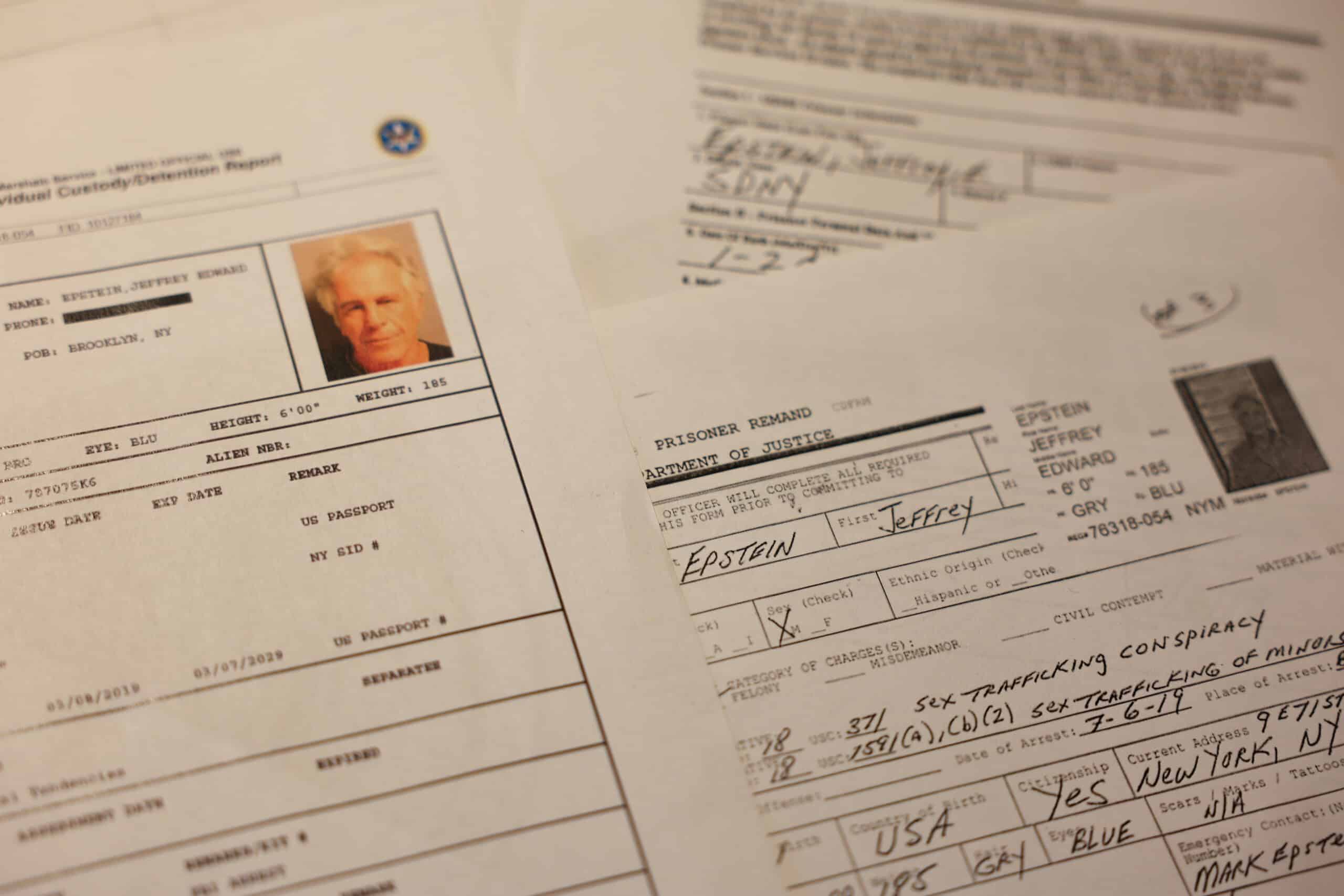

This May, the Wall Street Journal reported that TuSimple, while under Hou’s leadership, shared design plans and technology with a Chinese partner — an apparent violation of a national security agreement the company struck with American authorities in February 2022.

Senator Josh Hawley (R-MO) wrote a letter to the Department of Justice urging the agency to investigate TuSimple for alleged data breaches. Hawley also named Hou’s new venture in the memo. “The American people deserve to know how and why a supposedly U.S.-based company was allowed to serve as a conduit for the transfer of sensitive innovations to the Chinese Communist Party,” Hawley said.

Hou denies that TuSimple had ever violated the firm’s national security agreement with the U.S. government under his leadership, and told The Wire China that there was a “natural bifurcation” of the China and U.S. teams because they operated separate technologies on different servers.

He also thinks some of the accusations against him seized on his former Chinese citizenship and frames his legal battles, his work at Bot Auto, and his push to restore his reputation as part of a broader fight against injustice. “In every generation, people are fighting against improper discrimination. This is my mission,” he says. “I’m fighting a just war.”

CODING THE ROAD

Before he developed an interest in autonomous driving systems, Hou was a child in Beijing who enjoyed playing computer games such as Dune and Red Alert.

In the games, Hou built new worlds by managing resources, fortifying bases, and researching new technologies. But Hou was not content just to win. He also wanted to figure out how the games worked — and rewrite the rules that governed them. He learned how to code to do just that. “I needed to see how the program was operating. I needed to change the program,” he said.

Hou went on to study computer science and engineering at Shanghai Jiaotong University. But just as with the games he played as a kid, he quickly grew bored. He believed university teaching methods were outdated — his math teachers made him do routine equations manually instead of using calculators. He thought his peers cared only about what he saw as superficial metrics, such as grade point averages, instead of actually learning how to think.

With a group of friends Hou wrote a “survival guide” for students at Shanghai Jiaotong University in the late 2000s. The 62-page document was both a critique of China’s education system (the guide said Chinese universities amounted to “assembly lines” that produced “cheap, mass-produced parts”) and a guide for how to think independently and produce original work within the system.

Hou’s instinct to probe the inner workings of complex systems eventually led him to study the human brain. Hou started his PhD program in neuro-science and engineering at the California Institute of Technology’s Koch Lab in 2008, where he developed complex equations and algorithms designed to closely mimic how human vision functions.

Hou knew he didn’t want to enter academia after graduation, but finding practical applications for his graduate work proved challenging. In 2014, Hou returned to Beijing and launched CogTu, a platform that used Hou’s image-recognition technology to boost the performance of online ads. But the sector failed to excite Hou and generating revenue proved challenging.

But while the company sputtered within a year of its founding, two key relationships emerged from CogTu. At CogTu, Hou worked with Chen Mo, a veteran of China’s early tech scene, and he won the backing of Sina Corporation, which he says offered him both funding and full autonomy for his next venture.

Hou says he was attracted to autonomous trucking because there was both a clear business case — the autonomous vehicle sector was just beginning to take off and attract investment — and it was in a cutting edge technological field where he might have a competitive advantage. He moved to San Diego and co-founded TuSimple with Chen in 2015, with an agreement that Hou would be purely focused on the technology side of the company while Chen handled the business side, according to Hou. (A spokesperson for Create AI disputed the idea that responsibilities were so clearly defined.)

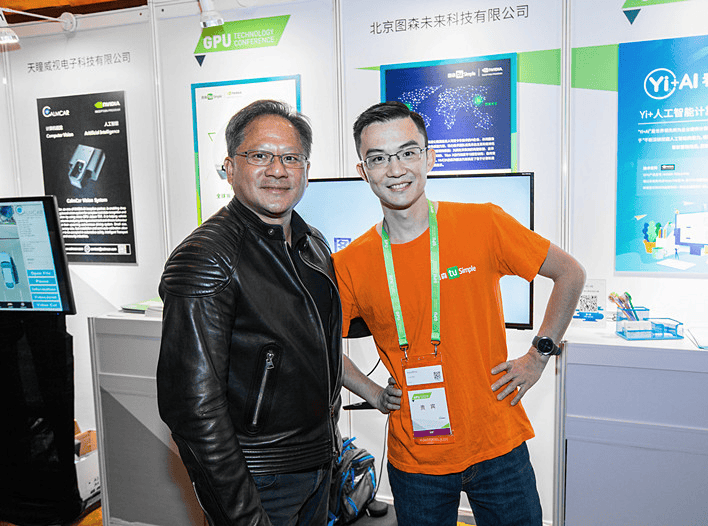

The plan worked. By 2017, TuSimple was running pilot tests with driverless trucks on roads in California and Arizona and attracted a $20 million investment from Nvidia, which agreed to help power TuSimple’s platform with its chips.

The most basic concern for the U.S. government is that these autonomous cars are capturing extremely high resolution data about the things they are driving past. And for Chinese companies, there is zero data privacy with respect to the government.

Peter Harrell, a fellow at the Carnegie Endowment for International Peace and former White House representative to CFIUS

Hou’s singular focus on the technology in the early years — a former colleague says he regularly worked 18 to 19 hours a day — was key to the company’s initial success. But Hou could also be challenging to work for, the former colleague added, because he had a perfectionist streak and tended to micromanage the work of his subordinates.

Hou counters that the complex and “safety-critical” nature of autonomous driving technology requires close oversight and attention to detail, since a minor change in one part of the system could bring down the entire operation.

Successful tests and rounds of investment followed with backing from major players such as shipping giant UPS and Navistar, the commercial truck maker. In 2021, TuSimple’s IPO valued it at $8.5 billion and the company achieved the world’s first fully driverless truck run on open roads, transporting 1,000 watermelons from Arizona to Texas in half the usual time.

THE CRASH

But TuSimple’s IPO honeymoon did not last long.

Shortly after the debut, Hou said he and his executive colleagues began to disagree about the company’s direction. Hou was committed to a long term vision of achieving “level four” driving automation, meaning the removal of drivers from trucks. But other executives wanted to focus on level-two “driver assisted” systems, which could be achieved sooner. A spokesperson for Create AI said there was “no disagreement with the direction of the Company” in 2021 and 2022.

In March 2022, TuSimple announced that Hou would replace TuSimple’s CEO, Cheng Lu, as part of a “leadership succession plan.” Within weeks of his promotion, Hou had to deal with a high-profile crisis.

On April 6, a truck operating with TuSimple’s autonomous technology — aided by an on-board safety driver — swerved off an interstate highway in Arizona and crashed into a barrier. The crash did not result in any injuries and a federal investigation did not impose any penalties, but TuSimple admitted that its technology was at least partially to blame for the accident and the firm was forced to temporarily ground its fleet.

Then, three months after that setback, TuSimple’s board of directors launched an investigation into whether Hou had improperly shared technology and data with Hydron, an autonomous driving company in China founded by Chen in 2021. The Wall Street Journal reported months later that the FBI, SEC and CFIUS were all independently probing TuSimple’s data-sharing practices with China.

“The most basic concern for the U.S. government is that these autonomous cars are capturing extremely high resolution data about the things they are driving past,” said Peter Harrell, a fellow at the Carnegie Endowment for International Peace and former White House representative to CFIUS. “And for Chinese companies, there is zero data privacy with respect to the government.”

The TuSimple board fired Hou as CEO on October 30th 2022, citing an “ongoing investigation” into Hou’s interactions with Hydron. In a LinkedIn post, Hou denied any wrongdoing: “As the facts come to light, I am confident that my decisions as CEO and Chairman, and our vision for TuSimple, will be vindicated.”

Ten days later, Hou had his revenge. He teamed up with TuSimple’s other co-founder, Chen, to oust the company’s interim CEO and the entire board of directors. Together the pair’s voting rights totaled 59 percent.

Hou and Chen rehired Cheng as the firm’s CEO. But as part of Hou’s effort to return to TuSimple, he transferred his voting rights to Chen, an agreement that Hou testified in court was made for a period of two years. A spokesperson for Create AI said the company disputes Hou’s claims about the voting rights.

TuSimple appointed a new board of directors, but by late 2022 the firm’s leadership drama, the accident, and the national security investigations had all taken their toll.

Hou’s relationship with Chen and Cheng also soured. TuSimple accused Hou of trying to poach its staff for a new venture in a filing announcing Hou’s resignation from the board. Hou denied the accusation, and said he was simply talking to employees who approached him because they were disappointed with the state of the company. He resigned in March 2023.

“I resigned from TuSimple given my continuing concerns about current leadership at the company, and my fundamental disagreement with TuSimple’s new business strategy and future direction,” Hou wrote in a LinkedIn post.

By late 2023 TuSimple had laid off hundreds of staff and announced that the firm was pivoting from the U.S. to Asia and voluntarily delisted from Nasdaq in January. Months later, TuSimple said it was renaming itself Create AI, and that the company would focus on generative AI for animation and video games.

“We’re an applied AI company redefining digital storytelling and video games by creating immersive, captivating, and visually stunning content for a global audience,” Create AI said in a recent investor presentation.

TuSimple’s demise set off a series of lawsuits.

Hou, who has a 29 per cent stake in the company, has sued Chen in Delaware to regain his voting rights. He also contends that TuSimple’s re-invention as Create AI was done without shareholder approval, and has set up a website regarding the case.

Meanwhile, the company recently reached a settlement with CFIUS related to its 2022 national security investigation, in which it did not admit fault in the case. It also paid out $189 million to shareholders to settle a class action lawsuit alleging that it had been defrauding investors without acknowledging fault.

HOU’S SECOND ACT

Throughout the tumultuous period at TuSimple, Hou maintained his determination to operate driverless trucks. “At Bot Auto, we have a deep loyalty to the autonomous future,” Hou says.

The autonomous vehicle industry defines autonomy on a one to five scale. Tesla’s Full-Self Driving, or FSD, system is level two and actually a misnomer, because drivers are still required to supervise and assist the autonomous system. Waymo cars, which are completely driverless within restricted areas, are level four.

In trucking, many autonomous driving companies say they are committed to a level four or five driverless future. But actually running driverless trucks on roads is both risky and expensive, so firms often chase shorter-term profits through developing and marketing autonomous software at the lower levels that require driver assistance.

“Hou is singularly committed to running trucks on the road,” says John Arent, information technology director at CMAC Transportation, a trucking and logistics company based in Michigan. “Everybody else in the industry has been dancing around [saying] ‘We’re going to be a software company. We’re going to be whatever.’”

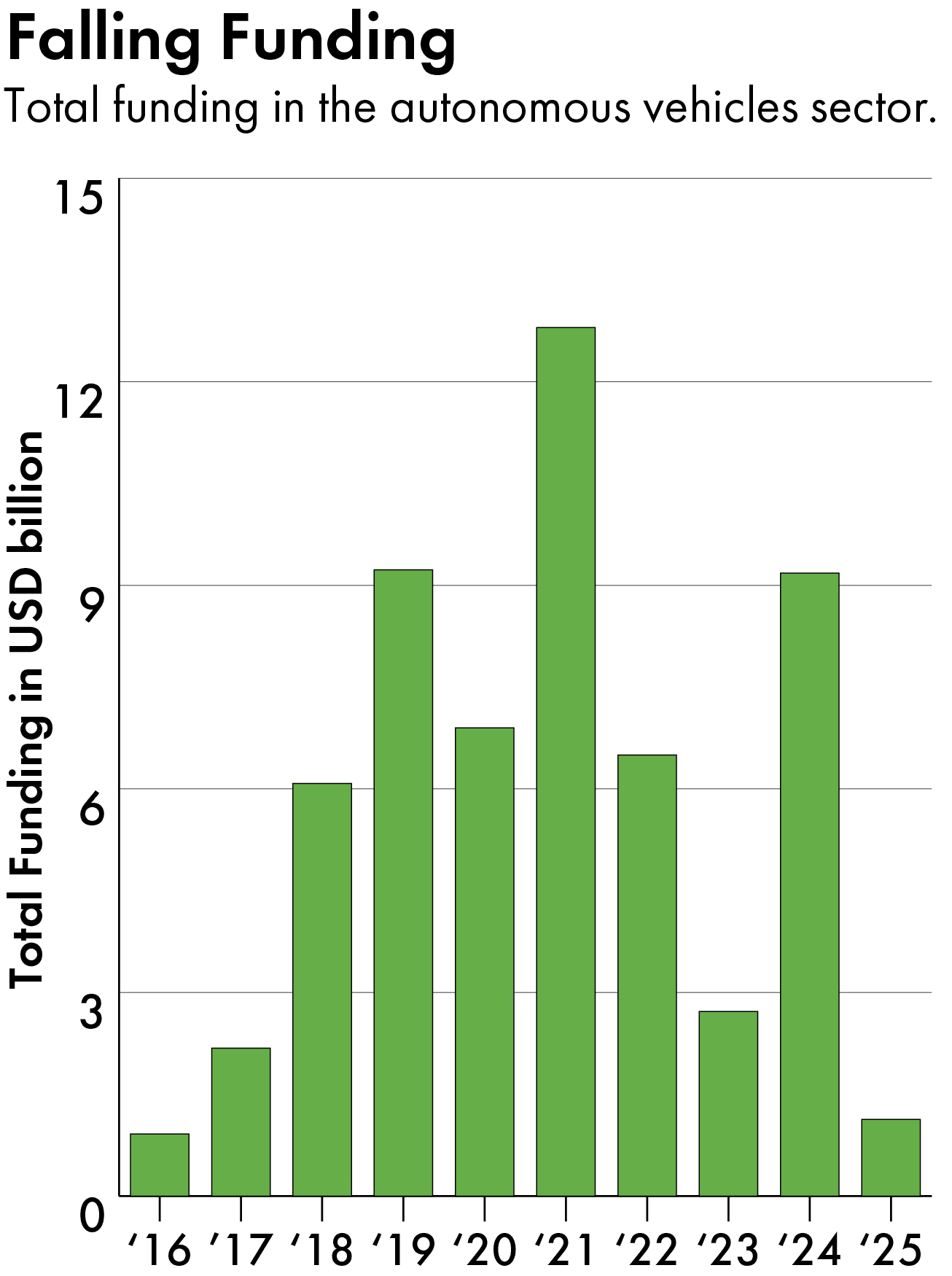

Bot Auto will need to attract hundreds of millions of dollars of additional investment dollars to help realize Hou’s dream — and do so at a time when the sector is struggling to attract financing.

In 2021, the autonomous vehicle (AV) sector attracted $12.8 billion in venture capital funding — more money than AV start-ups received in the 30 months from January 2023 to June of this year.

“The sizzle from autonomous vehicles has kind of subsided,” says Le, of Sino Auto Insights. He adds that although autonomous vehicle start-ups have tried to market themselves as AI companies over recent years, investors are gravitating instead to “purer” AI start-ups: “It’s all AI now. It’s all other emerging technology, frontier technology.”

Brennan, at Trucks venture capital fund, agrees that autonomous vehicle companies “didn’t initially attach themselves to AI, even if they were actually doing a lot of AI”.

“If you saw a self-driving car pitch in 2022 I can almost guarantee you they didn’t talk about AI that much,” he adds. “Now that’s totally different.”

Even if it can catch the AI wave and raise enough funding, Bot Auto may struggle to catch up with other autonomous trucking start-ups — such as Aurora and Kodiak — that surged ahead as TuSimple crashed.

A timelapse of the Aurora Driver travelling from Dallas to Houston, May 1, 2025. Credit: Aurora

“[Driverless trucking] is a challenge — convincing customers, convincing regulators and having deep partnerships with manufacturers,” says Steve Viscelli, a sociology professor at the University of Pennsylvania who studies freight transportation. “And I think Aurora is the only really credible company right now that can say that they would be able to put trucks on the road in meaningful numbers in the foreseeable future.”

In May, Aurora became the first company to launch a fully automated, driverless trucking service. The new route links Dallas and Houston.

But some observers believe Hou and Bot Auto have as good a shot to compete as any start-up, thanks to recent advances in AI and chip technology. The company has been conducting regular road tests in Houston since last year.

Investors are betting on [Hou] because he’s trying to close the door on TuSimple, and they believe in his ability to build a presence in the autonomous vehicle [industry]. He’s not shying away from the spotlight.

Tu Le, Managing Director of consultancy Sino Auto Insights

“Some people have sunk money into developing code that runs on old technology,” says Arent. “The second time you solve the problem [with newer technology], you solve it better. That’s where Bot Auto is sitting right now.”

Bot Auto’s autonomous driving technology in action on the U.S. Interstate 10. Credit: Bot Auto via LinkedIn

Brennan notes that AI developments have also vastly reduced the costs for a firm like Bot Auto in recent years. “Before, you needed a lot of engineers,” he says. “You needed to basically write a lot of rules-based methods to handle situations and the way that you thought about edge cases was difficult.”

Now, he adds, much of this work can be done more efficiently through advanced AI modeling.

“In 2025, it’s a cheaper way to start. The anecdotal numbers we hear on engineering is probably a quarter of the number of engineers required in a generic robotics company than you would have needed 10 years ago.”

Looking back, Hou acknowledges he made mistakes at TuSimple.

“I naively thought that if I had the best technology I didn’t need to care about anything else,” he says. “I had a feeling that I had to be the one to do the technology rather than managing the company.”

Some investors have bought into Hou’s new vision. Bot Auto recently announced that it had secured $20 million in a pre-A funding round, and Hou says the firm has raised $45 million since launching last year.

“Investors are betting on him because he’s trying to close the door on TuSimple, and they believe in his ability to build a presence in the autonomous vehicle [industry],” says Le. “He’s not shying away from the spotlight.”

Grady McGregor is a freelance writer for The Wire China based in Washington, D.C. He was previously a staff writer at Fortune Magazine in Hong Kong, writing features on business, tech, and all things related to China. Before that, he had stints as a journalist and editor in Jordan, Lebanon, and North Dakota. @GradyMcGregor