On a quiet, green bend of the Frieda River, in the remote highlands of Papua New Guinea, sits 16 hectares of land that may become one of the largest open-pit mines on earth. The Frieda River Project — operated by Australian miner PanAust, which itself is wholly owned by Chinese state-owned vehicle Guangdong Rising Assets Management — is forecast to yield gold, silver and copper worth around $1.5 billion per year for 33 years.

Yet, today there are no pits or blacktop roads at Frieda, and its small knot of cabins and machinery are enveloped on all sides by rainforest so extensive it has been called a “second Amazon.”

Thousands of local community members want to keep it that way.

Since 2020 local activists have launched a campaign called “Save the Sepik” — referring to the river from which the Frieda flows — and have accused the mine of various environmental and economic injustices. They say PanAust does not have a robust plan to deal with the mine’s estimated 1.5 billion tons of waste, or “tailings,” and they highlight the fact that China-backed pits nearby have rendered swaths of the country uninhabitable.

“We’re not going to feed the Chinese company and its greed and selfishness,” says Emmanuel ‘Manu’ Peni, the “Save the Sepik” group’s leader, adding that around a hundred thousand people have backed the campaign. Mining companies, he notes, have always been interested in the site, “but it was the Chinese who really pushed for the mine to operate, and I think it was their aggression and some of their practices around circumventing the laws and compliance procedures that raised concerns from the people along the river.”

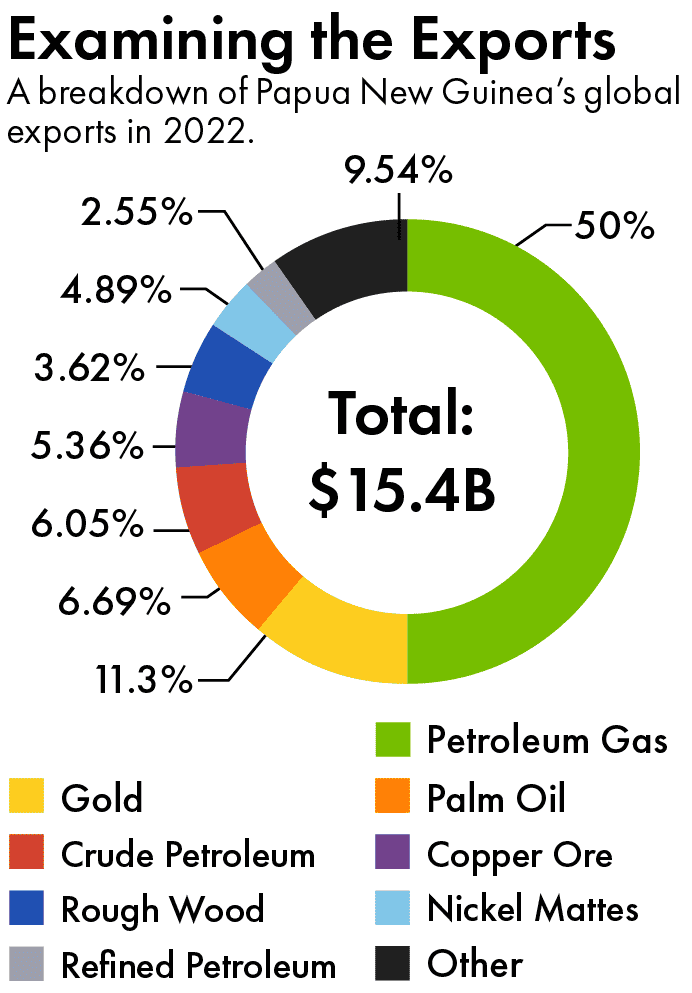

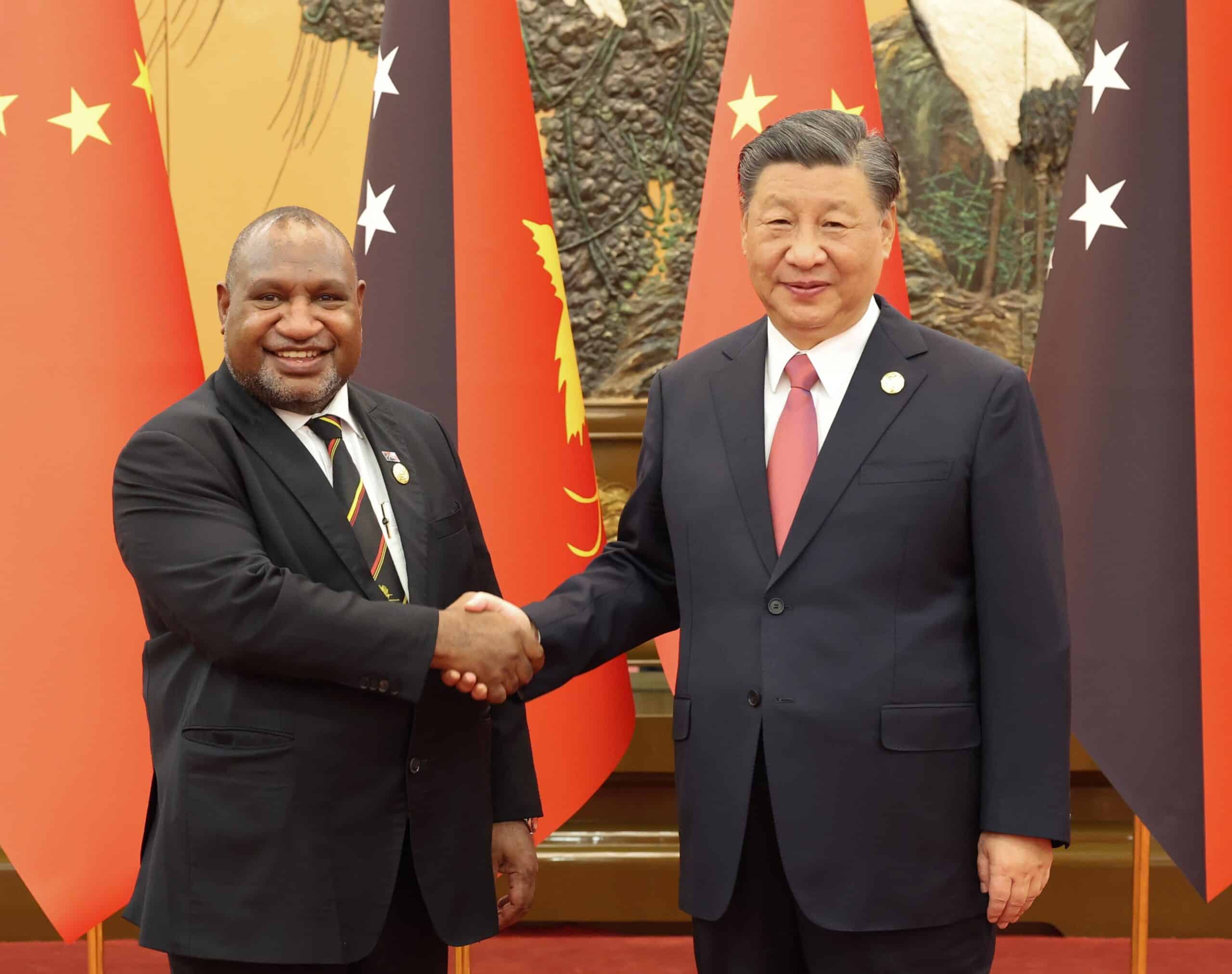

Powerbrokers in the capital city of Port Moresby, some 500 miles away, however, feel differently. Gold is Papua New Guinea’s second-largest export behind petroleum, and mines like Frieda are crucial if the country’s prime minister, James Marape, is to deliver on his promise to double Papua New Guinea’s GDP by 2029.

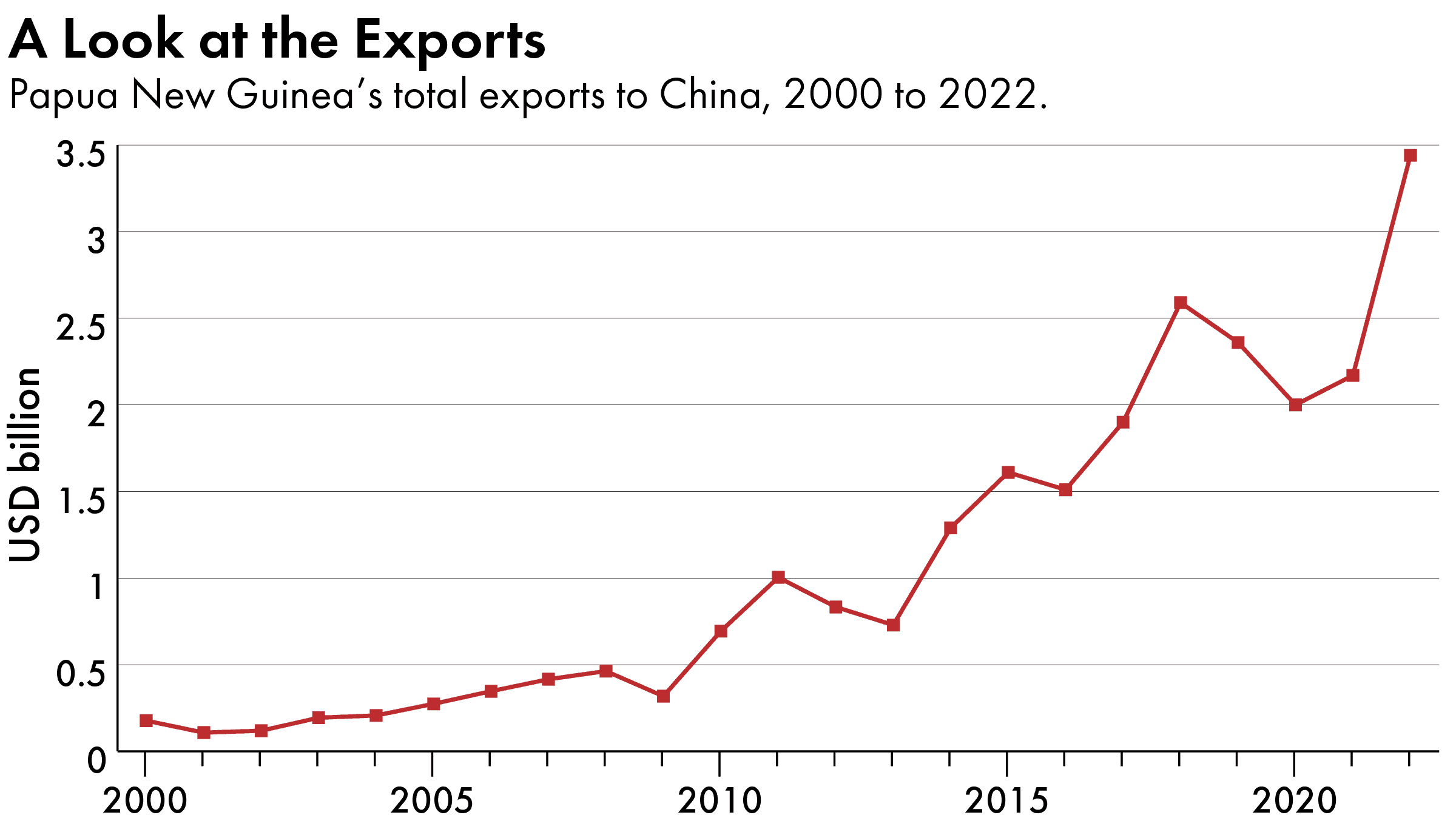

Moreover, those in the capital are feeling the full weight of China’s gold rush diplomacy. In recent years, as China’s demand for gold has skyrocketed, Chinese companies have invested billions of dollars in Papua New Guinea gold mines, and Chinese firms have offered to deliver much-needed infrastructure. Chinese gold purchases this past year are up as much as 28 percent, according to the World Gold Council’s 2023 Gold Demand Trends report. Economic turbulence and geopolitics have encouraged the People’s Bank of China to buy record amounts of bullion, and Chinese jewelers are riding a curious, new wave of nationalistic bling and have never sold more. Thanks in large part to the trends in China, global demand for gold is at record levels and its price recently hit an all-time high.

Papua New Guinea is not the only Pacific nation from which China can realize its golden ambitions. But scattered across the sprawling island nation of some nine million people are the clearest examples of what has — and could — go very, very wrong. Locals now pilot canoes along the Frieda and Sepik rivers emblazoned with slogans like “Stop Chinese Frieda Mine.” And Peni believes his country is at a turning point.

“The mining industry has left ghosts everywhere it has walked,” he says. “We won’t be the next in line.”

GOLD STANDARDS

Credit: Heritage Auctions

In the classic 17th century novel The Dream of the Red Chamber, a young courtier named Yu dies by swallowing a gold nugget — a “brave” and “painless” act that echoes a Chinese love for the metal stretching back to antiquity. Ancient Chinese blended gold into what they believed to be immortality-giving elixirs. “Immortals swallow gold and pearls,” wrote Huan Kuan in 81 BC, “so that they enjoy eternal life in heaven and earth.”

The Chinese symbol for metallic gold (金) even means money, and yet for centuries it was that other bedazzling metal, silver, that played the bigger role in Chinese economics: 15th century rulers imported silver in mammoth quantities, first from Japan, then from Europeans, who sailed from the New World to the markets of Macau.

In 1950, however, when hyperinflation wrecked the economy of the newly-christened People’s Republic, Mao Zedong pegged the yuan to gold — in turn pegged to the U.S. dollar — and, like so many economies that had done the same in previous decades, China’s stabilized.

Our cultural relationship has always been with Australia and the countries in the West. But for the first time we’re seeing a shift happening.

Theonila Roka Matbob, a campaigner and member of the Autonomous Bougainville Government

Beijing joined the west in leaving the gold standard two decades later, as economic turmoil rocked global markets, and its gold reserves remained low until the turn of the 21st century, when China’s economic boom meant it was held ransom by mineral giants like Rio Tinto, BHP and Anglo-American. Jiang Zemin’s subsequent “Go Out” policy, which dispatched Chinese businesses across the world, focused largely on targets in Asia, Africa, Europe and the Americas. But CCP insiders also stressed the importance of a Pacific “arc of instability” that began in Indonesia and stretched across Melanesia, a tectonically volatile region that includes Papua New Guinea, the Solomon Islands and Vanuatu.

Not coincidentally, the arc’s geology meant each state was abundant in minerals — especially nickel, copper and copper’s common bedfellow, gold.

China’s expansion in the Pacific, says Pete Connolly, a security and strategy expert at the University of New South Wales in Australia, “used to be about ‘squeezing’ Taiwan’s strategic space. But I think there’s a lot more to it now.”

Starting around 2015, Chinese gold reserves grew sharply, and in 2017, Guangdong Rising took over PanAust. (It was also investigated by Chinese authorities that year over claims it covered up mining losses, and its chairman, Li Jinming, was arrested.) Connolly notes that Beijing began placing a cohort of “high-quality” ambassadors in the Pacific for the first time, and that China has significantly enhanced its political, security and economic statecraft in Melanesia since — with economic projects at the forefront. “Melanesia’s priority in China’s grand strategy either changed at this point or was higher than the PRC had previously acknowledged,” says Connolly.

Still, the country’s miners were limited. Domestically, they enjoyed colossal subsidies, but they “were inexperienced and naive,” says Clinton Dines, an Australian mining executive and professor at Griffith University who worked as BHP’s China lead from 1988 until 2009. Chinese firms weren’t used to markets, rule-based systems, environmental concerns and employee rights.

“Outside of their home turf,” Dines says, “they’re not terribly effective.”

This has been especially evident in Papua New Guinea. In 2004, China embarked on its first extraction project in the island nation: the $2.1 billion Ramu Nickel-Cobalt Project, on the northern shore of New Guinea island. It was jointly-developed by the China Metallurgical Group Corporation (MCC) and Papua New Guinea, but the mine faced delays in every stage of development. In 2012 local groups attacked Chinese staff, while in 2014 the mine faced a lengthy closure after clashes in which one Chinese worker was killed.

Even more dramatic has been the fate of Porgera, a huge, high-altitude mine that has produced over 16 million ounces of gold. Canadian giant Barrick Gold acquired Porgera in 2006, but faced immediate backlash from local landowners. In 2009, amid environmental protests, Papua New Guinea dispatched police who beat protesters and burned their homes, while in 2015 Barrick admitted its own security had carried out abuses including torture and rape.

In 2015, as China’s gold reserves almost doubled to 56.7 million ounces, or roughly $67 billion, Longyan-headquartered Zijin Mining paid almost $300 million for a 50 percent stake in Porgera. But in 2020, in light of the environmental damages, claims and resettlements issues, Papua New Guinea’s prime minister, James Marape, refused to extend the joint venture’s lease, effectively nationalizing the mine.

Zijin, which is state-owned, reportedly wrote to Marape warning of “a significant negative impact on the bilateral relations between China and [Papua New Guinea].” And the following year, as COVID-19 shrank Papua New Guinea’s economy, the government reversed the decision, restructuring Porgera’s ownership to give landowners and the national government a 53 percent stake, with Barrick and Zijin owning the rest. “It’s better to work with the devil you know,” mining minister Johnson Tuke said at the resigning ceremony.

(Neither Barrick Gold nor Zijin Mining responded to requests for comment.)

The devil Papua New Guinea knows is of increasing geopolitical importance. Gold mining, and mineral extraction more generally, has been a linchpin of Chinese economic diplomacy across the Pacific in recent years. Last July Solomon Islands, which sends almost all its mineral exports to China, signed a controversial “strategic partnership” with Beijing, and has joined a string of island nations in dropping its recognition of Taiwan. Nauru, for instance, reversed its stance on Taiwan after turning to China for an ambitious deep-sea mining project.

Chinese statistics claim that trade volume between Beijing and the Pacific islands has grown from $153 million in 1992 to $5.3 billion in 2021.

At the moment, Australian and U.S. concern over this trend is most focused on Bougainville, an autonomous island territory in Papua New Guinea, that is looking to secure its independence.

Almost 600 miles east of Port Moresby, across the Coral Sea, Bougainville is home to the Panguna copper and gold mine, the largest man-made hole on earth when it opened in 1972. With estimated reserves of $60 billion, the mine once provided almost half of Papua New Guinea’s GDP. But when less-than 1 percent of its profits were channeled to local landowners, and when the mine’s environmental destruction became evident, a ten-year civil conflict broke out in 1988 that saw an estimated 20,000 people killed.

The war’s peace process offered Bougainville a route to independence, which it hopes to achieve by 2027. But in order to secure its future, Bougainville needs to re-open the Panguna mine, which hasn’t been operational since 1989. Today its gigantic pit is surrounded by twisted, rusting machinery and roads whose surfaces are cracked like peanut brittle. Analysts estimate it would take close to a decade and $5 billion to get it up and running again.

The Panguna mine pit in Bougainville. Images courtesy of Sean Williams.

Ishmael Toroama, who was elected president of the autonomous region in 2020, has looked to the U.S. for support re-opening the mine, but experts are unsure he’ll find it. In addition to the U.S. not wanting to get involved in what it sees as a domestic matter, Papua New Guinea is one of the toughest places on earth to do business, according to the World Bank. Political turnover is high — there have been two separate mining ministers since research on this article began — as is graft: Papua New Guinea ranks 133rd of 180 nations on Transparency International’s Corruption Perceptions Index.

While this environment might deter Western investors, China seems undaunted. In 2019, China reportedly offered to construct airports and other infrastructure in Bougainville — a notable development, according to Theonila Roka Matbob, a campaigner and cabinet member of the Autonomous Bougainville Government.

“Our cultural relationship has always been with Australia and the countries in the West,” she says. “But for the first time we’re seeing a shift happening.” Noting the “geopolitical game that’s happening in the region,” she says that China is “one of the biggest forces now that’s coming in to impose its control.”

…it’s almost like [China is] held to a different standard, and that could be because of China’s space in the south cooperation narrative, where it’s managed to successfully cultivate this image of itself as a fellow developing country.

Mihai Sora, a Lowy Institute research fellow

Indeed, Emily King, founder of mining analyst Prospector Portal, warns that, no matter the politics, China’s mining spree will continue apace.

“The Chinese, frankly, always have the ability to either outbid, or undersell, on commodity price,” she says. And with western cash largely diverted from physical extraction projects, there is “a vacuum for Chinese capital to not only come in and mine more gold…but also be the investor that starts to own larger and larger shares of mining companies.”

BLING

China’s desire to dominate the mining of cobalt and other critical minerals needed for the “green” revolution is well documented. But why is China so hungry for gold?

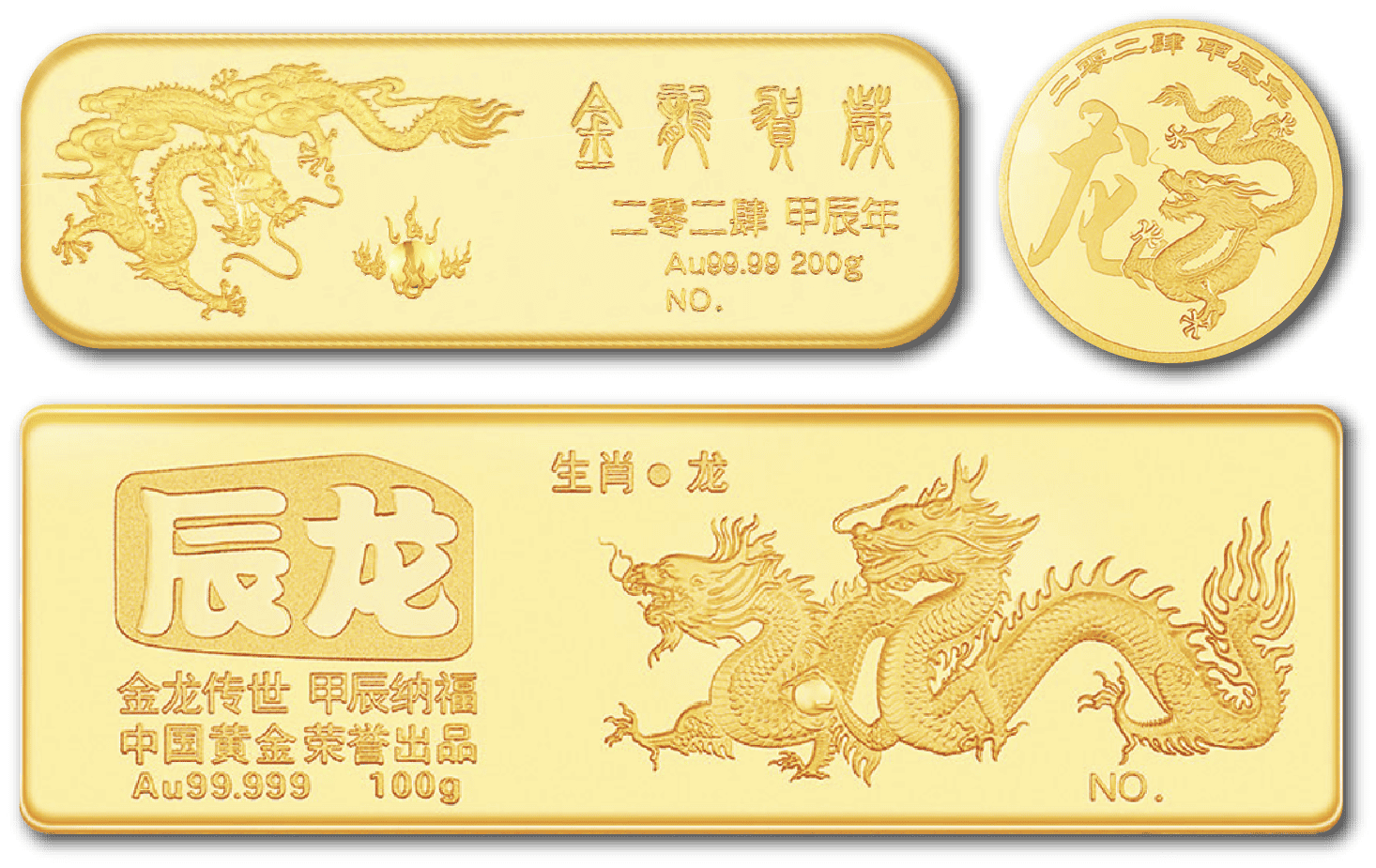

For starters, two-thirds of global demand is driven by jewelry — and China’s goldsmiths are enjoying something of a renaissance. This is thanks, in part, to a new trend called guochao, or “China Chic” (国潮), which pairs gold with crafts and iconography celebrating Chinese history and culture.

“The surge in interest has led Chinese consumers to gravitate towards Chinese jewelers who can align with their preferences and cater to their needs,” says MingYii Lai, a strategy consultant at Daxue Consulting, “especially those seeking pieces that reflect and celebrate their cultural heritage.”

Chinese demand for gold jewelry rose 10 percent in 2023, according to the World Gold Council. But Chinese consumers are also turning to gold as a safe way to store value. As China’s economy has slowed and its stocks have stuttered over the year, demand for gold bars and coins leapt 28 percent.

With the country’s housing market set to drag, explains Claudio Wewel, a foreign exchange strategist at Swiss bank J. Safra Sarasin, “safe havens such as gold have a relative edge.”

“With capital controls in place,” he says, “Chinese investors have fewer opportunities to diversify their investments than private investors in developed markets.”

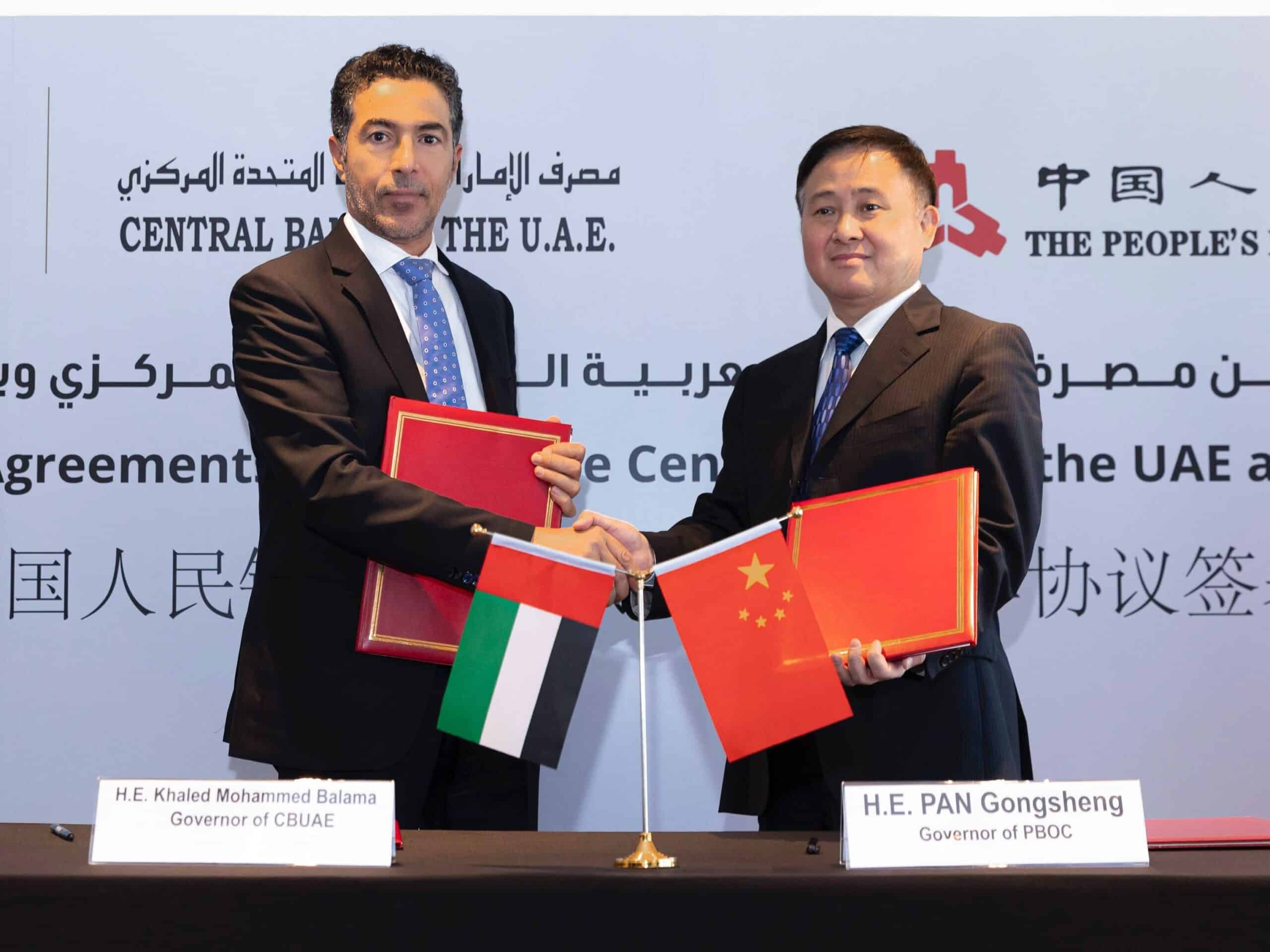

The People’s Bank of China also seems to be looking for diversification, purchasing a record 225 tons of gold in 2023. The precious metal, however, still accounts for just 4.3 percent of China’s total reserves, which suggests Beijing isn’t repeating Chairman Mao’s inflation-busting gold standard of 1950.

“Unlike most developed economies, China did not have to deal with a surge in inflation in the course of the recovery from Covid,” Wewel says. “Generally, we think that the accelerated acquisition of gold reserves is part of a broader effort to de-dollarize China.”

Indeed, this January, state outlet China Daily reported that Beijing’s ballooning gold reserves are part of a move to shift reserves away from dollar-denominated assets. As tensions with Washington increase, some have speculated that the CCP is hedging against the kinds of sanctions that have blocked between $300 and $415 billion from Russia’s central bank reserves since its invasion of Ukraine. Increased trade between Beijing, Moscow and other anti-Western allies also suggests that China is attempting to circumvent the dollar, if not dethrone it.

Yet while China has long held ambitions for a global yuan to challenge the dollar, restrictive capital controls render it little more than a pipe dream. And stocking up on gold will do little to change that.

“When it comes to central bank finances, I think [gold] is a complete non-starter,” argues Fraser Howie, an economist and co-author of Red Capitalism: The Fragile Foundations of China’s Extraordinary Rise. “When you look at how modern finance works — your ability to collateralize against things, and effectively your ability to create money — how on earth does gold factor into that equation?”

All the gold that has ever been mined throughout history — 212,582 tons, according to the World Gold Council — would only fill four, Olympic-size swimming pools, or just the bottom tier of Beijing’s famed Temple of Heaven’s Harvest. An impressive monument, perhaps, but representing $14.7 trillion — at its current, record price — it is trivial to today’s connected economy.

“Gold is not needed to build a credible financial system,” says Howie. “It’s the institutions, it’s the trust, it’s the mechanisms. And I think that’s where China is stumbling to get recognition and engagement, certainly from the developing world.”

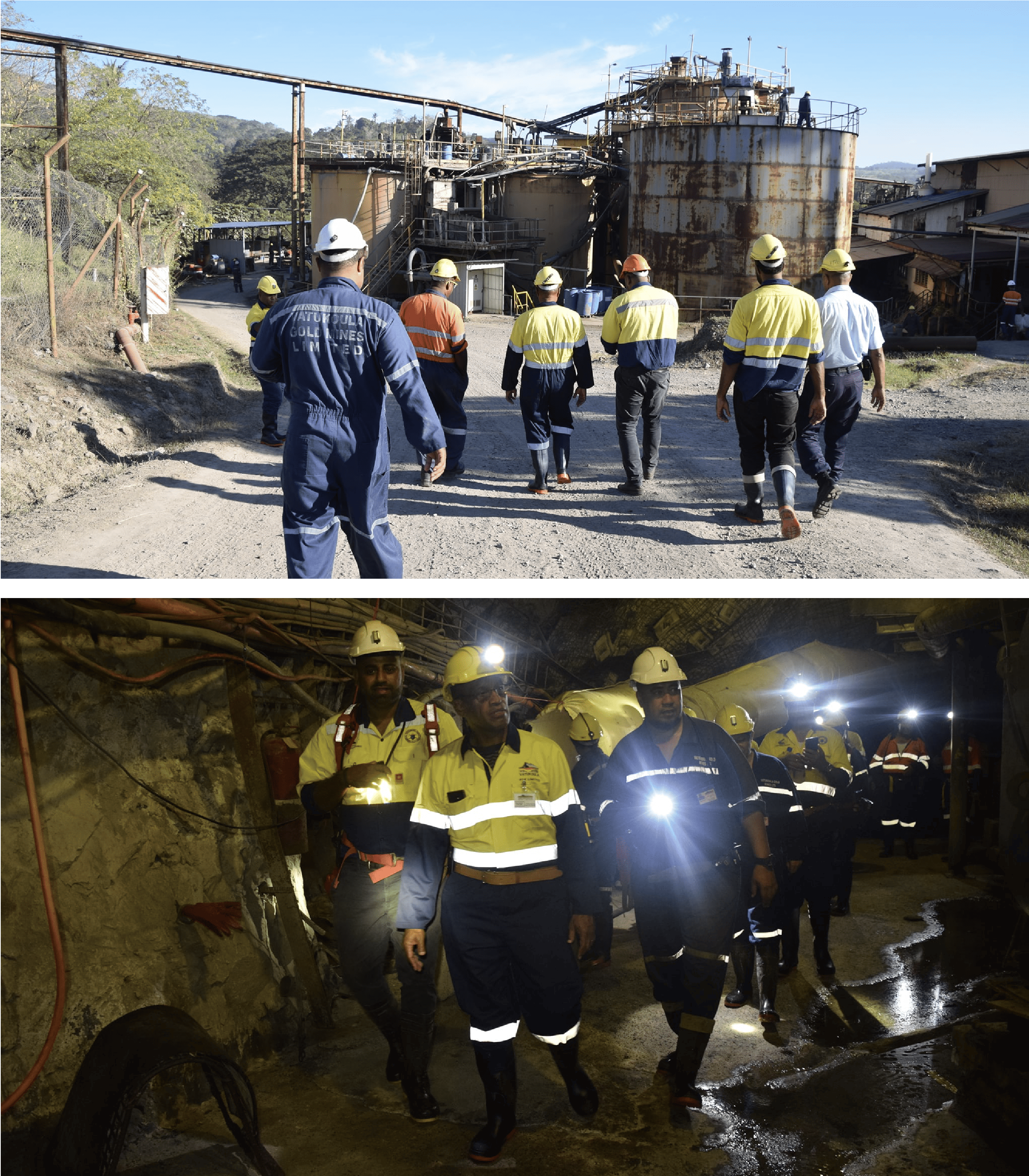

Indeed, even China’s quest for gold is backfiring with some regularity. In Fiji, where Chinese firm Zhongrun International Mining Company Limited has invested tens of millions of dollars in the Vatukoula gold mine, repeated environmental and social controversies have caused political tensions. China-backed gold mining in the Philippines, meanwhile, may be a factor in President Bongbong Marcos’s anti-China turn.

Mihai Sora, of the Lowy Institute in Australia, notes that, until recently, China has managed to get something of a “free pass” in the Pacific. “Whether it’s from voices in the community or from government decision-makers, it’s almost like [China is] held to a different standard, and that could be because of China’s space in the south cooperation narrative, where it’s managed to successfully cultivate this image of itself as a fellow developing country.”

But given the disasters that have befallen projects in Papua New Guinea and elsewhere, there could be a new opening for Western firms to compete with Chinese capitalization.

“One area where the west is trying to combat this — or perhaps to propose alternatives — is through aligning much higher standards for the extractive industry, and collaborating on information sharing and on areas where specific financing could be deployed,” says Milo McBride, an energy, climate and resources expert with the Eurasia Group.

The best strategy for western miners, however, may be to do nothing at all.

“There’s a Chinese chauvinism and an inexperience in this, which is basically doing our work for us,” says Dines, the former mining executive. “We can rush in and try to do stuff, but we can’t compete with the Chinese checkbook. So you might as well stand back and let it roll, and let it work its way through and come out the other side. And some of these places will go, ‘Yeah, we’ve had a taste of the Chinese, we now see more clearly.’”

That certainly seems to be the case along the Frieda River. According to Mary Boni, a ‘Save the Sepik’ activist, locals initially welcomed the project, believing it would bring development. Quarterly forums were held between landowners, PanAust and Guangdong Rising, she says, but resistance grew when there was “nothing concrete” from the mine about environmental concerns or resettlement plans.

“All projects are worrying,” says Boni. “But especially the Chinese, because they do not comply with existing legal policy requirements.”

In May 2020 Frieda River landowners issued a declaration calling for a “total ban” on the pit, but a spokesperson for PanAust, the mining company that owns the Frieda River Project, says the pushback is only a minor hitch — and one China’s deep pockets can overcome.

“Being owned by Guangdong Rising Holding Group enables increased access to the required capital and expertise to deliver such a large project,” the spokesperson says. With Guangdong’s backing, he says, the mine has contributed to local education, health and infrastructure projects. “Overall, our stakeholders are generally very supportive of the project, and we are confident of obtaining the consents and agreements required to proceed.”

Peni, whose activism has made him something of a national celebrity, is not so sure. He says that he only met with PanAust and its Chinese backers once, in 2019, and told them to “pack their bags.” His tribe doesn’t refer to the land as a ‘resource,’ he adds: When he and his cousins used machetes to cut down palms as children, Peni’s mother would chide them. “Don’t do that,” she said. “They’re your ancestors.”

“We are not going to compromise our river, our land, lakes and everything,” he says. “We don’t care if you’re an outsider coming in and saying, ‘We want to develop you.’ Because we watched you develop your towns and build your structures in China, and they’re all falling apart. It’s all based on greed.”

Sean Williams is a British reporter and photographer based in New Zealand. His work has been published by The New Yorker, Harper’s Magazine, GQ, The Daily Beast, The New Republic, Wired, The Economist and more. @swilliamsjourno