Good evening. Here’s your factoid for the week: Of all U.S. farmland, only 0.03 percent is Chinese owned. Yet both the federal government and at least 27 different state governments have passed or are considering legislation to restrict Chinese purchases of U.S. farm land. Our cover story this week looks into the U.S. heartland’s complicated and interdependent relationship with China. Elsewhere, we have infographics on China’s biggest employers; an interview with Tao Wang on making sense of China’s economy; a reported piece on the difficulties of creating a U.S. supply chain for batteries that doesn’t touch China; and an op-ed about de-risking Macron’s China policy debacle. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Buying the Heartland

Does the U.S. need to worry about China encroaching on its territory? Many states used to court Chinese investors, but in recent months, more than two dozen states have considered or passed new legislation to restrict Chinese ownership of farmland. With the federal government getting involved too, the change in attitude could manifest into one of the most significant and potentially consequential ‘decouplings’ in the U.S.-China relationship: agriculture. Grady McGregor reports.

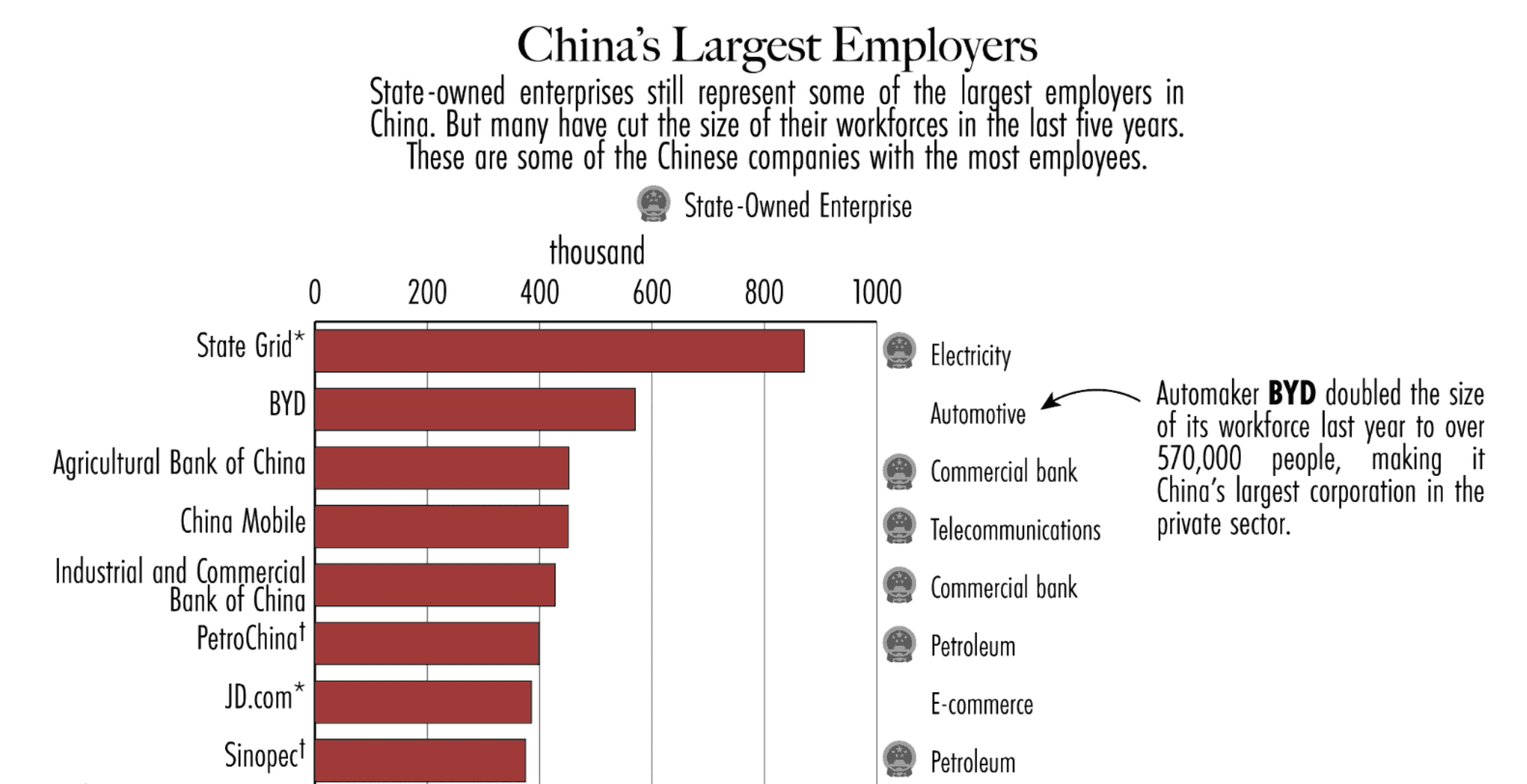

The Big Picture: China’s Biggest Bosses

Last month, Beijing announced a 5 percent cut in the size of the central government’s workforce, which caused quite a stir. This week’s infographics by Eliot Chen look at China’s largest employers: who they are, how they’ve changed, and how the largest state and privately-owned companies compare.

A Q&A with Tao Wang

Tao Wang is an economist who worked at the International Monetary Fund after gaining a doctorate at New York University. She later joined the investment bank UBS where she is currently a managing director and chief China economist. Her new book is entitled Making Sense of China’s Economy. In this week’s Q&A with Andrew Peaple, she talks about the complex story that is China’s economy, including China’s rebalancing dilemma; the cost and benefit of state intervention; why resolving debt issues is more of a slow burn in China; and the perennial questions she gets from investors.

Tao Wang

Illustration by Lauren Crow

Playing Both Sides?

Last October, the Department of Energy announced a $200 million grant to battery maker Microvast Holdings, a U.S.-based company that has the majority of its assets and revenues in China. As Katrina Northrop reports, the ensuing controversy lays bare the political liability that connections to China have come to represent for U.S. companies, while underscoring just how difficult it is for the government to build up U.S. supply chains in sectors like battery technology without funding companies with at least some ties to China.

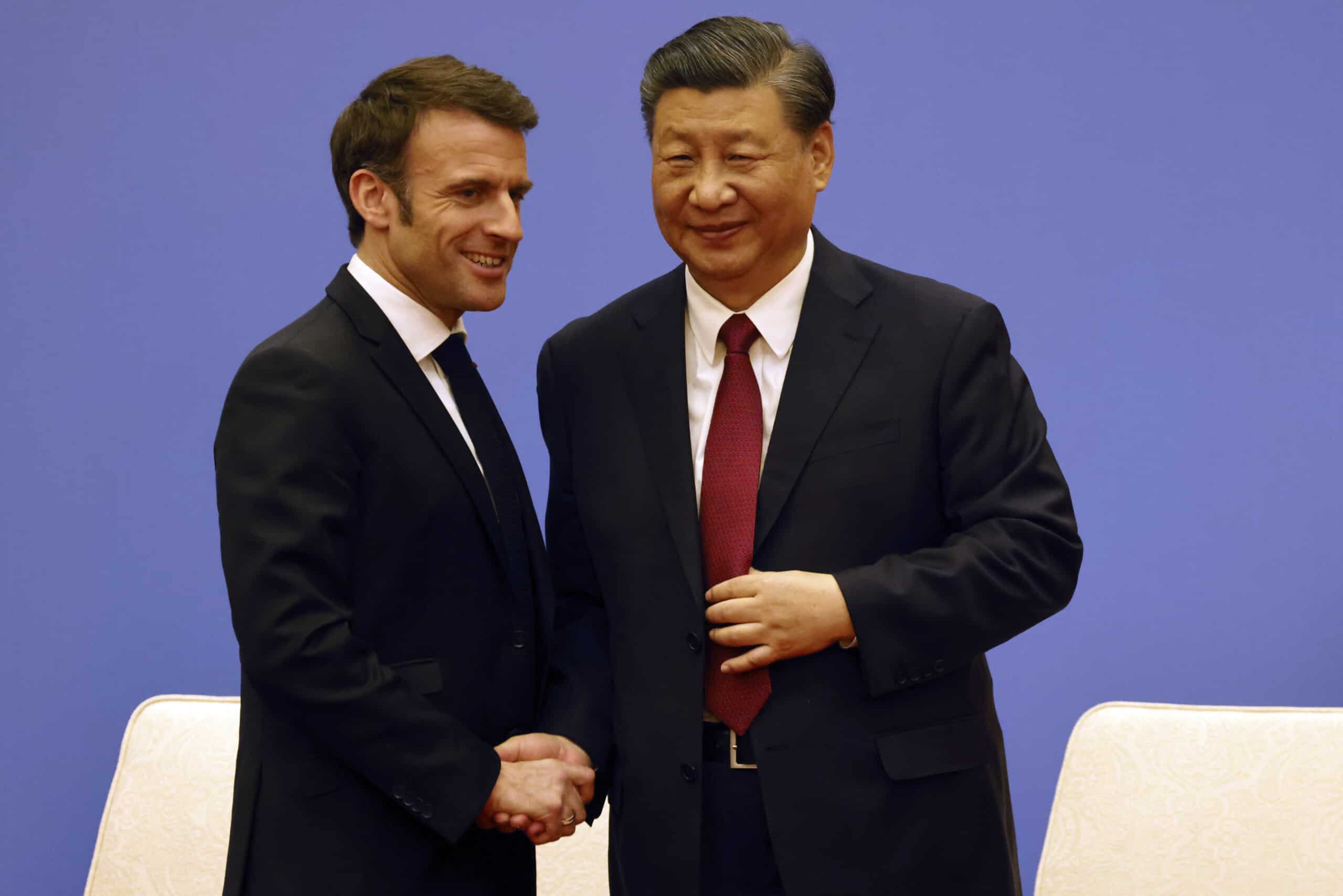

De-risking Macron’s China Policy Debacle

Grzegorz Stec of MERICS unpicks the fallout from French President Emmanuel Macron’s controversial comments following his trip to China, arguing that the EU needs to sharpen how its communicates its policy towards Beijing amid a deteriorating international environment. Stec says that behind the scenes there is more unity across European capitals than Macron’s comments suggest.

Subscribe today for unlimited access, starting at only $19 a month.