Good evening. It’s no secret that it’s been a tough few years for Hong Kong. It’s also no secret that Singapore has, in many ways, benefited from this duress. But what exactly the changes in both cities means going forward has been less clear. This week, our cover story puts Hong Kong and Singapore in conversation with one another to take stock of what to expect from the two financial hubs. Elsewhere, we have infographics on Zijin Mining, one of China’s largest miners; an interview with Chris Marquis on Mao’s lingering impact on China’s political economy; a reported piece on Huawei’s surprising resilience; and an op-ed on autocrats’ bad education. Plus, in case you missed it, earlier this week, Katrina Northrop broke the story of the two men who seem to be at the center of China’s balloon program. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

A Tale of Two Financial Hubs

For the Chinese upper-class and many businesses, Singapore is increasingly filling a role that Hong Kong used to play. In fact, the changes in both cities have led to a general sense that Singapore is the new Hong Kong. But not everyone is so bearish on the Fragrant Harbour. As Brent Crane reports this week, the reality of the two financial hubs — and their relationship to each other — is more complicated.

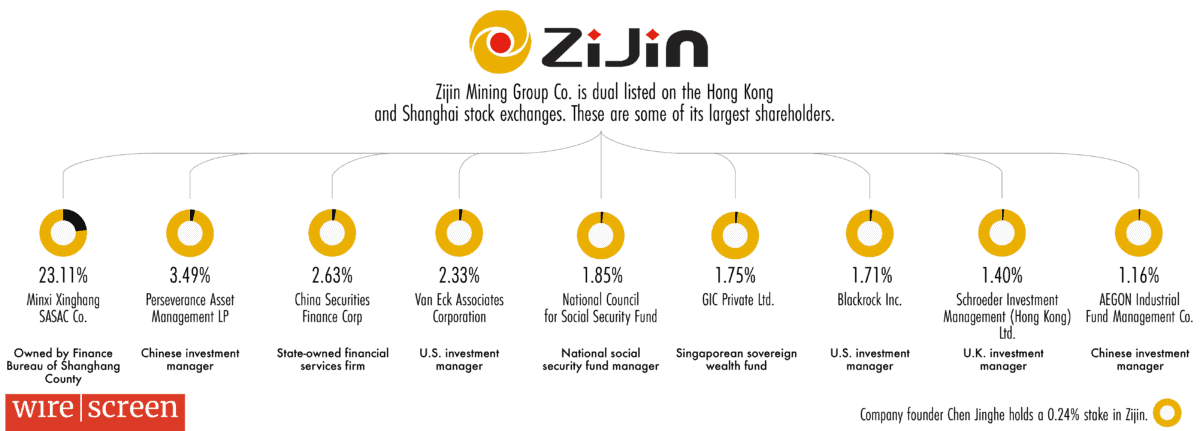

The Big Picture: Major Miner

Zijin Mining made its name digging up gold, but it is now hoping to catch up in the race to produce the minerals that power electric vehicles. This week’s infographics by Eliot Chen look at its emergence as one of China’s largest miners, its overseas investments, and the challenges it faces amid its expansion into minerals for the green economy.

A Q&A with Chris Marquis

Christopher Marquis is Sinyi Professor of Management at the Cambridge Judge School of Business, and a fellow of Jesus College at the University of Cambridge. His recently published book, Mao and the Markets: The Communist Roots of Chinese Enterprise — written together with Kunyuan Qiao from Georgetown University — uses detailed research into Chinese corporate sources and interviews with the country’s business leaders to analyze the lingering impact of Mao Zedong on China’s political economy. In this week’s Q&A with Andrew Peaple, he talks about why Mao is still relevant to Chinese entrepreneurs, and why appreciating the Great Helmsman’s legacy is vital to understanding how Chinese business and politics work today.

Chris Marquis

Illustration by Kate Copeland

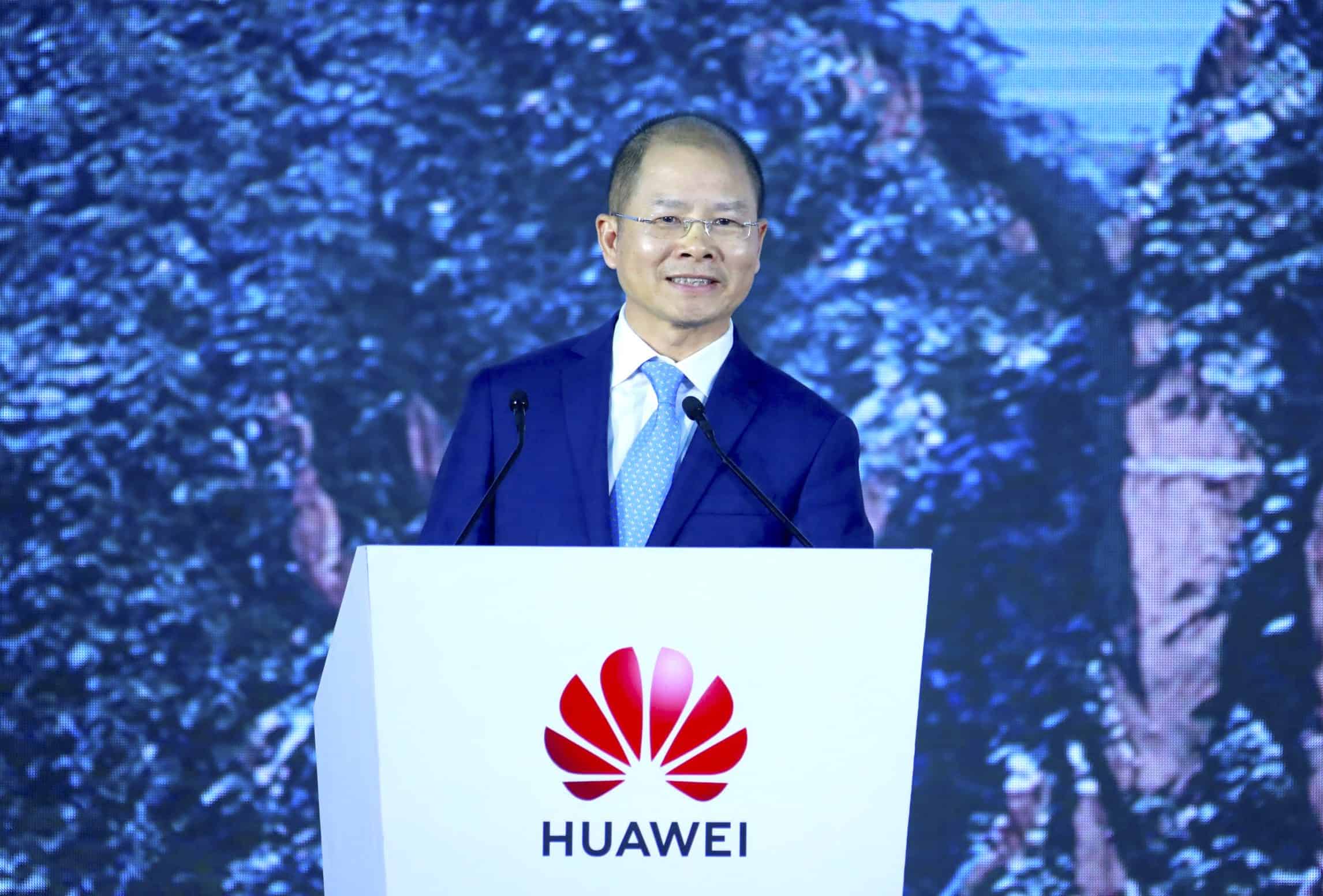

Huawei Hunting

The Chinese telecoms giant faces a new existential threat from U.S. sanctions. But as Grady McGregor reports this week, Washington is still finding international support for its campaign against Huawei hard to come by.

Autocrats’ Bad Education

Autocrats around the world are using their countries’ education systems to help entrench their regimes, but this will have an adverse longterm impact on their economies, argues Charles Dunst in this week’s op-ed. The bargain autocrats make is to keep themselves in power by undermining their peoples’ possibilities.

The Balloon Scientist and His Financier

After a surveillance balloon was discovered flying over the U.S., the U.S. sanctioned six Chinese firms believed to be related to the balloon program. As Katrina Northrop reported earlier this week, two men — a balloon scientist and his financier — are linked to four of the six firms. The men have a complex network of companies involved in balloon and aerospace technologies, some of which are closely affiliated with the Chinese military but are not sanctioned by the U.S. government.

Subscribe today for unlimited access, starting at only $19 a month.