Good evening. As recently as 2020, China’s massive steel industry — like its economy — was in gloating mode after a stronger-than-expected bounce back from the pandemic. But as our cover story this week shows, the steel industry, which is prized by the CCP, is starting to wobble — and it represents some difficult choices for Beijing. Elsewhere, we have infographics on Twitter vs. Weibo; an interview with Teng Biao on fascism with CCP characteristics; a reported piece on global investors’ change of heart on China; and an op-ed about whether Beijing can mandate China to be an innovation powerhouse. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Steel Trap

No other sector has quite embodied China’s rise from a poverty-stricken agrarian state to a modern industrial powerhouse more than the steel industry. It has quite literally undergirded decades of China’s growth. But as Isabella Borshoff reports this week, China’s economic model now needs to shift its reliance away from property and infrastructure — which has the steel industry in a panic. Can Beijing bear to let this prized sector shrink so the rest of the economy can grow?

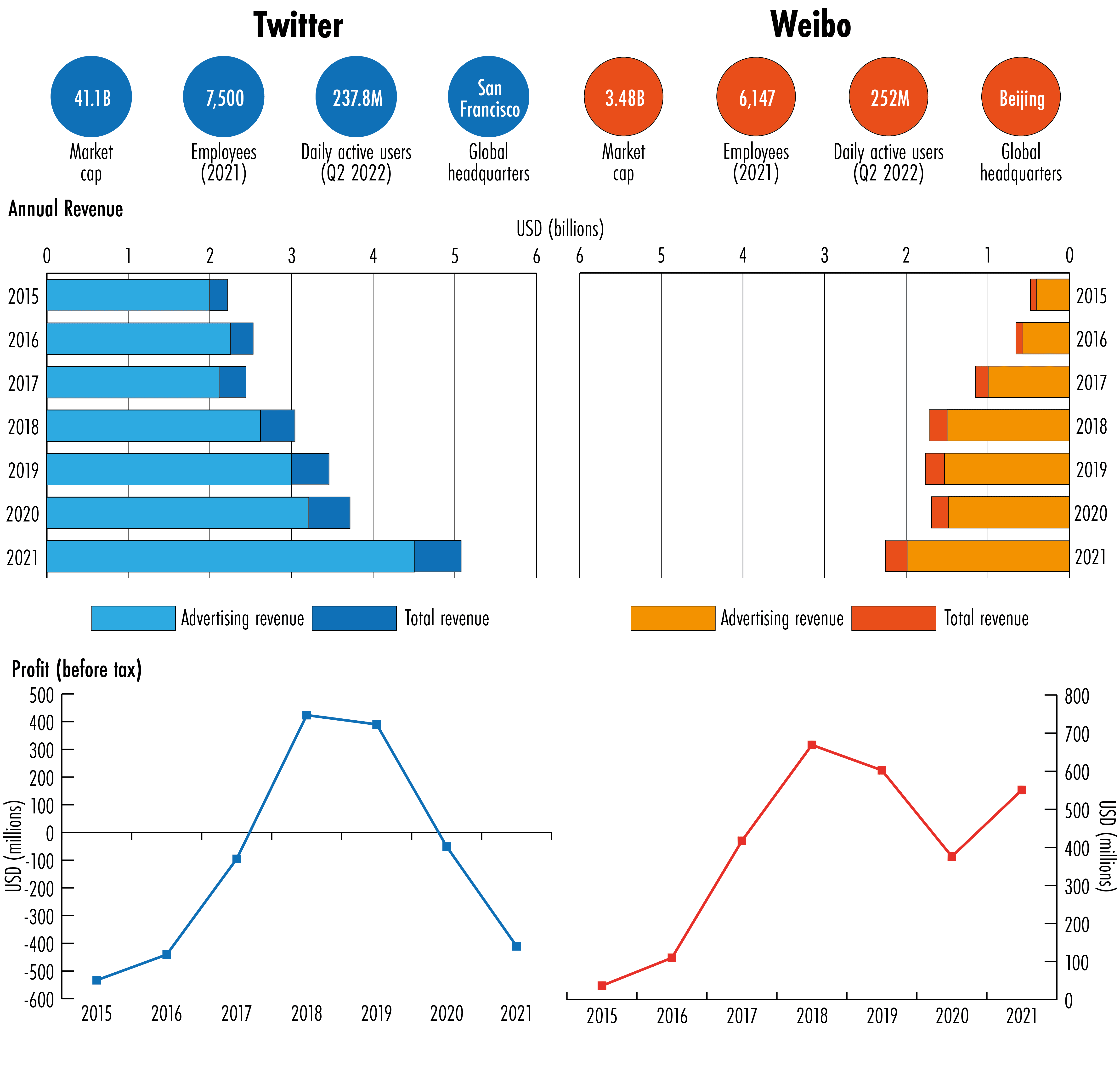

The Big Picture: Twitter vs. Weibo

As Twitter lurches from change-to-change under the mercurial leadership of its new owner, Elon Musk, the platform is, in some ways, becoming increasingly like its Chinese counterpart, Weibo. This week’s infographics by Eliot Chen look at the two social media sites: their financials, their business models and their content moderation.

A Q&A with Teng Biao

Teng Biao co-founded two human rights NGOs in China before being imprisoned for his activism in 2011 and expelled. He is now the Hauser Human Rights Scholar at Hunter College [City University of New York] and the Pozen Visiting Professor at the University of Chicago. In this week’s Q&A with Scott Savitt, he talks about fascism with CCP characteristics; why the billionaire exile Guo Wengui turned on him; and why resistance in China these days is increasingly impossible.

Teng Biao

Illustration by Kate Copeland

Global Change of Heart?

Foreigners have pulled a net $9 billion out of mainland Chinese equity markets this year. For the first time since new trading links with Hong Kong were opened in late 2014, more money has left China than entered over the first ten months of the year. Has foreign investor sentiment towards China changed for good, or can potential policy changes restore confidence? Isabella Borshoff reports.

China’s Innovation Mandate

Can China become a successful location for broad-based innovation? Chinese policymakers have certainly understood the importance of innovation, but as Simon Commander and Saul Estrin argue in this week’s op-ed, the results of Beijing’s ambitious plans so far have been mixed.

Subscribe today for unlimited access, starting at only $19 a month.