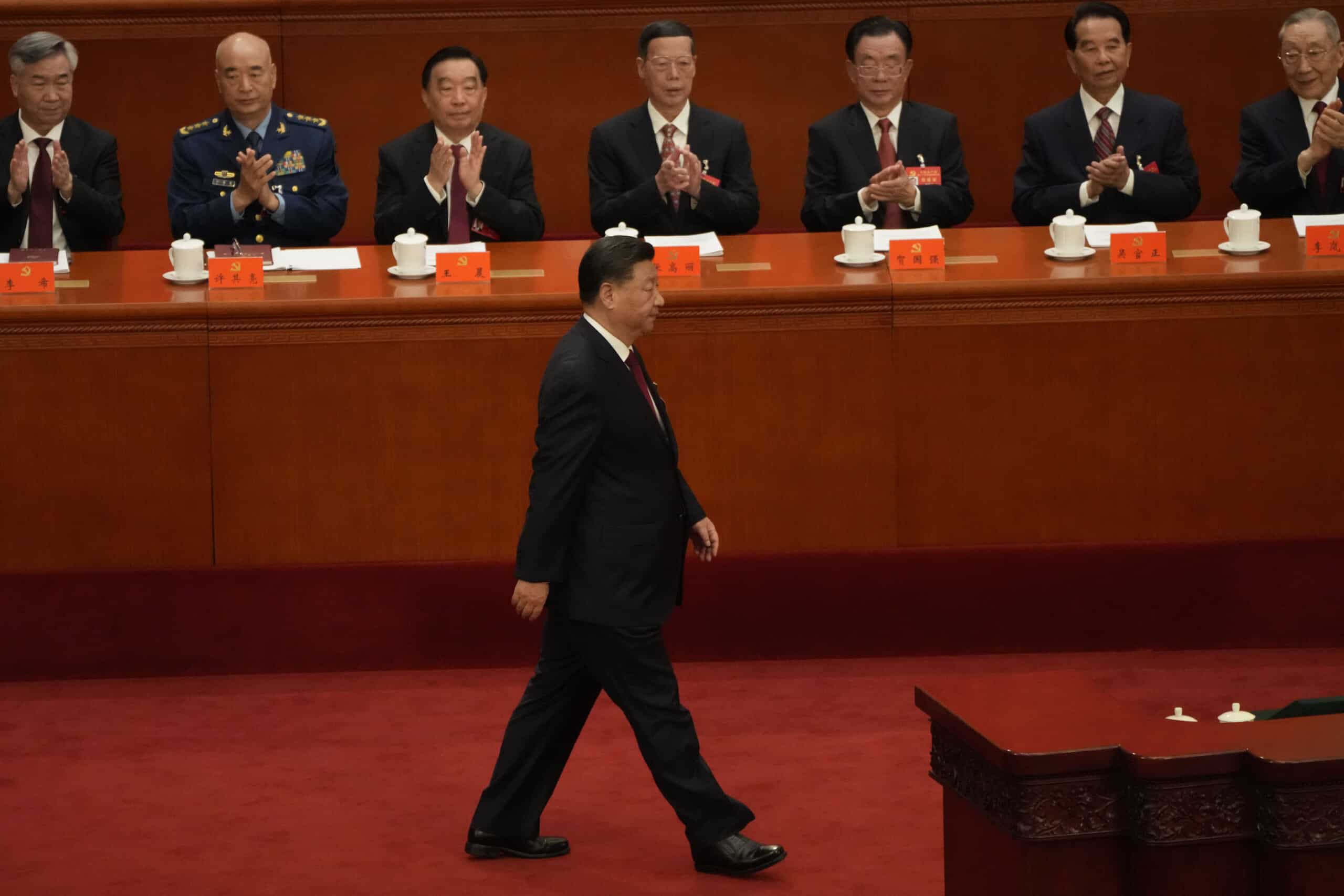

Good evening. Xi Jinping’s name was first mentioned in the New York Times in 1992; it did not appear again until 2006. Things have clearly changed a lot in the past decade: Since 2013, Xi’s name has been mentioned in the Times an average of 1,409 times each year. Now, as the 20th Party Congress kicks off in Beijing, much has been written about Xi’s consolidation of power. Our special cover story this week takes a slightly different approach, illustrating Xi’s centrality in the Chinese Communist Party and the profound changes he represents with figures and in graphic form. Elsewhere, we have a reported piece on China’s potential coal comeback; an interview with James Fok on the flawed dollar system; an op-ed from Logan Wright on how China’s illusions of control could make a financial crisis more likely; and an op-ed about how Xi Jinping can strengthen the Chinese economy. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Xi Jinping By the Numbers

Ten years after Xi Jinping ascended to China’s top leadership position, the Chinese Communist Party is a party remade. More than at any point in the post-Mao period, it is an organization constructed around personalistic rule, with power in the hands of a single man. Now, on the eve of the expected confirmation of Xi’s third term, The Wire‘s Eliot Chen gathered a variety of figures that illustrate his power and how the country has changed during his decade at the top.

Coal Comeback?

China has said it wants to reduce coal’s share in the country’s overall energy mix, but following a summer of power shortages, two state-owned energy companies have begun construction of a coal plant in Xinjiang. Isabella Borshoff reports on Beijing’s mixed messages about the role of coal in China.

A Q&A with James Fok

James A. Fok is a financial markets veteran who most recently worked as a senior executive at Hong Kong Exchanges and Clearing (HKEx), the company that runs Hong Kong’s stock market. His recently published book, Financial Cold War, describes the economic and financial background to the current U.S.-China tensions. In this week’s Q&A with Andrew Peaple, he talks about the flawed dollar system; the mistake of decoupling; China’s international markets predicament; and why mutual dependencies in the global financial system is in the self interest of all countries.

James Fok

Illustration by Lauren Crow

Illusions of Control

Public messaging that Xi Jinping is further consolidating power at the 20th Party Congress would make a financial crisis in China more probable, not less, argues Logan Wright in this week’s op-ed. The Communist Party’s efforts to cultivate a perception of political stability have interacted with financial stability in often misunderstood ways, and the economic bargain between the Party and Chinese citizens, which has broadly sustained this financial stability in the recent past, has now fundamentally changed.

How Xi Jinping Can Strengthen the Chinese Economy

Xi Jinping is expected to win a third term as the country’s top leader, but as Nancy Qian tells us in this op-ed, his management of the economy during the past decade has been less than stellar. The country has been faced with a number of challenges, including Covid and a declining workforce. But the economy is struggling under Xi partly because it has given up much of the flexible and experimental policies of the recent past in favor of his personal directives. For China’s economy to strengthen, that has to change.