Good evening. According to the National Strategy for Climate Adaptation released last month, China will be a “basically climate-resilient society” by 2035. Our cover story this week — the second part of our “Warming War” series — looks at the huge infrastructure projects currently under construction to make this goal a reality, what they illustrate about China’s approach to climate change, and what they mean for geopolitics. Elsewhere, we have infographics on Tianqi Lithium, which just netted $1.7 billion in its IPO; an interview with Larry Summers on the principles of a multipolar system; a reported piece on China’s latest effort to push out Microsoft Windows; and an op-ed about how globalization and inflation are linked. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Adaptation Advantage

China is mobilizing to adapt and thrive in a rapidly warming world. Under Xi Jinping, the country has undertaken thousands of projects — across industries and in every part of the country — that are clearly designed to protect the country against severe, longterm climate change. But as Eyck Freymann reports in the second part of our new series, “The Warming War,” if it succeeds, the geopolitical consequences will be profound. Is America ready?

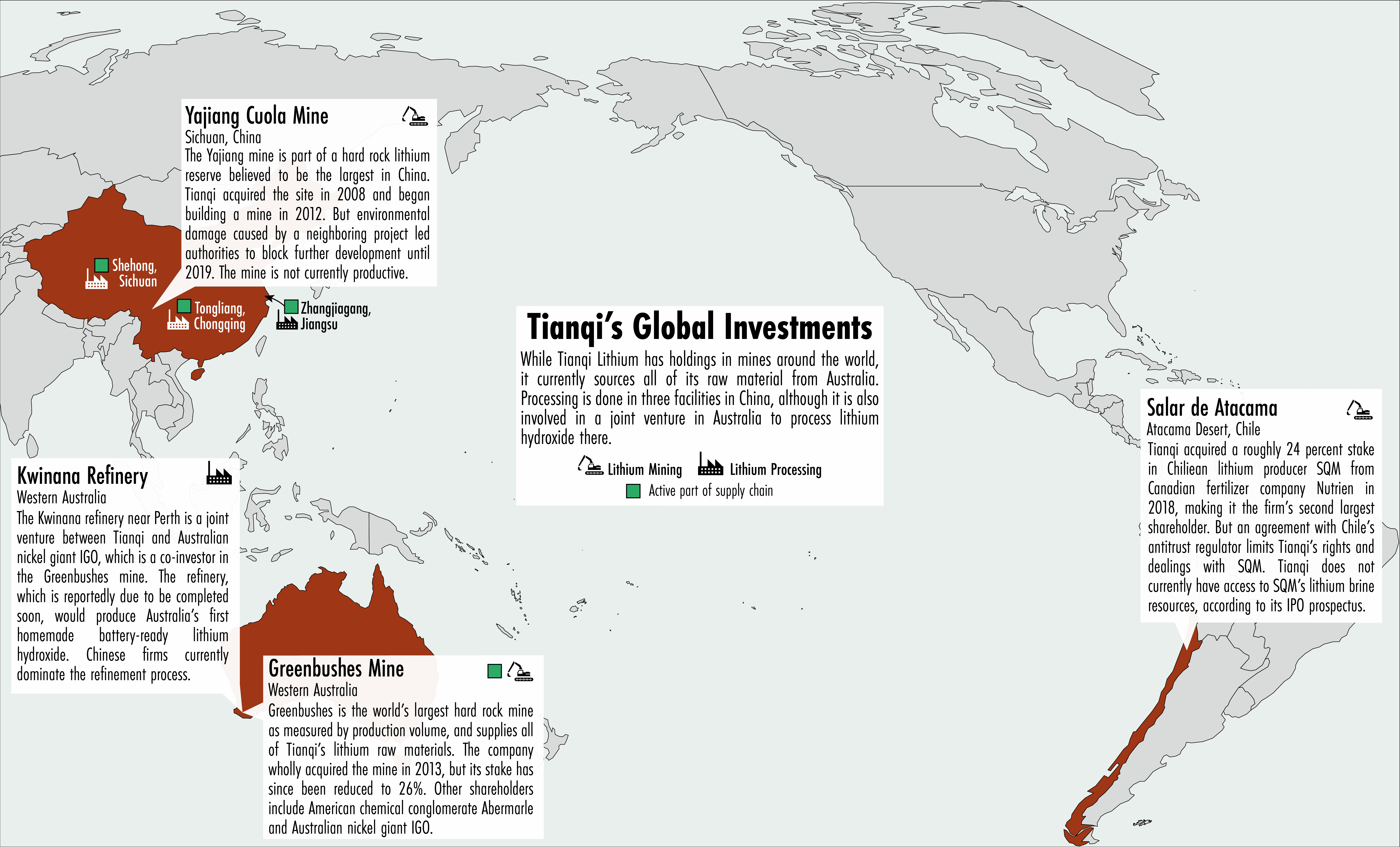

The Big Picture: Mining Lithium and Money

The green energy transition has pushed a new class of companies to prominence, including major Chinese producers in the critical mineral supply chain like Tianqi Lithium: the largest producer of mined lithium in the world in 2020, which just netted $1.7 billion at its IPO. This week, our infographics by Eliot Chen look at Tianqi Lithium: its rise, its investors and its global footprint.

A Q&A with Lawrence Summers

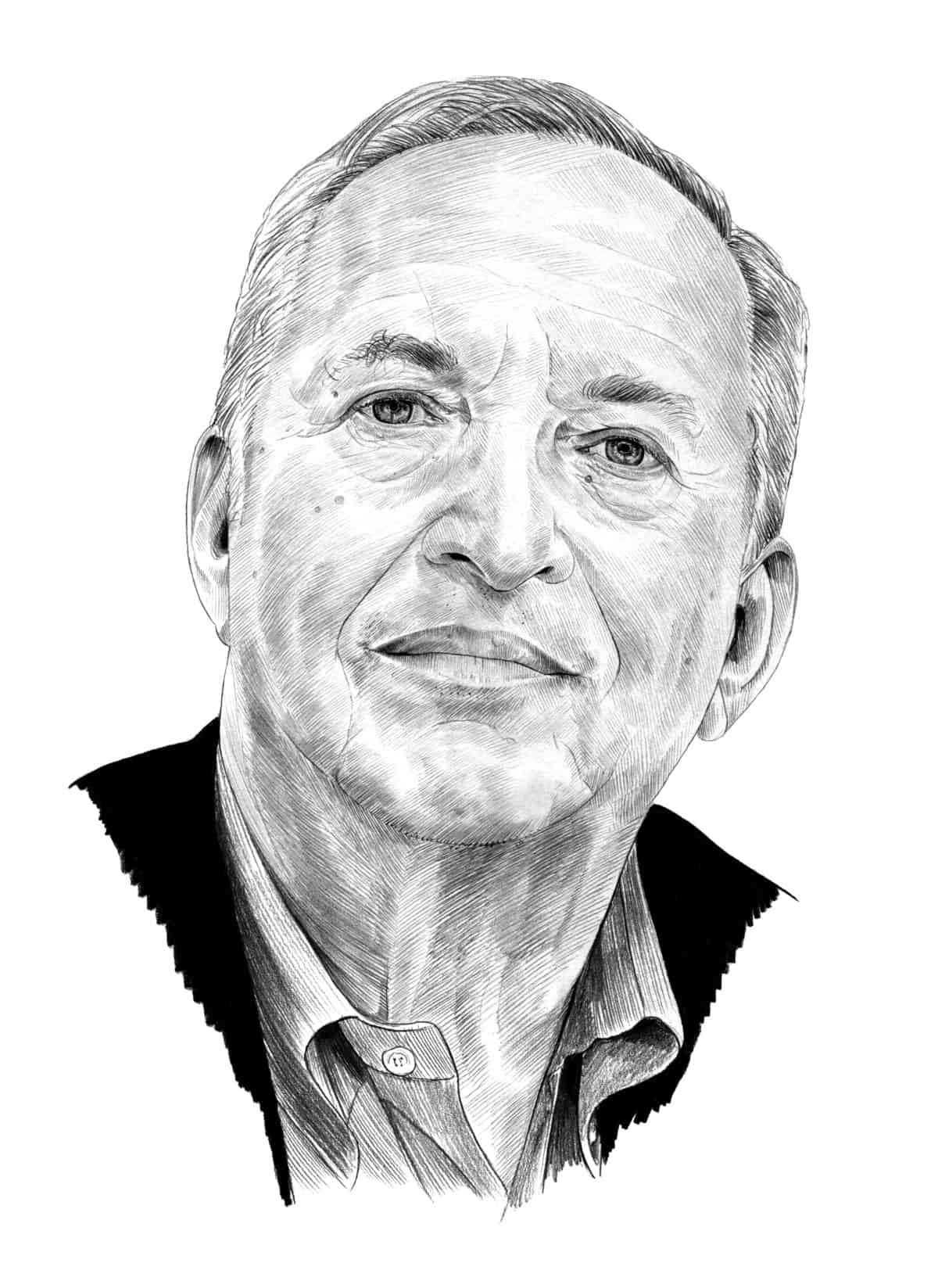

Lawrence H. Summers has played a leading role in Democratic Party policymaking since the 1980s. As Treasury Secretary in 1999, he helped finish negotiations with China for its entry into the World Trade Organization. More recently, back at Harvard University, he urged the Biden administration and the Fed to focus on inflation before either gave it much attention. In this week’s Q&A with Bob Davis — part of our new series Rules of Engagement — he talks about the principles of a multipolar system; alternatives and counterfactuals in the U.S.-China relationship; lessons from both the Japanese and Russian experiences; and why truculence is never productive.

Lawrence Summers

Illustration by Lauren Crow

Shutting Out Windows

In June, Beijing launched its latest attempt to come up with a viable, indigenous rival to Microsoft Windows. But as Garrett O’Brien reports, edging out Windows, which has an 85 percent market share in desktop operating systems in China, remains a formidable challenge.

The Inflationary Consequences of Deglobalization

Globalization previously made it easier for major central banks to pursue and maintain low inflation. As Shang-Jin Wei and Tao Wang argue in this week’s op-ed, deglobalization risks having the opposite effect, and if this process continues unchecked, monetary policy may need to be tightened more than would otherwise be the case.

Subscribe today for unlimited access, starting at only $19 a month.