Good evening. The U.S. has been fighting the opioid epidemic for years now, and yet still overdose deaths are at all time highs — up an astonishing 61 percent since 2018. As our cover story this week shows, two things are contributing to the latest, devastating chapter of the opioid crisis: a surge of fentanyl on U.S. streets, and the unexpected rise of the Chinese fentanyl industry in Mexico. Elsewhere, we have infographics on multinationals’ revenue in China; an interview with Mikko Huotari on Germany’s ‘capacity to act’; a reported piece on why the Chinese acquisition of even a small British chip-maker now warrants international pressure; and an op-ed about why China and the G7 following separate paths will leave both sides worse off. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Fentanyl’s New Flow

After years of U.S. pressure, Beijing finally banned fentanyl in 2019. Many celebrated the announcement, thinking it would help turn the tide in America’s deadly opioid crisis. But as Sean Williams reports for this week’s cover story, there is more Chinese-made fentanyl flooding U.S. streets than ever before. Experts say it’s because of increased and unexpected ties between Chinese producers and Mexican cartels, and they’re torn on how to stop it.

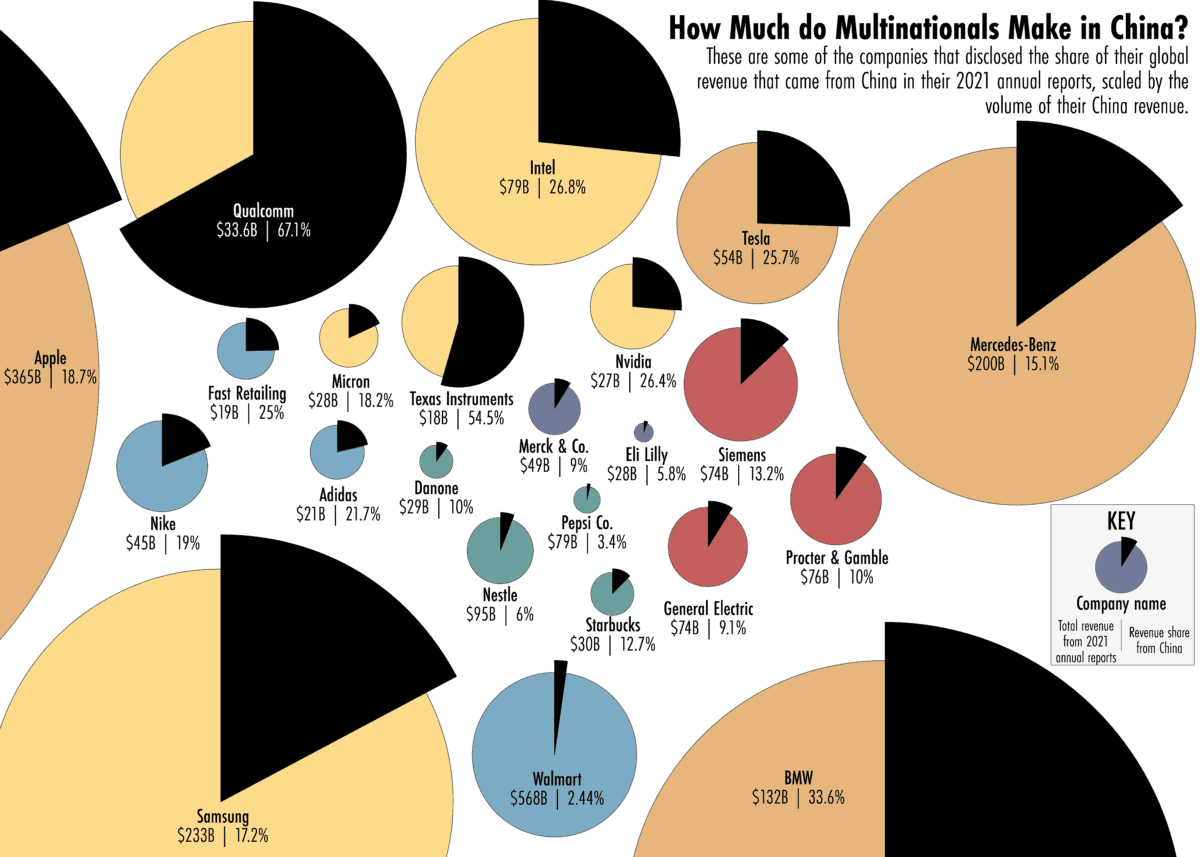

The Big Picture: Puzzling Profits

For many multinationals, the China market is crucial to their bottom line. But how much revenue do they actually generate from China? For the world’s most recognized brands, that answer is surprisingly elusive. This week, our infographics by Eliot Chen look at recent public filings for more than 100 multinational firms to find that only about a quarter disclosed what share of global revenue they derive from their China operations.

A Q&A with Mikko Huotari

Mikko Huotari is the executive director of MERICS (Mercator Institute for China Studies), the Berlin-based think tank. He is an expert on China’s foreign policy, global and economic governance and competition, as well as China-Europe relations. In this week’s Q&A with Andrew Peaple, he talks about Germany’s ‘capacity to act’; the choices facing German businesses; ‘patchwork globalization’; and why no one in Europe is interested in decoupling from China.

Mikko Huotari

Illustration by Kate Copeland

The Semiconductor Effect

As U.S. and European governments, fearful of future supply chain disruptions, look to become more self-reliant in semiconductor manufacturing, the acquisition of even a small chip-maker by a Chinese company causes an international storm. As Isabella Borshoff reports this week, the UK’s recent decision to review the Newport Water Fab deal comes after months of mounting pressure.

How to Engage with China

Contrary to the prevailing narrative in the West, argues Paola Subacchi in this week’s op-ed, cooperation with China has been the norm, rather than the exception, for decades. But if G7 leaders decide to make “core values” the basis of international cooperation, this could well change, and a global economy in which China and the G7 follow separate, non-converging paths, she says, will leave both sides worse off.

Subscribe today for unlimited access, starting at only $19 a month.