Good evening. Solar panel technology is not like other green tech: it doesn’t rely on hard-to-get minerals and manufacturing is actually pretty easy to stand up. It’s also not like traditional energy sources like oil, in that the panels last for decades and the supply can’t just be “turned off.” So why has the U.S. spent more than a decade fighting against China’s dominance of the supply chain? Our cover story this week looks into America’s great solar struggle. Elsewhere, we have a Q&A with Michel Lowy, a CEO who specializes in distressed debt, on where the investment opportunities are in China; infographics on ‘neo-commodities’ and the Chinese companies that stand to gain from them; a round up of the best new China books, including some always popular sci-fi; and an op-ed from Columbia’s Shang-Jin Wei about what the U.S. gets wrong about the WTO and China. We’re off next week, but we’ll be back in your inbox in the new year. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Solar Struggle

For more than a decade, the U.S. has tried to use tariffs as a way to thwart China’s solar panel manufacturing industry while nurturing its own. But many analysts say it’s been a disaster: the U.S. still relies heavily on imports while the tariffs have raised prices on installations, slowing the country’s solar adoption. But as Lili Pike reports in this week’s cover story, U.S.-China trade policy is never that simple, and now allegations of forced labor in China’s solar supply chain are further complicating matters for President Biden — and the clock is ticking.

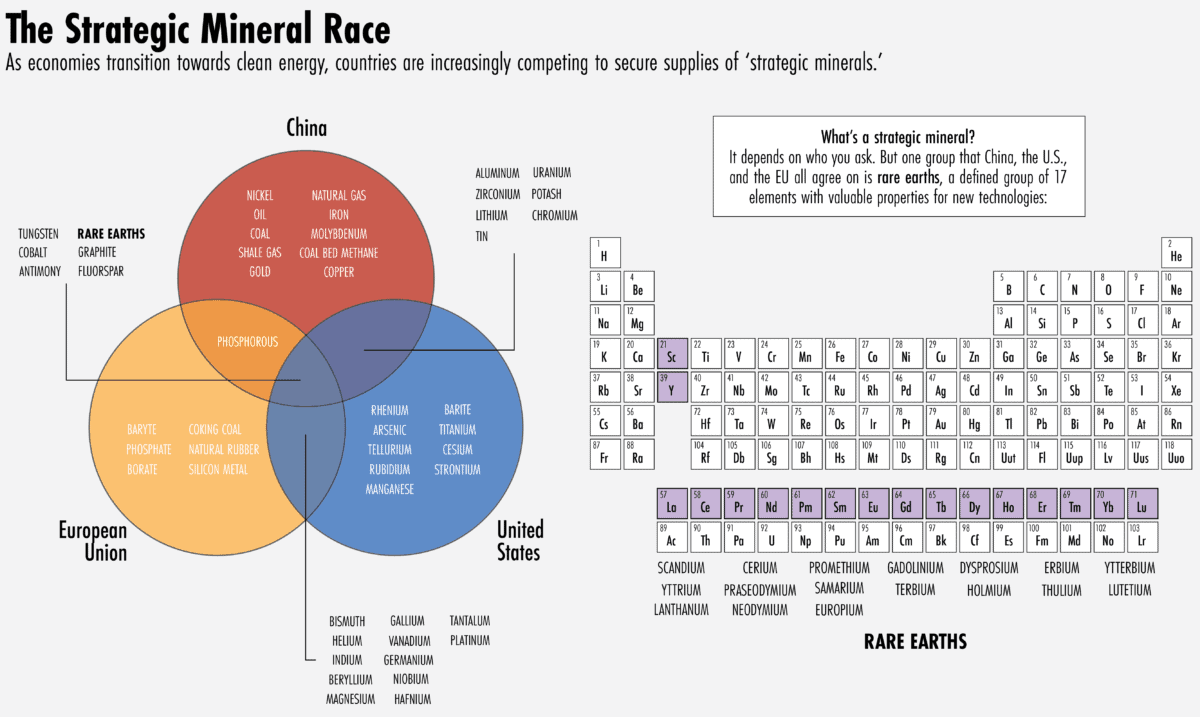

The Big Picture: In with the Neo-Commodities

As countries make the switch to clean energy, governments are paying more attention to the resources they need for the transition. This week, our infographics look at China’s role in the production of the ‘neo-commodities’: the resources needed to produce the breadbasket goods of the future as well as the key Chinese companies that stand to gain.

A Q&A with Michel Lowy

Michel Lowy is co-founder and CEO of SC Lowy, a Hong Kong-based firm that invests in so-called ‘distressed debt’ — bonds issued by companies that have fallen into severe financial difficulty. In this week’s Q&A with Andrew Peaple, he talks about how he assesses investment opportunities in China right now and just how widespread the problems in China’s real estate sector are.

Michel Lowy

Illustration by Kate Copeland

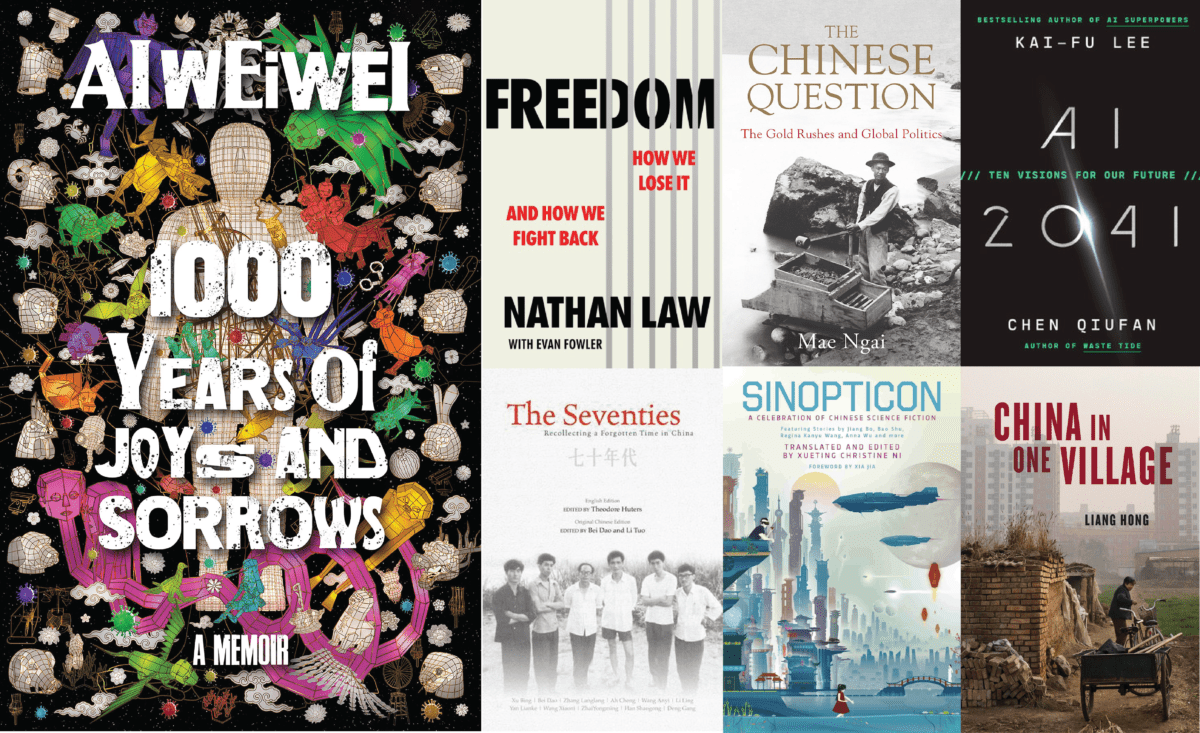

Rewriting China’s History

A ream of recent books shed new light on the history that is being made — and rewritten — apace in China. Topping Alec Ash’s list is Ai Weiwei’s long-awaited memoir (previously excerpted by The Wire) followed by books on Hong Kong’s fight, China’s 1970s, and views of the nation’s present and past all the way through to sci-fi visions of its future.

Misreading China’s WTO Record Hurts Global Trade

The United States claims that China routinely violates its WTO obligations, and that the body is ineffectual at changing Chinese behavior. But as Shang-Jin Wei, a professor at Columbia University, argues in this week’s op-ed, the data do not support such assertions, and the misperception that this narrative has created is hurting the global trading system.

Subscribe today for unlimited access, starting at only $19 a month.