Good evening. Exactly one year ago today, Jack Ma gave the now infamous speech that reportedly ticked off Xi Jinping and regulators — and resulted in Ant Group’s giant IPO being squashed. What followed has been, as our Big Picture this week calls it, a year of crackdowns on private business. But throughout it all, Ray Dalio, the billionaire hedge fund manager, has emerged as something of a cheerleader for China’s policies, trumpeting their wisdom publicly and vociferously. As our cover story shows, Dalio has a uniquely long and surprising history in China, and you can’t fully understand his bullishness without understanding his experiences and connections there. Elsewhere, we have a Q&A with Rosemary Foot, the scholar whose new book explores China’s relationship with the UN; a round up of the best new China books; and an op-ed from Yu Yongding, the former president of the China Society of World Economics, about why China’s slowing growth is the real problem. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The China Bull

Ray Dalio, the founder of Bridgewater Associates, has spent four decades building connections with China’s elites. After first visiting in 1984, he has become close friends with Vice President Wang Qishan, who is often cited as President Xi’s number two, made more than $100 million in charitable donations (there is a Dalio Auditorium at Tsinghua University), and even at one point sent his 11-year-old son to live in Beijing for a year. Only recently has Bridgewater had a big presence in China — it launched its first onshore China fund in 2018 — but, as Brent Crane found from talking with Dalio and others, this history is essential for understanding Dalio’s very public China optimism.

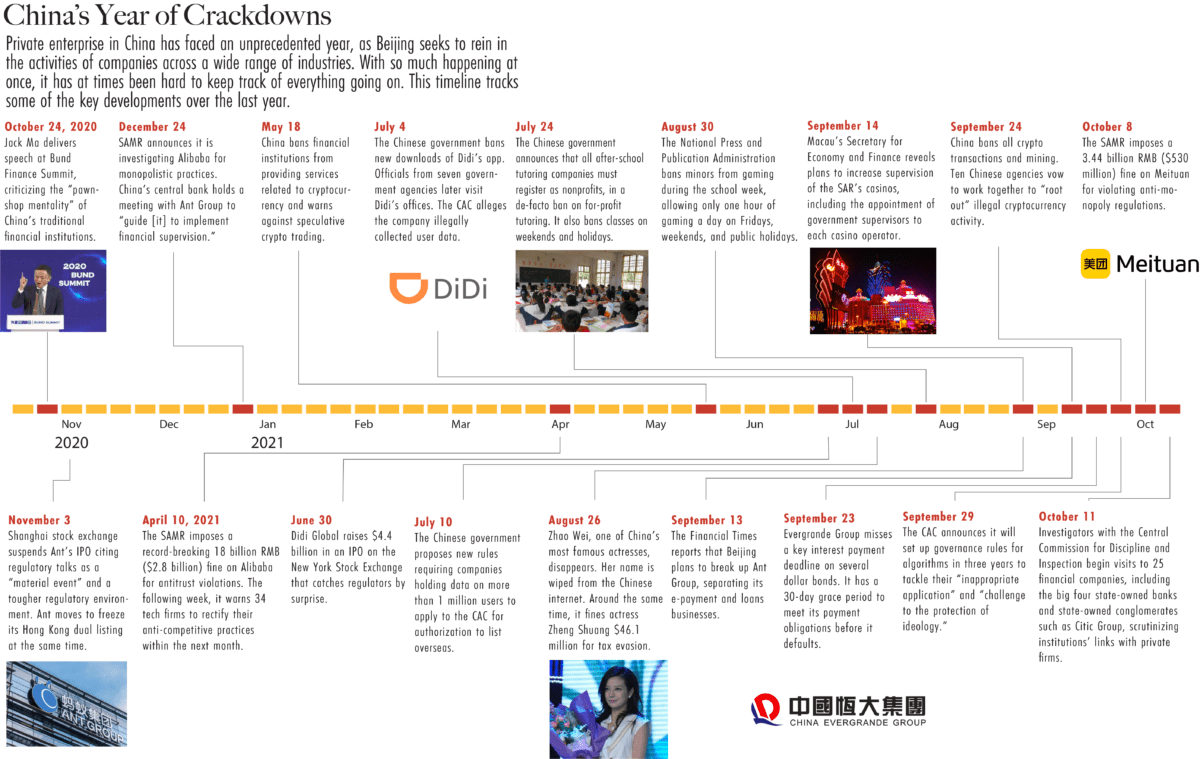

The Big Picture: A Year of ‘Crackdowns’

China’s year of ‘crackdowns’ has been a wide-ranging series of regulatory and political moves that have reined in some of China’s most valuable companies. This week, The Wire looks back at the year of upheaval for private enterprises in China, taking stock of which sectors have been affected and why, and the companies and institutions to watch going forward.

A Q&A with Rosemary Foot

Rosemary Foot is an emeritus Professor of International Relations at the University of Oxford. Her latest book analyzes China’s approach to and relationship with the United Nations, and in this week’s Q&A with Andrew Peaple, she talks about what China gets out of the UN, including its defensive use of the institution and the benefits it gets from participating in peacekeeping missions.

Rosemary Foot

Illustration by Kate Copeland

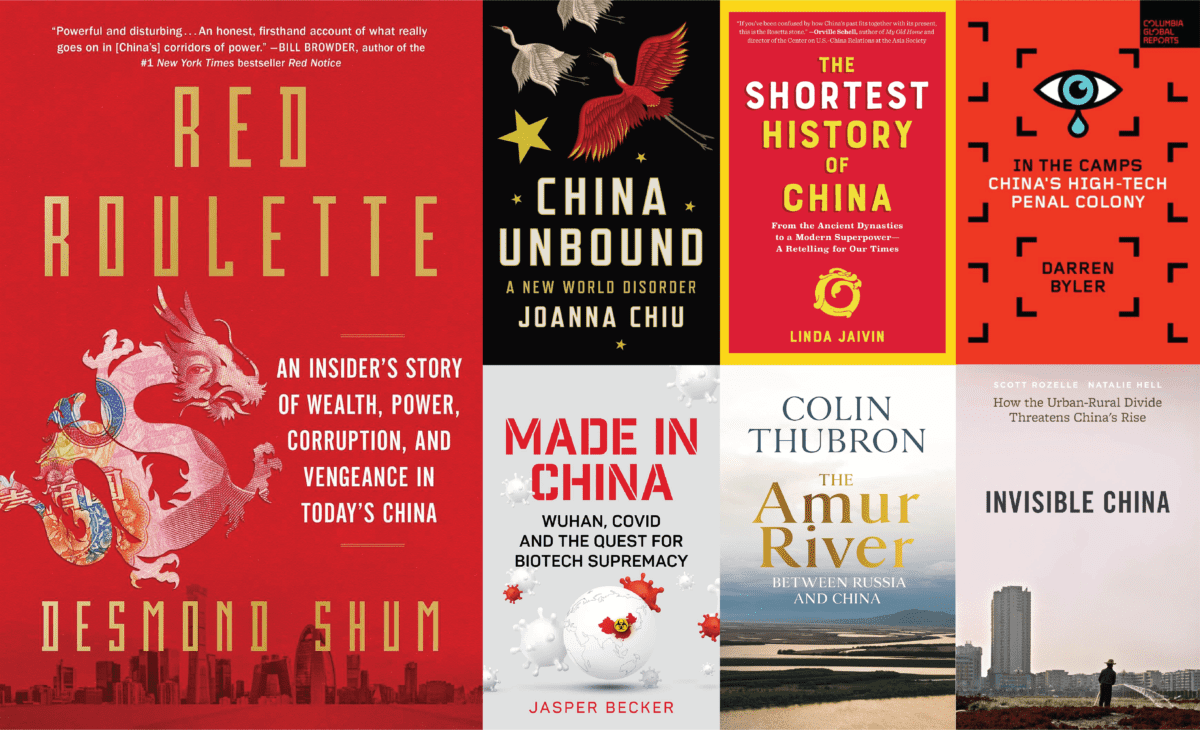

Books for the ‘Red New Deal’

Dubbed the ‘Red New Deal’ in some Anglophone media, China’s re-tightening of the business reins is evidence both of the influence that Xi Jinping’s government exerts over the private sector and also its belief that it needs to bring it further under control in order to maintain stability and power. This round-up of the most essential China books from the last two months covers a reading list that adds much-needed depth to the headlines.

China Must Restore Growth

China’s energy crisis and the Evergrande debacle do not pose systemic risks, argues Yu Yongding, the former president of the China Society of World Economics, in this week’s op-ed. But the persistent slowdown in economic growth, which began in 2010, does. This trend, he says, is at least as worrying as the short-term structural problems that have grabbed headlines lately because China’s experience over the past 40 years shows that without decent growth, financial stability is difficult to achieve.

Subscribe today for unlimited access, starting at only $19 a month.