Good evening. Over the last few months, China’s regulators have cracked down on tech giants for some of the ruthless strategies they use to get ahead of each other. This week’s cover story — about Chinese ‘super app’ Meituan — is a reminder of why. From crippling coupon wars to delivery drivers literally fighting in the streets, battle-hardened Meituan fought tooth and nail to get to its $180 billion valuation. Now, Chinese regulators want to know whether it broke the rules in the process. Elsewhere, we have a graphics spread on Anta Sports, the biggest sportswear manufacturer you’ve probably never heard of; a Q&A with David Lubin, managing director and head of emerging markets at Citi, on China’s approach to international financial integration and overseas investment; a reported piece on the decline of Chinese international students at U.S. universities and its implications for university finances; and an op-ed from Victor Shih about China’s tech crackdown and the return of ‘magic sword’ syndrome. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Special Delivery

For a long time, industry insiders referred to serial entrepreneur Wang Xing as “the Cloner” since all of his ventures were copies of U.S. companies. But after one of his start-ups, Meituan, emerged victorious from the infamous “War of a Thousand Groupons,” it became clear Wang was more than just a copy-cat. In the past few years, he has grown Meituan into a “super app” — one with a $180 billion valuation that trails only Alibaba and Tencent in the Chinese tech space. But with success and size has come scrutiny, especially amid China’s tech crackdown. In this week’s cover story, Brent Crane profiles the company, it recent troubles and its “almost Vulcan” founder.

The Big Picture: Anta Goes All In On China

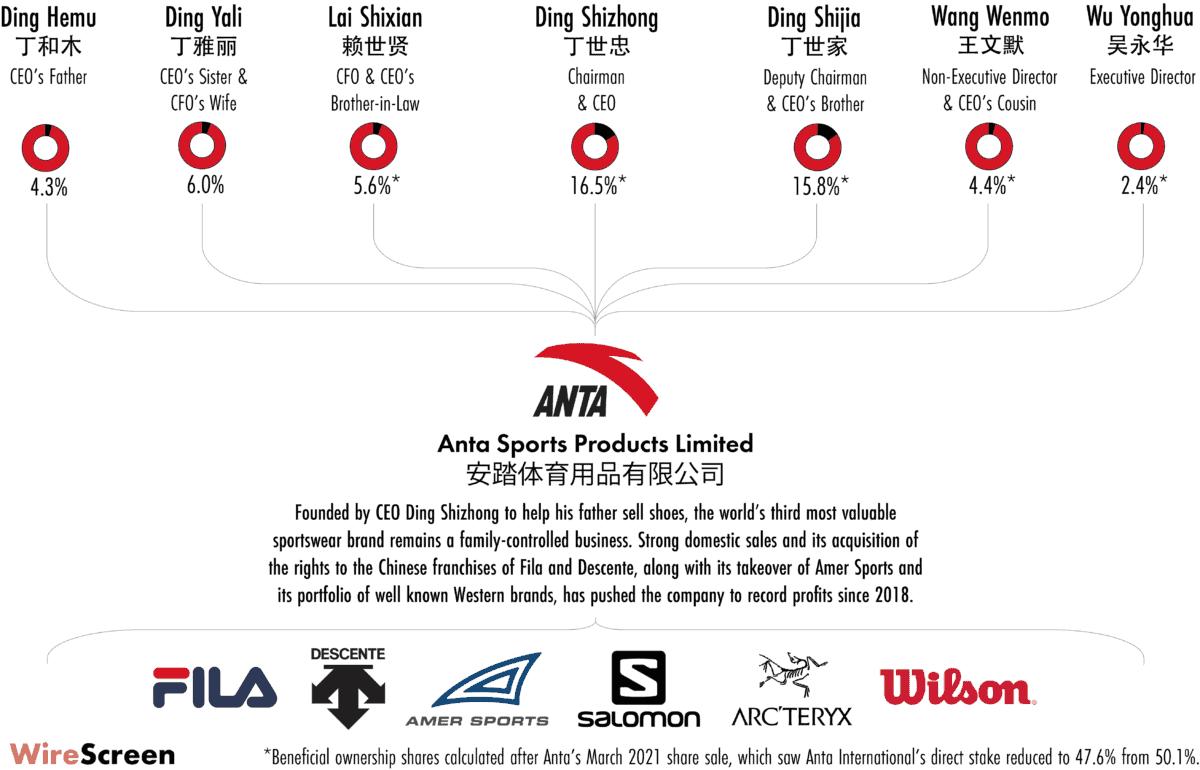

Anta Sports is the biggest athleisure company that you’ve probably never heard of. It’s the third most valuable sportswear brand by market capitalization, having rocketed in value since March of this year, when the company benefitted from a Chinese consumer boycott of foreign apparel brands. In this week’s infographics, Eliot Chen takes a deep dive into the origin and ownership of Anta Sports, and examines its unusual expansion strategy of ‘growth by acquisition’ that’s seen the company acquire several well-known Western labels and franchises.

A Q&A with David Lubin

David Lubin is the managing director and head of emerging markets at Citi, as well as the author of Dance of the Trillions, which in part examines China’s role in the finance of developing nations. In this week’s interview with James Chater, he discusses, China’s approach to international financial integration, its fluctuating investment in the Belt and Road Initiative, and why the goal of transitioning China to a consumer-driven economy may be overrated.

David Lubin

Illustration by Kate Copeland

What Happens to U.S. Colleges After China?

It’s back to school season, but this year, U.S. universities are going to notice one major change that’s not just pandemic-related: far fewer Chinese international students than before. While the number of Chinese students in the U.S. ballooned over the last decade, this year saw an 18 percent drop in Chinese applicants even as prospective students from other countries have surged. Katrina Northrop looks at the implications of this decline for U.S. colleges, many of which have much to lose financially from the dip in Chinese enrollment.

The Dangers of Xi Jinping’s ‘Magic Swords’

At the height of the Cultural Revolution, insiders in Beijing referred to Chairman Mao’s unimpeachable instructions as “magic swords.” In an echo of that era today, some investors are studying President Xi Jinping’s past speeches to “read Xi’s mind” on the next policy trends and crackdowns. In this week’s opinion piece, Victor Shih argues that this is likely to be a fruitless task, and warns that the renewed manifestation of “magic swords” syndrome could upend the behavior of China’s markets.

Subscribe today for unlimited access, starting at only $19 a month.