Good evening. It’s not just Germany. Devastating floods are becoming more common around the world. Last summer, for instance, China suffered 21 large-scale floods — the most in over two decades — and more than 30 rivers swelled to their highest levels ever recorded. But, as this week’s cover story shows, with the help of “sponge cities,” a new vanguard of visionary urbanists are determined to help the Chinese Communist Party build an “ecological civilization.” Elsewhere, we have a look at 5Y Capital, which was rebranded last October from Morningside Venture Capital; a Q&A with Zuoyue Wang, who is an expert on the long history of Chinese students and scholars studying in America; a reported piece on China’s embrace of robots — and what it means for workers in China’s many factories; and an op-ed from Victor Shih about what Beijing’s recent crackdown on Didi means for its tech sector. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

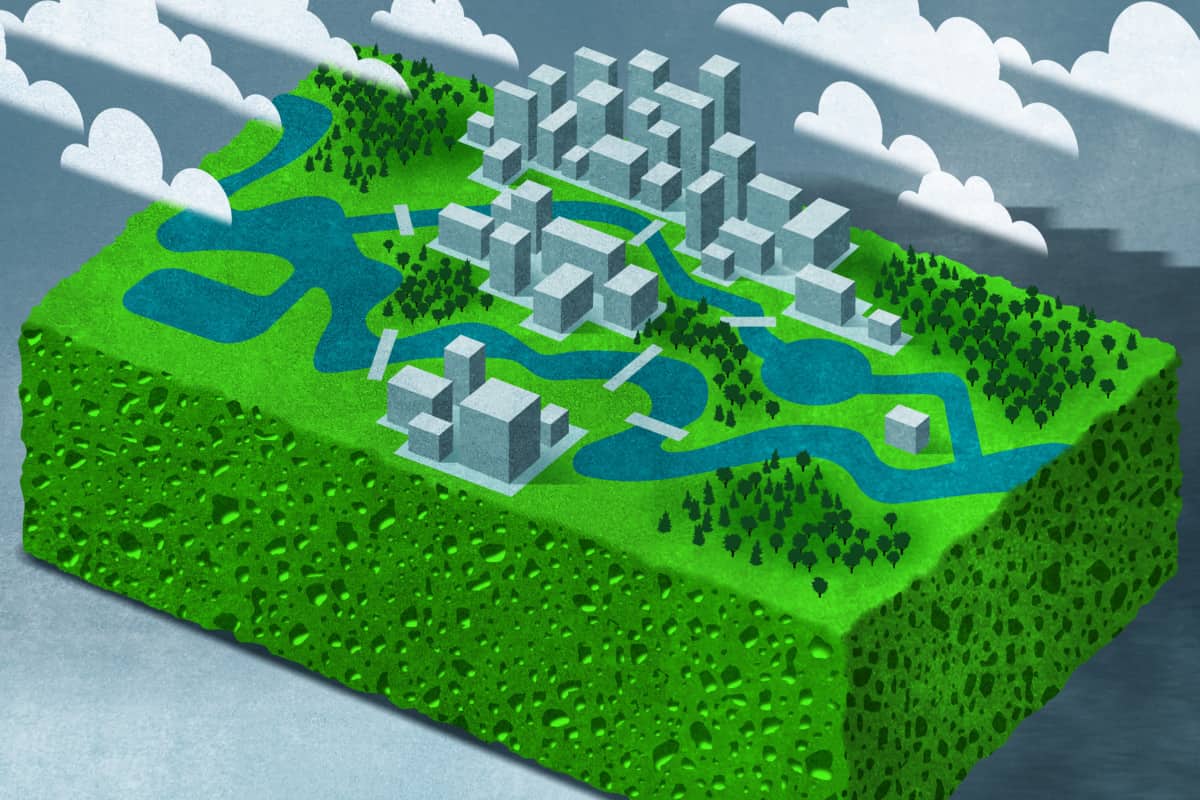

The Sponge Revolution

Just months after taking power in 2013, Chinese President Xi Jinping proposed a novel solution to the persistent flooding problem in southern and central China. Rather than build more dams, canals, and floodwalls, China needed to turn its sprawling metropolises into “sponge cities” by clearing vast open areas in low-lying urban centers and filling them with parks and wetlands. Now, with 70 percent of Chinese cities planning to become sponges by 2030, the sponge city initiative is rapidly scaling up, and its goals are growing broader, more ambitious, and more ideological. In this week’s cover story, Eyck Freymann explores whether or not the sponge revolution can transform China and even the world.

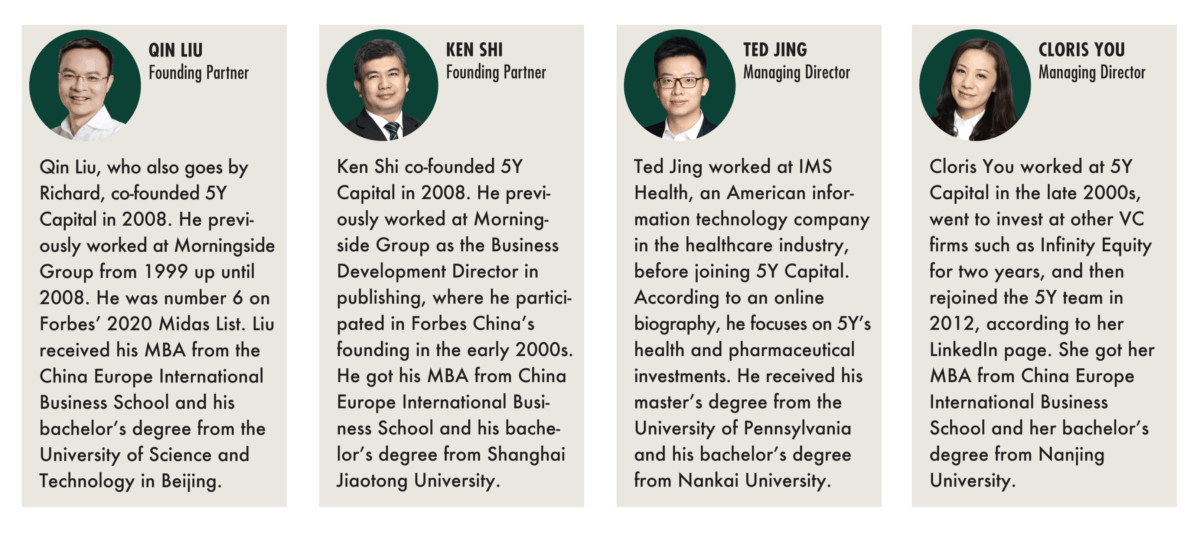

The Big Picture: Who Is 5Y Capital?

5Y Capital, rebranded last October from Morningside Venture Capital, is a fast-growing venture capital firm that made headlines earlier this year after it reported a $30 billion return on its investment in short-form video app Kuaishou. The firm has made other significant investments in its 13-year history, including in EV startup XPeng, and Agora, the voice and video engagement platform behind social media app Clubhouse. This week, as part of our ongoing series mapping fast-growing firms investing in China, our infographics break down the corporate and shareholding structures of 5Y Capital.

A Q&A with Wang Zuoyue

Zuoyue Wang is a professor of history at California State Polytechnic University, Pomona, where he specializes in the history of science and its relationship with U.S. and Chinese government policy. He is the author of In Sputnik’s Shadow, which traces the role of scientific advisers during the Cold War. In this week’s interview with David Barboza, Wang talks about the long history of Chinese students and scholars studying in America, as well as contemporary challenges for U.S.-China academic cooperation, from China’s Thousand Talents program to the U.S.’s China Initiative.

Wang Zuoyue

Illustration by Kate Copeland

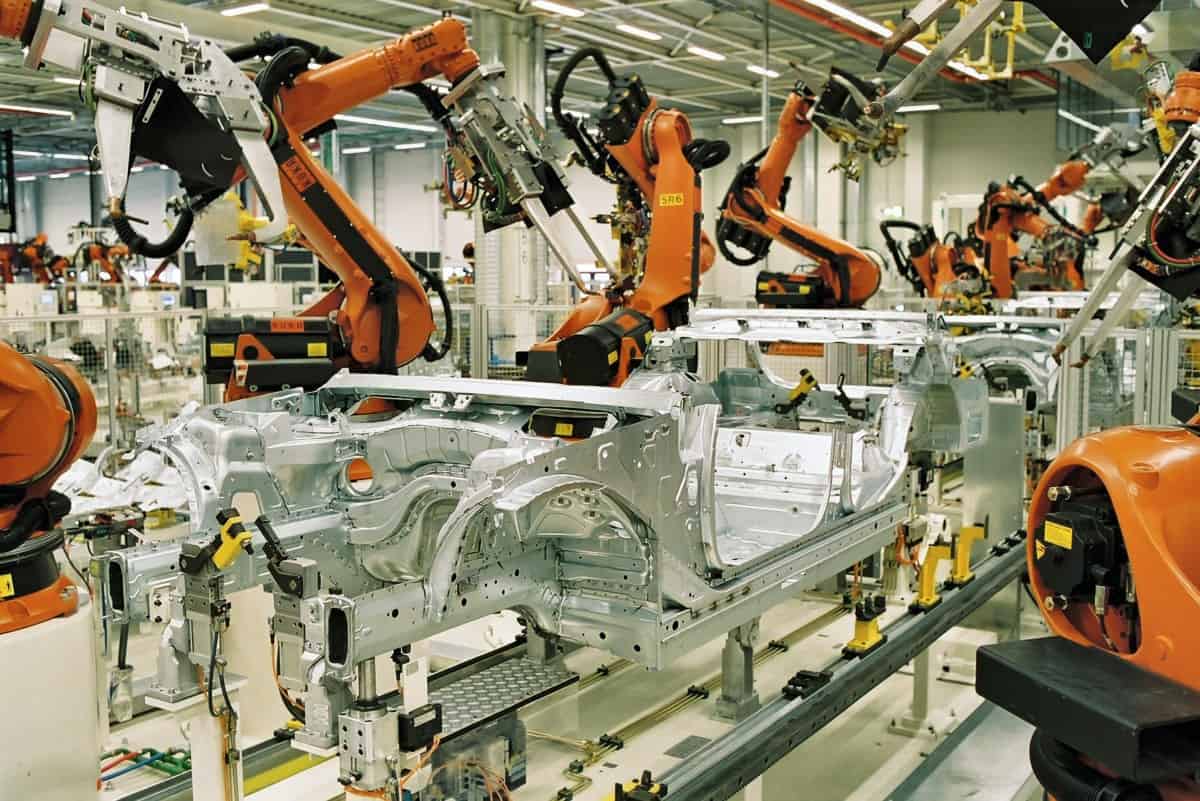

Made in China — By Machines

While global sales of industrial robots slowed during the pandemic, purchases in China jumped last year, solidifying China’s lead in the race towards automation. Automation and robotics are key priorities under China’s landmark industrial policy masterplan, ‘Made in China 2025.’ But as Anastasiia Carrier reports, the strong push for automation in China could intensify fears about structural unemployment, particularly in China’s manufacturing sector. Experts question whether China is prepared to deal with the consequences.

Farewell to a Community of Common Destiny?

For over a decade, the Chinese government allowed domestic tech entrepreneurs to raise money, recruit talent, and develop their technologies with relatively little restrictions. Funded by global investors, Chinese tech companies pioneered new technologies and applications, becoming giants while transforming entire industries such as payment services. But as Victor Shih writes in this week’s op-ed, Beijing’s regulatory crackdown threatens to break up the transnational community of investors and entrepreneurs that allowed China’s homegrown tech sector to thrive, while accelerating the threat of economic decoupling between China and the rest of the world.

Subscribe today for unlimited access, starting at only $19 a month.