Source: Esquel group via Facebook

Good evening. Historically, the Commerce Department’s Entity List has set its sights on clear-cut targets, including companies involved in nuclear proliferation and producers of weapons of mass destruction. So when a Chinese textile company known for being a pioneer of corporate social responsibility landed on the list last year, it raised more than a few eyebrows. Our cover story this week examines the curious predicament Esquel Group has found itself in. Elsewhere, we have an interview with Peter Martin, the author of last week’s cover story and a new book on ‘Wolf Warrior’ diplomacy; infographics about China’s stakes in Africa’s mines; reporting on how China could stymie a global tax deal; a roundup of the latest and greatest China books; and an op-ed about the risky mechanism by which many Chinese companies, including Alibaba and Tencent, list on U.S. exchanges. We’re off next week for July 4th, but we’ll be back July 11th with a special issue. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Hemmed In

With her textile company, Esquel Group, Marjorie Yang is known as an early pioneer of corporate social responsibility in China. For the past decade, the M.I.T. and Harvard graduate has been lauded for Esquel’s commitment to labor and environmental standards. And yet, last year, a subsidiary of Esquel Group ended up on the Commerce Department’s Entity List because of allegations of forced labor in Xinjiang. Has the U.S. government gone too far by sanctioning Esquel Group? Or does the listing further support the idea that no company — no matter how well intentioned — can navigate business in Xinjiang without compromising its values? Katrina Northrop reports.

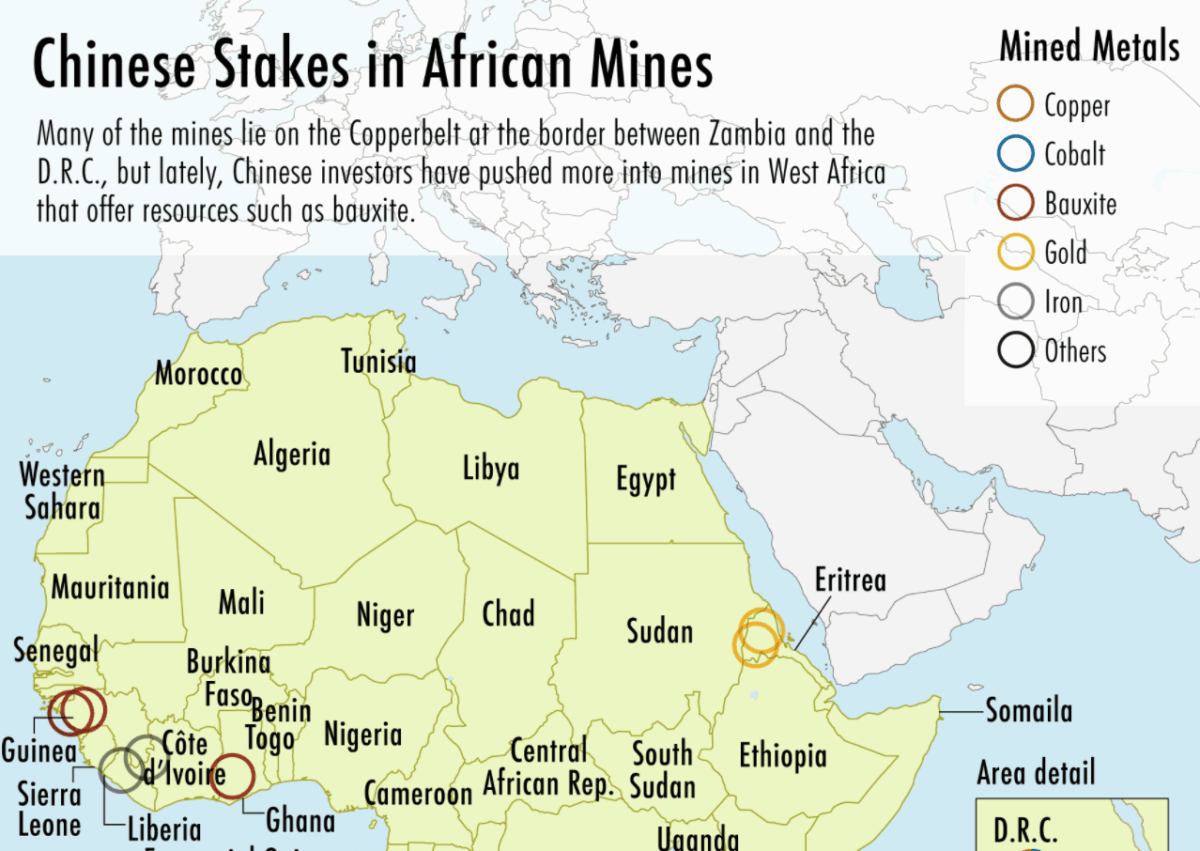

The Big Picture: China’s Stake in Africa’s Mines

China’s push into the African mining industry has brought with it problematic side issues, notably the attention drawn towards the impact on local environments and dangerous labor conditions. This week, The Wire looks at Chinese ownership of African mines in the context of its broader investment in the region, with a focus on Jinchuan Group, one of the most prolific investors.

A Q&A with Peter Martin

Peter Martin is a political reporter for Bloomberg News, who has written extensively on escalating tensions in the U.S.-China relationship and reported from China’s border with North Korea and its far-western region of Xinjiang. His new book, China’s Civilian Army: The Making of Wolf Warrior Diplomacy, traces the history of China’s foreign policy and its diplomatic service under the Communist Party. In this week’s interview with Andrew Peaple, he talks about how ‘Wolf Warrior’ tactics aren’t entirely new and why China’s political system sets an upper limit on the effectiveness of its diplomats.

Peter Martin

Illustration by Lauren Crow

How China Could Stymie A Global Tax Deal

The G7’s groundbreaking agreement on international taxation, brokered at its meeting in the UK earlier this month, has received plaudits from many quarters. But one country that will be critical to making the plan a reality has remained notably silent: China. As Katrina Northrop reports, the reticence among leaders of the world’s second-largest economy should come as little surprise — and China could still water down the deal’s impact.

Books for China’s 21st Century Strategy

Alec Ash rounds up the best new China books, and these ones tackle the big issues, like geopolitics, Party politics, anti-trust law, grand strategy — even mahjong. Because if China is playing the long game, then it surely doesn’t hurt to revisit the cultural history of its most successful strategy game.

Are VIE Structures Viable?

Chinese companies like Alibaba and Tencent use ‘VIE’ structures to list on foreign exchanges like the NYSE. But these structures are inherently risky, says Fredrik Öqvist in this week’s op-ed, as the recent case of KE Holdings illustrates. If we are stuck with the VIE structure, he argues, it’s at the very least time to make sure we’re minimizing the risks involved and taking minority interests into account.

Subscribe today for unlimited access, starting at only $19 a month.