Good evening. Now that 43 percent of U.S. adults have received at least one dose of a Covid-19 vaccine, the U.S. vaccination effort is beginning to plateau, and experts say it’s just a matter of months before the U.S. begins exporting vaccines en masse. This could set up a stark contrast to China’s ongoing ‘vaccine diplomacy’ efforts, which come with mixed reviews as this week’s cover story shows. Elsewhere, we have an interview with Rasheed Griffith about China, the Caribbean, and the offshore world; a look at ‘iso,’ the new synthetic opioid coming from China; an op-ed about the crucial difference between China’s per capita GDP and its aggregate GDP; and infographics about Chinese-owned firms employing workers in the United States. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Credit: Ezra Acayan/Getty Images

Shots in the Dark

Thanks to its ‘vaccine diplomacy,’ China is now the world’s largest exporter of vaccines, exporting 200 million doses abroad, as compared to the 3 million doses that the U.S. has shipped abroad. The effort has earned the gratitude of leaders all across the world as well as widespread praise, especially compared to criticisms that the U.S. has been hoarding its vaccines. But as Eli Binder and Katrina Northrop report this week, China’s strategy of using the vaccine as a political and economic tool is a gamble. There is still no peer-reviewed data about China’s vaccines and early indicators suggest they are only 50 percent effective — a far cry from U.S. vaccines, which experts say, will soon be flooding the market. How did China end up with such inferior products? And, perhaps more consequentially, will they end up coming back to haunt Beijing?

The Big Picture: “Now Hiring” in Silicon Valley

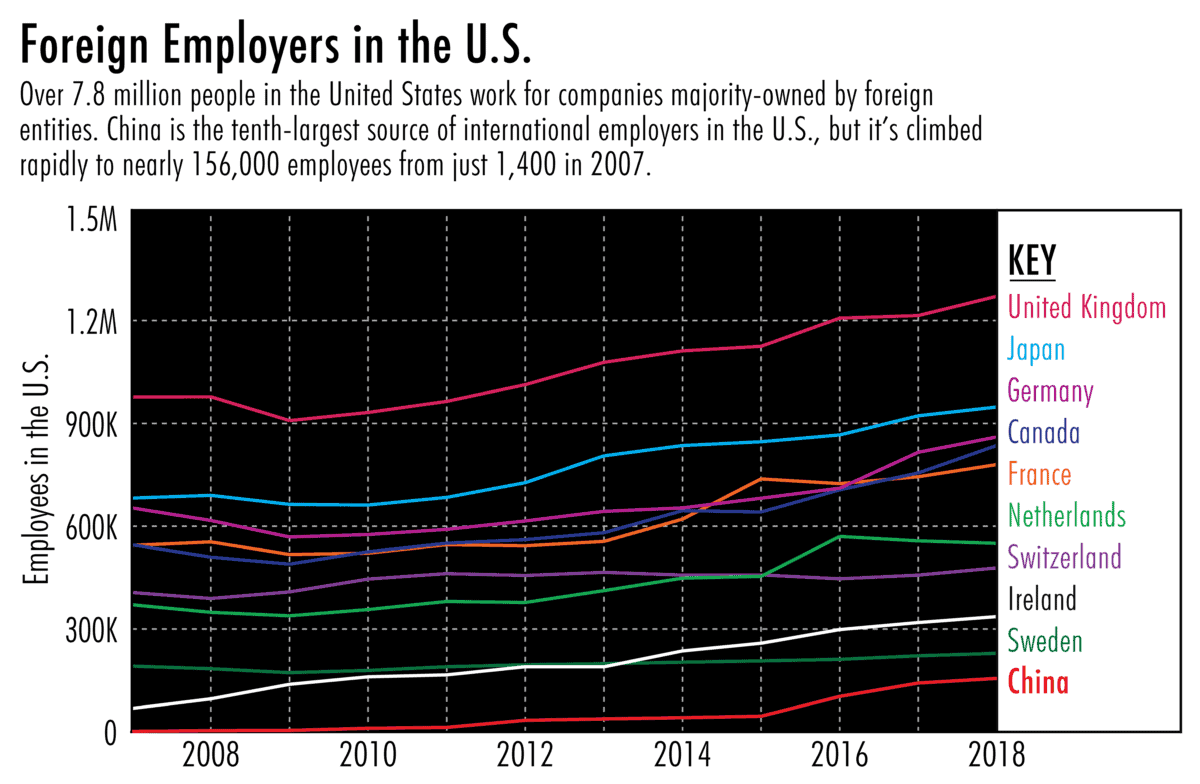

More than a decade ago, Beijing began encouraging its companies to “go global,” to learn by competing on the world stage, and to acquire overseas assets. Well today, even though the U.S. is no longer as hospitable as it once was to Chinese investments, there are more than 155,000 people employed in the United States by Chinese-owned firms. This week, The Wire looks at the growth of Chinese companies in the U.S. market, and their R&D operations in California.

A Q&A With Rasheed Griffith

Rasheed Griffith is an expert on China’s economic activities in the Caribbean. In this week’s interview with Eli Binder, he explains why Jamaica has emerged as a U.S.-China flashpoint as well as why offshore havens like the Cayman Islands have become so important not only for Chinese companies, but for U.S.-China economic engagement. In his words, “the linchpin holding together these contrasting markets is these very, very well regulated centers that we call offshore.”

Rasheed Griffith

Illustration by Lauren Crow

Credit: SoQ錫濛譙, Creative Commons

Opioid Whack-a-Mole

Before Covid-19 sent the nation into lockdown, there were some signs the U.S. was finally making progress fighting the opioid epidemic. In 2019, for example, under growing pressure from the U.S., China banned the production of fentanyl — the infamous prescription painkiller that is mostly manufactured in China and whose potency has contributed significantly to overdoses in the United States. But now with the arrival of Isotonitazene, or ‘iso,’ however, it appears Chinese chemical and drug manufacturers — many of whom still illicitly produce and trade in fentanyl — have discovered a new way to tap into the huge demand for opioids among Americans.

Credit: Y Denali, Creative Commons

The Two Sides of Chinese GDP

China’s aggregate GDP gets a lot of front-page attention, and rightly so given its phenomenal growth in the past decades. But, as Nancy Qian argues in this week’s op-ed, many economists are more interested in the country’s per capita GDP. China’s per capita GDP in 2019 was $8,242, placing the country between Montenegro ($8,591) and Botswana ($8,093). As Qian says, “Behind the world’s second highest GDP are hundreds of millions of people who just want to stop being poor” — a crucial reality, she argues, to understand both business and politics in China today.

Subscribe today for unlimited access, starting at only $19 a month.