Good evening. This week, we’re excited to bring you the first installment in a two-part series from David Barboza. David has long been fascinated by the case of Elliott Broidy, the Trump insider and Republican fundraiser, because of what it reveals about China’s influence campaigns. In this series, he not only recreates the audacious scheme (which involved Jho Low and Guo Wengui), but looks into what it means for U.S. vulnerabilities. Elsewhere, we have an interview with Noah Barkin about Europe’s struggle to define its China position; a look at the complicated China legacy Petr Kellner, the richest man in the Czech Republic, leaves behind; an op-ed about why China still needs expansionary economic policy; and infographics about Honeywell’s long and evolving history in China. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The New Influencers

In early 2017, while the U.S. was focused on investigating Russian interference in U.S. politics, China was plotting its own campaign to influence the young Trump administration. And, as The Wire’s David Barboza reports this week, it got uncomfortably close thanks to the help of Elliott Broidy, a Trump fundraiser and deputy finance chairman of the Republican National Committee. In the first story of this two-part series, Barboza recreates the Broidy case and looks at the Foreign Agents Registration Act (FARA), an obscure 1930s-era law, that was meant to thwart foreign influence campaigns. But with China’s deep pockets and connections to business tycoons, is FARA enough?

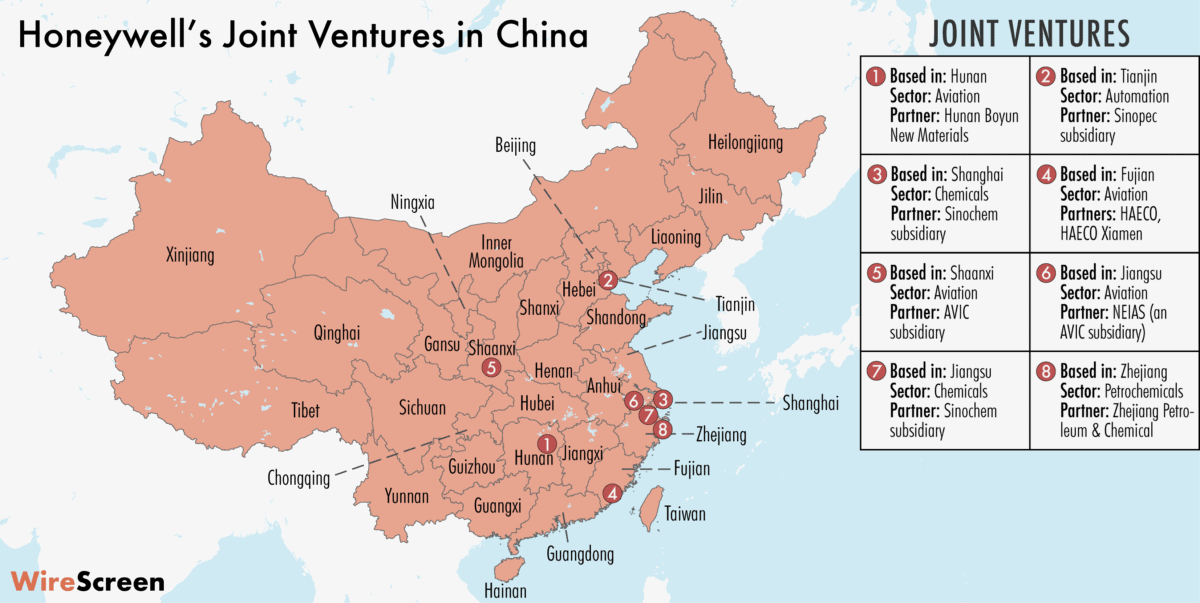

The Big Picture: Honeywell’s China Ventures

Honeywell first entered China in 1935, established joint ventures with state-owned firms as far back as 1993, and later, it set up wholly-owned subsidiaries in China and hired executives who grew up in the country. Its long history in China — and huge scale across multiple sectors — can be seen as a microcosm of multinationals’ evolving presence in China. This week, The Wire maps the Fortune 100 company’s ventures in China, tracing the company’s evolution as well as China’s shifting policies towards multinational companies.

A Q&A With Noah Barkin

Noah Barkin is managing editor in the China practice at Rhodium Group, but his Twitter handle sums up his work best: “Europe in a world of 🇺🇸 vs 🇨🇳.” In this week’s interview with James Chater, he talks about why Europe has struggled to define its China position, including the nebulous new term “strategic autonomy” and why Europe doesn’t want to be bullied — by the U.S. or China.

Noah Barkin

Illustration by Kate Copeland

Credit: Genesys

The Czech Man in China

When Petr Kellner, head of the international conglomerate PPF Group, died last month in a helicopter crash near Anchorage, Alaska, he left behind a complicated legacy about his relationship with China. As Eli Binder reports, the 56-year-old was the wealthiest person in his native Czech Republic in large part because, for the past decade, he had been one of the most successful foreign businessmen in China. Kellner’s Home Credit served over 52 million Chinese customers, but his relationship with both Chinese and Czech politicians raised eyebrows at home.

Credit: ILO Asia-Pacific, Creative Commons

China Still Needs Expansionary Economic Policy

Addressing this year’s meeting of the National People’s Congress last month, Prime Minister Li Keqiang announced that China’s growth target for 2021 is “above 6 percent.” But while the economy’s growth momentum looks strong at the moment, Yu Yongding — who served on the Monetary Policy Committee of the People’s Bank of China from 2004 to 2006 — argues there are signs that China may risk tightening fiscal and monetary policy too soon. In this week’s op-ed, which is full of economic stats and figures, Yu says China’s macroeconomic policy in 2021 should focus on boosting growth in line with the economy’s potential growth rate, rather than on stabilizing or lowering leverage ratios.

Subscribe today for unlimited access, starting at only $19 a month.