Credit: Yum China

Good evening. Here’s a fun fact to put China’s remarkable economic rise into perspective: When the first KFC — then known as Kentucky Fried Chicken — opened in Beijing on Nov. 12, 1987, thousands of people lined up to enter. The restaurant, which could accommodate 500 customers, offered China an entirely new concept of what a restaurant could be. But now, as this week’s cover story shows, KFC’s China operations have been spun out on their own — and they’re teaching their U.S. counterpart some new tricks. Elsewhere, we have a look at the Chinese companies that listed on NYSE in 2020 as well as America’s race to develop EV battery recycling; an interview with Isabel Hilton on China’s climate evolution; and a column from Rui Ma about the world’s next big investment opportunity. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Credit: Qilai Shen/Bloomberg via Getty Images

The Yum Model

When Yum Brands — one of the biggest fast food brands in the world — spun off its China operations, naysayers warned it would miss out on massive growth potential. But, in the four years since, the setup’s success, which includes what amounts to a massive franchise fee, has been impressive. Sure, Yum Brand isn’t earning the billions in China that its executives once enjoyed, but its investors opted for a durable bargain: the company reaps a dependable fortune without trying to manage a Chinese market that is spirited but challenging. And as Matt Schiavenza reports for this week’s cover story, the Yum model could serve as a reality check for other U.S. companies.

The Big Picture: China Comes to the NYSE

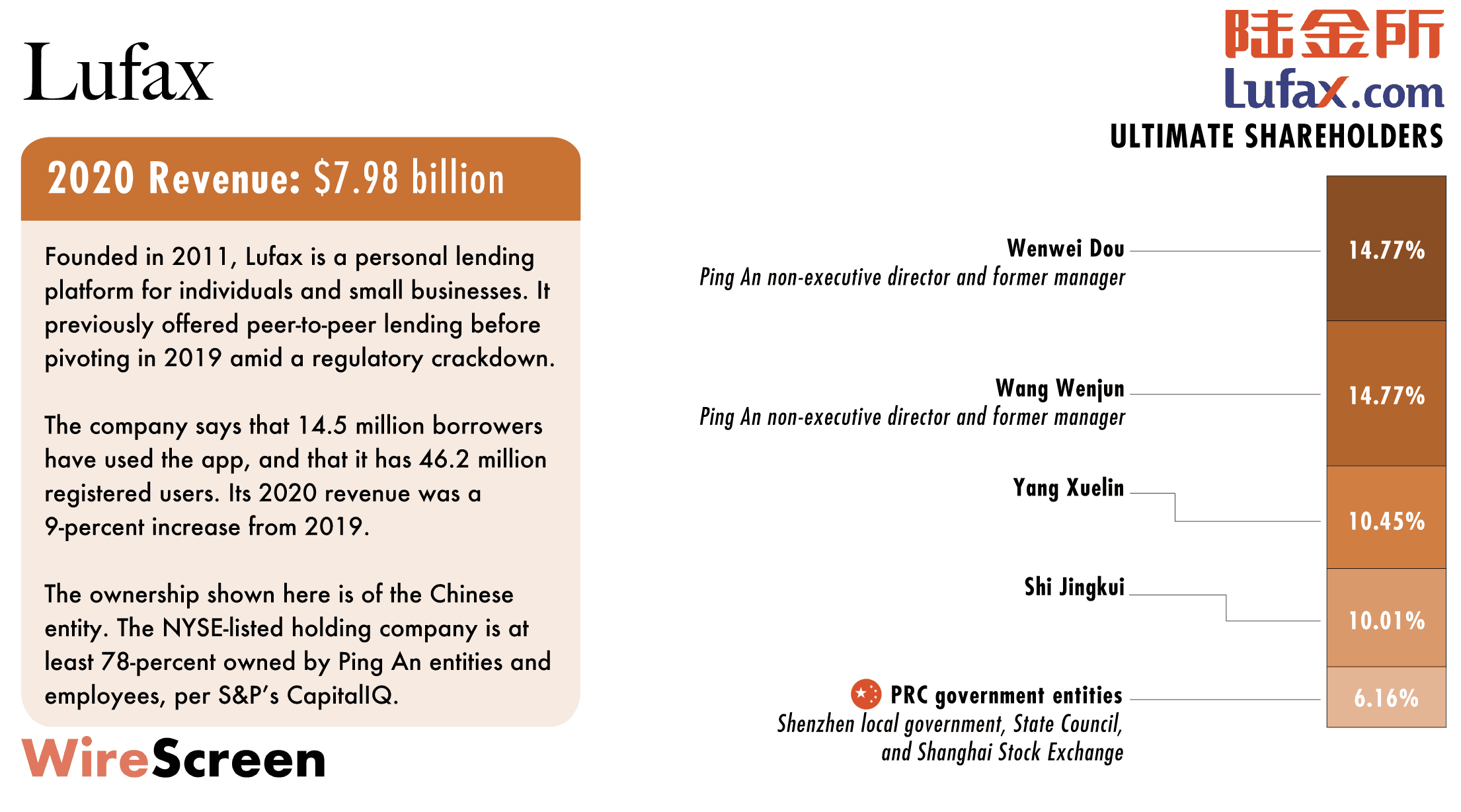

As we’ve already covered, Nasdaq had a particularly good year with Chinese companies, but the relative few that listed on the NYSE — 9 to Nasdaq’s 26 — were worth more. The 229-year-old NYSE is known as the destination for more established companies, while Nasdaq attracts up-and-coming tech companies. This week, our datagraphics turn to the NYSE, the Chinese companies that debuted there in 2020, and state-backed financial services provider Lufax Holdings.

Credit: Steve Jurvetson, Creative Commons

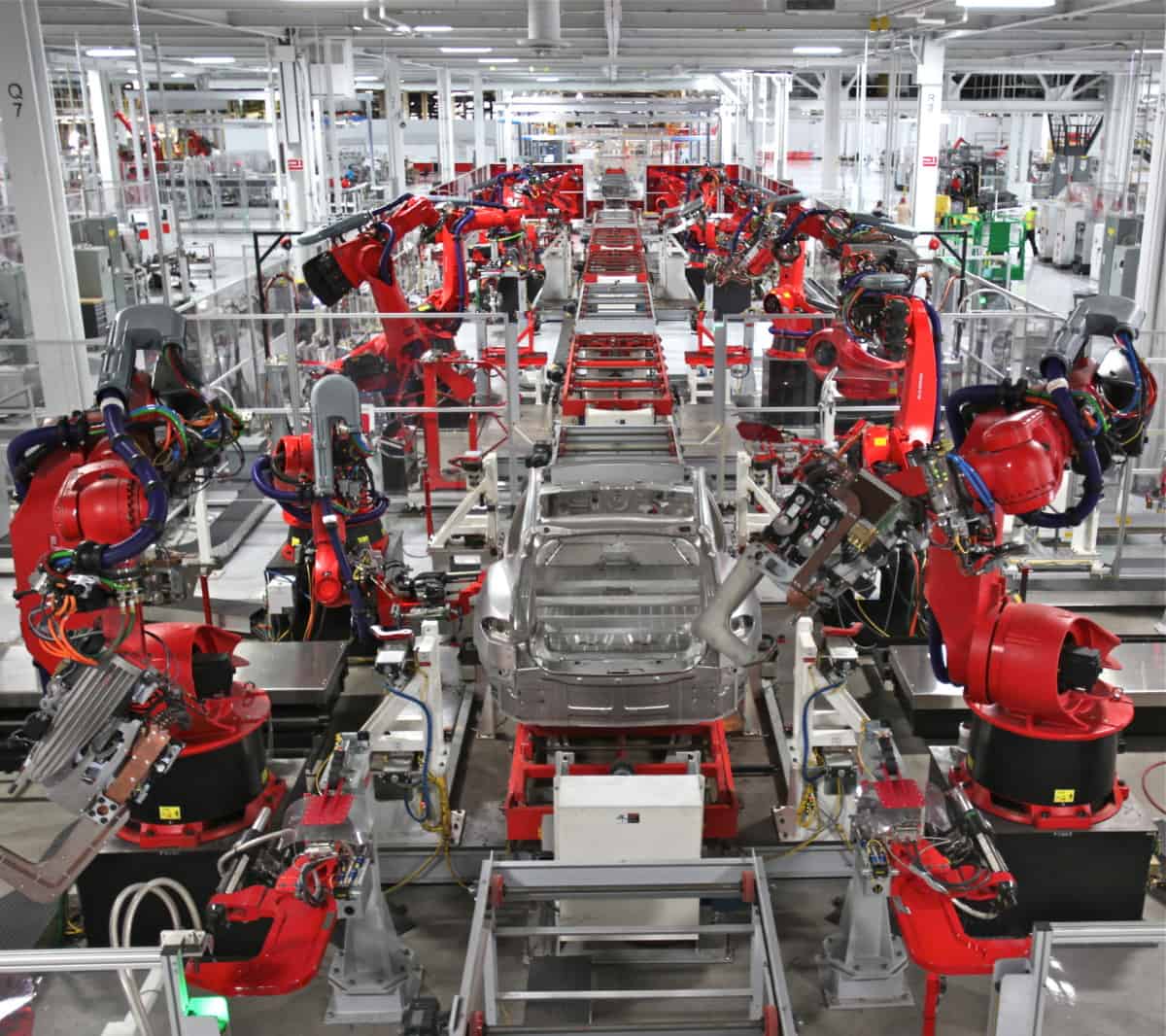

America’s Race to Recycle and Recharge

As the world’s carmakers maneuver toward an electric future, China’s grip on the precious minerals vital to their acceleration may spark another revolution: a race to retrieve and recycle batteries. China now controls much of the supply chain for cobalt, lithium and nickel — critical elements for a variety of batteries — and it has hinted that it could move to restrict the export of some, creating concerns among global business executives and policymakers. As Eli Binder reports, analysts say the only way around China may be to rummage through the trash at home — in an industrial-sized way — to wrest still-usable metals from worn-out batteries.

A Q&A With Isabel Hilton

Isabel Hilton is the founder of China Dialogue, a nonprofit and bilingual news organization based in London and Beijing, focusing on China’s interaction with the world on environment and climate issues. In this week’s interview with Katrina Northrop, she discusses the potential for environment collaboration between China and the rest of the world, the constrained nature of climate activism in China, and why Chinese banks are beginning to account for climate risk.

Isabel Hilton

Illustration by Lauren Crow

Credit: Pinduoduo

The Next China is… China

With China’s growth decelerating, where will investors go? Will they try their luck in Southeast Asia, perhaps? Or how about India — which is often touted as the next China? In this op-ed, Tech Buzz China co-host Rui Ma argues that the next China is actually “developing China,” the vast inland area in the central and western parts of the country that is much poorer on a per capita basis than the eastern coast. For those willing to put in the time, she says, rural China is a giant, untapped market opportunity.

Subscribe today for unlimited access, starting at only $19 a month.