Good evening. Pierre Trudeau, prime minister of Canada in the 1970s, once commented that living next to the U.S. was like “sleeping next to an elephant…One is affected by every twitch and grunt.” Now, as our cover story this week shows, Canada has found itself between two elephants, and Justin Trudeau, Pierre’s son, has to figure out his next move. Elsewhere, we have a look at China’s sovereign wealth fund; HNA’s impending failure; a Q&A with Ma Jian, the Chinese novelist in exile; and an interesting op-ed about how debt-for-climate swaps could help China out of its looming debt crisis. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Trudeau’s Move

When Justin Trudeau became Canada’s prime minister in 2015, he promptly pulled out the same China playbook that his father, Pierre, had used as prime minister in the 1970s. Thanks to Pierre’s legacy, the Trudeau name was synonymous with Sino-Canadian optimism, and for the first three years of Justin’s term — even as the U.S.-China relationship deteriorated — the two countries got along swimmingly. Then Meng Wanzhou, Huawei’s CFO, was arrested in Canada at the United States’s request. As Chris Beam reports for The Wire, Trudeau has since struggled to figure out how to address his father’s legacy while also acknowledging that the game has changed.

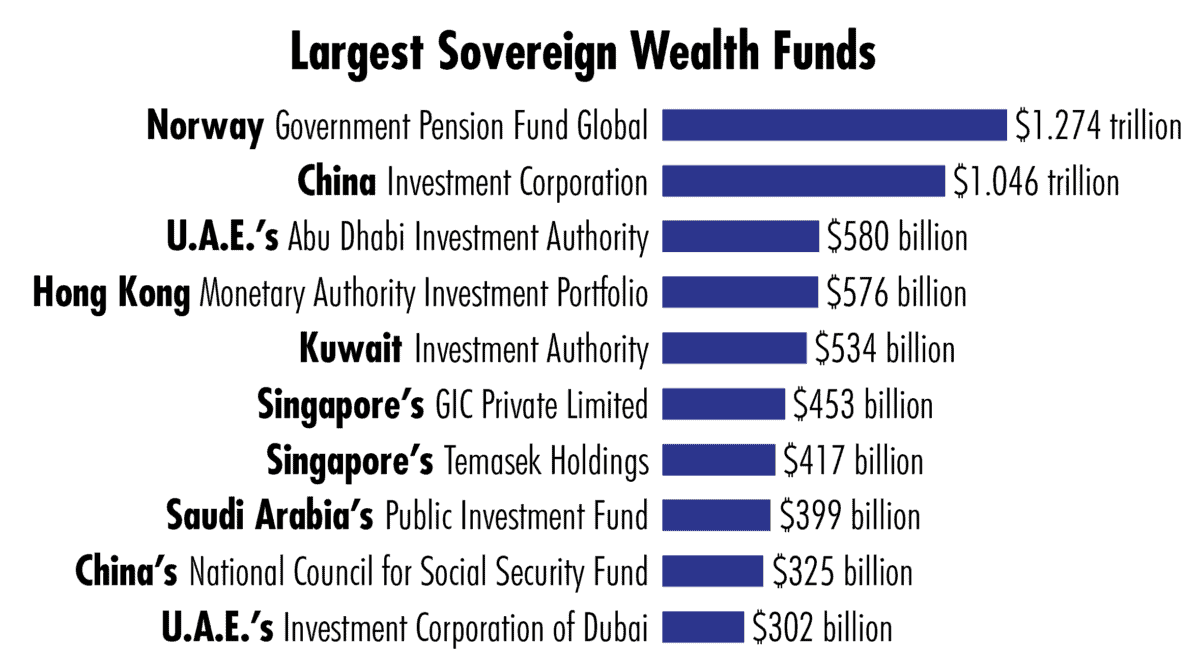

Credit: Sovereign Wealth Fund Institute

The Big Picture: China’s Trillion-Dollar Sovereign Wealth Fund

China Investment Corporation (CIC) has quickly become the world’s second-largest sovereign wealth fund in the short 14 years since its founding. With assets topping $1 trillion, significant global investments, and a large domestic investment vehicle in Central Huijin, the power of its funding can be felt all over the world. This week, The Wire’s datagraphics look at the massive investor and its global influence.

Credit: World Travel & Tourism Council, Creative Commons

China’s Falling Star

One of China’s biggest corporate failures is at hand. The HNA Group, the massive airlines-to-hotels conglomerate that between 2015 and 2017 went on a global shopping spree — spending tens of billions of dollars to acquire stakes in the Hilton Hotels, Deutsche Bank and other overseas properties — is heading towards bankruptcy reorganization. How did such a muscular, politically-connected company unravel so rapidly? This week, The Wire‘s co-founder David Barboza reports on how it may have been spurred on by shifts inside the Communist Party.

A Q&A With Ma Jian

Ma Jian is an acclaimed, Chinese-born writer who lives in exile in London. His debut novella, Stick Out Your Tongue, published in 1987, led to the permanent ban on his books being published or sold in China. In this week’s interview with James Chater, he talks about China’s efforts to extinguish memory, his life in exile, and why he’s pessimistic about his homeland’s future.

Ma Jian

Illustration by Lauren Crow

Credit: Jean-Marie Hullot, Creative Commons

Swapping Out a Debt Crisis for a Climate Opportunity

After rising to become the world’s top bilateral creditor, China is facing a new challenge: a looming global debt crisis as many of China’s most frequent borrowers find themselves unable to repay their debts. In this op-ed, Rebecca Ray and Blake Alexander Simmons argue that China, which has already shown itself as a willing partner in debt renegotiations, should convert financial debt into environmental commitments through debt-for-nature or debt-for-climate swaps. Such efforts, they argue, would allow China to continue to pursue mutual policy goals with debtor countries, while also cementing its status as a global leader on climate.

Subscribe today for unlimited access, starting at only $19 a month.