Good evening. Given everything else happening in Washington right now, you likely won’t hear about a ruling CFIUS is poised to make regarding an American engine company and the Chinese businessman who wants to rescue it from bankruptcy. Given the state of the world, it’s seemingly small potatoes. But, as this week’s cover story shows, baked into it are all the very messy layers of U.S.-China business today. Elsewhere, we have info on Jack Ma’s empire and network, a story on Playtika — the new Nasdaq-listed gaming company owned by Chinese entrepreneurs — an interview with Michael Dunne on China’s auto industry, and an interesting op-ed from Victor Shih about China’s looming vaccination dilemma. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Bidding War

After winning contracts from the U.S. Air Force, Engineered Propulsion Systems (EPS) — a small Wisconsin-based company — went bankrupt. Now, a Chinese businessman is poised to take control of its revolutionary engine and his company has advertised its close ties to the Chinese military. At first glance, the story of how Hang Wei took control of EPS and its engine seems like the embodiment of America’s worst fears about U.S. tech transfer to China. But, as Eli Binder and Katrina Northrop report, the reality may be a lot messier. With a CFIUS decision expected this week on Hang’s bid for EPS, the full story exposes the many complications of U.S.-China business today.

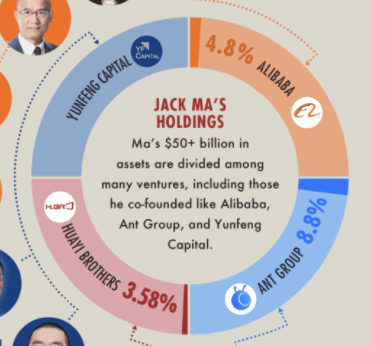

The Big Picture: The Empire Jack Built

While the business world wonders where Jack Ma is, we asked another question: Who else in his circle should we be watching? Though he is most known for Alibaba and Ant Group, Jack Ma has also built a series of venture capital firms as well as a financial and entertainment empire that produces films, television programs, sells insurance and, most recently, helped take control of one of the world’s hottest mobile gaming startups, Playtika. In this week’s Big Picture graphic, we look at his network of business associates and where some of his largest holdings currently are.

Credit: Playtika

The Playtika Prize

Playtika, a mobile gaming startup, was born in Israel. Then, in 2016, Chinese investors — including Jack Ma — bought it. On Friday, it went public on New York’s Nasdaq. As The Wire‘s Eli Binder reports, the offering is just the latest sign of the rising influence of globe-trotting Chinese entrepreneurs. Even though China has been the target of economic sanctions, tariffs and efforts aimed at decoupling its firms from U.S. money and technology, Chinese investors continue to build hot startups at home and finance others overseas — in Africa, India and the Middle East.

A Q&A With Michael J. Dunne

Michael Dunne, the founder and chief executive of ZoZo Go, a San Diego-based consulting firm, has followed the ups and down of Asia’s auto markets for decades. In this week’s interview with The Wire’s David Barboza, he talks about how joint ventures have changed, the state of China’s electric vehicle start ups, and explains how cars became one of the most dynamic and competitive industries in China.

Michael Dunne

Illustration by Lauren Crow

Credit: Andrii Makukha, Creative Commons

China’s Emerging Vaccination Dilemma

Covid-19 may have gotten its start in China, but the country seemed to be the first to contain it. Whether China can maintain that edge, though, is another question. In this week’s op-ed, Victor Shih lays out why China currently faces two unpalatable choices. As the rest of the world inoculates against Covid-19, China has to either launch a mandatory inoculation campaign — no small feat given both its population size and the uninspiring efficacy rate of the Sinovac vaccine — or continue its draconian quarantine from the rest of the world.

Subscribe today for unlimited access, starting at only $19 a month.