Good evening. In uncertain times, people always look to lessons and figures from history for guidance. There is plenty of that happening in the U.S. this week, but it’s worth doing the same thing for China. With his recent actions against Jack Ma and with measures to increase control of private firms, Chinese leader Xi Jinping has alarmed the corporate world. Our cover story this week offers the extraordinary life of Rong Yiren up as a guide to the recent turmoil. Elsewhere, we have data on China’s exploding asset management industry; an examination of Beidou, China’s answer to GPS; an interview with Huang Yasheng on de-risking America’s universities; and an argument from William Overholt on the bipartisan myths undermining the U.S.’s China policy. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Red Capitalist

Although Rong Yiren, China’s first billionaire, died in 2005, Xi Jinping recently held the founder of CITIC up as a model “patriotic entrepreneur.” As Beijing grows increasingly suspicious of powerful business elites like Jack Ma, Rong’s delicate, 50-year relationship with the Chinese Communist Party offers valuable insights into what it means to do the Party’s business. In this week’s cover story, Neil Thomas uses Rong’s extraordinary life to illustrate the Party’s evolving relationship with capitalism and to show how capitalists have managed to survive, and even prosper, under the CCP. It’s an issue of critical importance today, as Xi Jinping moves to exert greater control over the private sector.

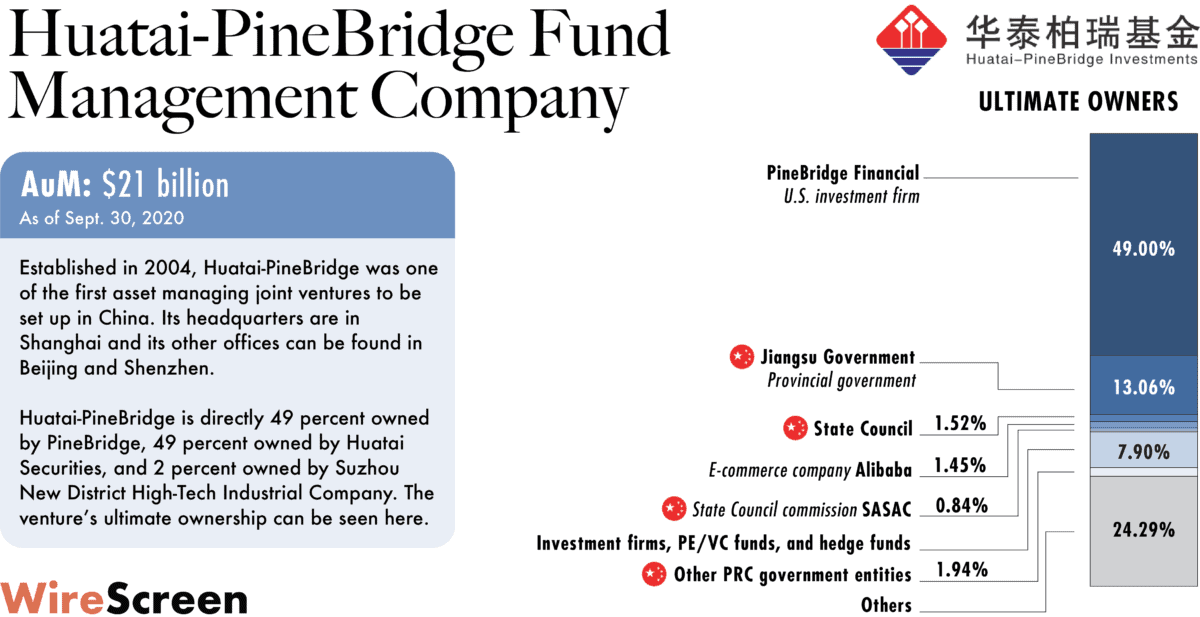

The Big Picture: Managing Growth

China’s asset management industry is undergoing explosive growth. With its economy and export market humming, the stock market soaring, and household wealth expanding, the nation’s fund management companies now have more than $2 trillion in assets under management, up from about $1.3 billion in 1998, when the government first allowed six firms to begin building the industry. This week, our data graphics look at the biggest players in a market that now has 1.7 million high net worth individuals (those having at least $850,000 to invest), ranking China second in the world, behind only the United States.

Beidou’s Global Mark

When the iPhone 12 was unveiled in October, with new features like an ultra-wide camera lens and faster processing chip, many people may have missed something in the fine print: the iPhone is compatible with Beidou’s satellite system. China’s answer to GPS, the first Beidou satellite was launched by the Chinese military in 2000, and the network was completed this summer with its 55th satellite. But as The Wire’s Katrina Northrop reports, while Beidou is a new system, it is already making a global mark, from companies like Apple producing Beidou compatible products to countries along the Belt and Road Initiative (BRI) signing up to use Beidou data.

A Q&A With Huang Yasheng

Huang Yasheng, a professor at MIT, is an expert on China’s political economy and its financial markets. His books, Selling China and Capitalism with Chinese Characteristics, were landmark studies in how money flowed into China, and how the state often represses entrepreneurship. In this week’s interview with The Wire’s David Barboza, he talks about de-risking university collaboration with China, existential threats vs. risks, and why he’s singling out Wall Street as a problem.

Huang Yasheng

Illustration by Lauren Crow

Credit: Lintao Zhang/AP Photo

Myths and Realities in Sino-American Relations

The recent toughening of the U.S.-China relationship is inevitable. China has changed in multiple adverse ways — from Xinjiang to Hong Kong to the South China Sea — which necessitates a more demanding relationship. But William Overholt, a senior research fellow at Harvard’s Kennedy School, argues in this week’s op-ed that several bipartisan U.S. policies have also made things worse because they are based heavily on myths. He outlines six of the most pernicious and damaging myths undermining U.S. policy.

Subscribe today for unlimited access, starting at only $19 a month.