Good evening. Our tag line is that every story is a China story, and this week we’re proving it by taking you to Sioux Falls, South Dakota. Our cover story looks at China’s global offshoring efforts, which have taken a strange turn from tropical islands to the Great Plains. Elsewhere, we have the best new China books out this month, data graphics on the Chinese companies making the most headway on a Covid-19 vaccine, and pieces on China’s macro economic outlook as well as the pending changes to Chinese listings on American exchanges. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

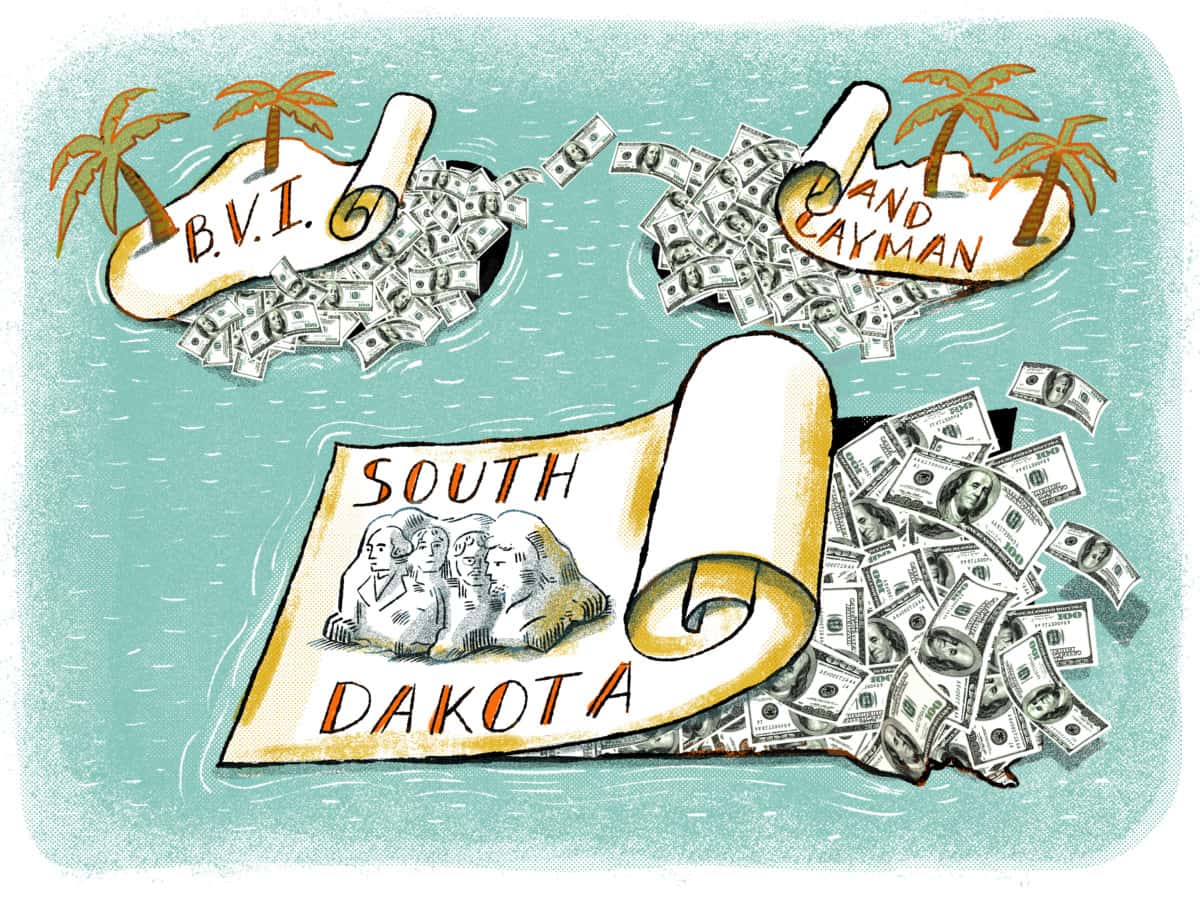

China’s Global Treasure Map

About a year and a half ago, the sleepy state of South Dakota found itself rudely awoken by the global spotlight. In a filing for his Hong Kong-listed company, Sunac, Sun Hongbin, the Chinese real estate tycoon, disclosed he had just transferred his shares to the South Dakota Trust Company. A small, two-story brick building in downtown Sioux Falls was now the proud custodian of a chunk of shares worth more than $6 billion. South Dakota, it turns out, has among the most generous trust laws in the world, and Sun was just doing what an increasing number of Chinese elites are doing: turning to the U.S. to protect their money. The Wire‘s Eli Binder and Katrina Northrop explain how the U.S. became one of the world’s hottest “offshore” destinations, and what it means for the larger system of global capital.

Design: Hiram Henriquez

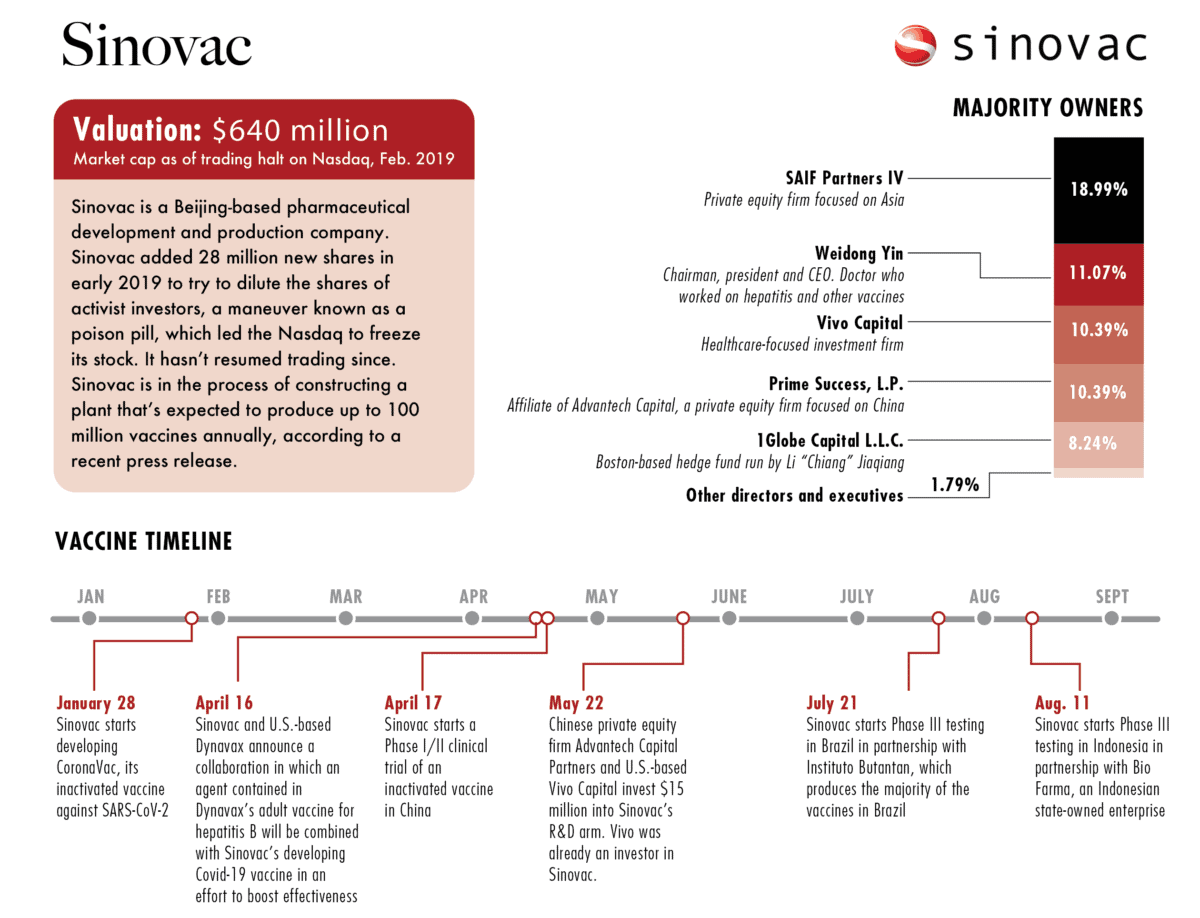

The Big Picture: China’s Covid-19 Vaccine Contenders

Scientists around the world are racing to develop Covid-19 vaccines on an accelerated timeline. Eight Covid-19 vaccines are now in Phase III clinical trials — the last phase of testing new medicines before they go to regulatory review — and half of them are made by Chinese companies. This week, our data graphics examine the five Chinese companies that have made the most progress on a coronavirus vaccine, including their owners and vaccine timelines.

A Q&A With Charlene Chu

Charlene Chu, once dubbed the “rock star” of Chinese debt analysis by the WSJ, is an expert on China’s macrofinancial landscape. In this week’s interview with The Wire’s David Barboza, she explains how China’s debt, foreign exchange reserves, and relationship with the U.S. could affect its economy in the near and long term.

Charlene Chu

Illustration by Kate Copeland

Books: History is What China Makes of It

Alec Ash highlights some of the best new China books out this month. His top pick, Rana Mitter’s China’s Good War: How World War II Is Shaping a New Nationalism, looks at how China’s perception of its role in World War II has changed from wronged victim to defiant hero — a shift that mirrors a broader change in China where the “century of humiliation” narrative is steadily giving way to confidence. Mitter’s history, Ash says, is a fascinating read that examines China’s growing nationalism with a longer lens than most.

Credit: Andriy Blokhin, Shutterstock

The Great Delisting?

The gloves have come off. With a renewed recognition of the importance of audit access, the U.S. government is finally moving to tighten regulations on Chinese companies listed in the United States. So, if the new regulations are inevitable, what is the likely result? Everyone may lose out, The Wire columnist Steven Solomon says. While the U.S. government hopes the changes will help crackdown on fraud, the effort will also further reorder global capital markets into competing Chinese and American spheres. It is no coincidence, for example, that the enormous initial public offering from Ant Financial, expected in October, is not taking place on a U.S. exchange at all.

Subscribe today for unlimited access, starting at only $19 a month.