Good evening. One of the reasons we love covering China’s economic rise here at The Wire is because seemingly mundane business stories come to life with geopolitical tension and drama. You’ll see what we mean with this week’s issue, which includes a profile of the Hong Kong Exchanges and Clearing Ltd. (HKEX), not one, but two pieces on the semiconductor industry, and a look into the Chinese companies that received U.S. bailout funds. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

HKEX at the Crossroads

From its failed bid to take over the London Stock Exchange to its boom since the National Security Law was announced, HKEX has been on a roller coaster ride this past year. In many ways, it reflects the tensions and uncertainty of its home city. With Beijing’s tightening grip and rising geopolitical tensions, the world’s most valuable stock exchange has a lot to lose — and, potentially, even more to gain.

The U.S. Government’s Flawed Logic on Huawei

Since May 2019, the U.S. government has been trying to destroy China’s Huawei, the world’s largest telecommunication equipment maker. Most recently, a new round of measures would bar Huawei from even employing outside firms, such as chip manufacturing giant TSMC, to make its chips while using American equipment. The goal may be to kill off Huawei’s access to chips and destroy Huawei’s competitiveness in 5G telecom equipment, but as City University of Hong Kong professor Douglas B. Fuller argues in this op-ed, there are a number of reasons why weaponizing the semiconductor supply chain might not only fail to destroy Huawei, but may even backfire on the United States.

Semiconductors 101

We get it: all the stories about semiconductors can be confusing. The technology, the supply chains, the business interests, and the geopolitical jostling for supremacy are near constant news items these days in U.S.-China relations. Just this week, China’s largest semiconductor manufacturer, Semiconductor Manufacturing International Corporation, announced plans for a secondary listing in Shanghai that would raise up to $7.6 billion — the biggest fundraising in China in a decade, according to Caixin. To help clarify what semiconductors are, who the leading businesses are, and why the industry has become such a flash point for U.S.-China tensions, we put together an explainer.

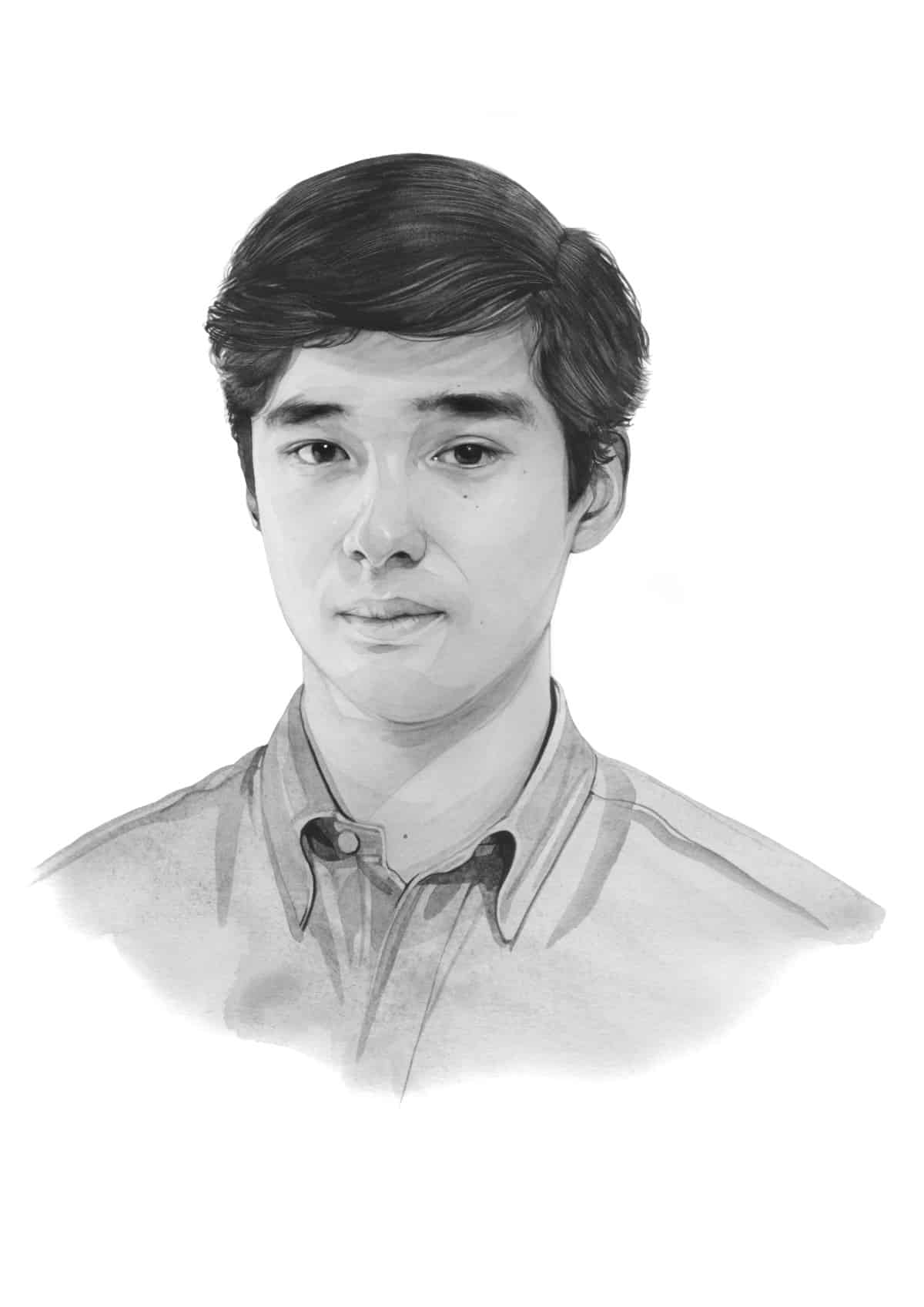

A Q&A With Alex Joske

Alex Joske is an analyst at the Australian Strategic Policy Institute where his reports, such as Picking Flowers, Making Honey, have gained a wide following. In this week’s interview with The Wire’s David Barboza, he discusses his work researching China’s influence operations and the PLA’s efforts to send scientists abroad.

Alex Joske

Illustration by Kate Copeland

Credit: John Hill, Creative Commons

The Big Picture: Where China Gets Its Oil

Over the past few decades, China’s oil imports and refining capacity have increased dramatically. Today, China represents the world’s largest importer and second largest refiner of oil, but it hasn’t always been that way. In this week’s Big Picture, we’re looking at how and when China became the world’s top importer of oil, how its suppliers have changed, and which Chinese companies are the most important to China’s domestic oil industry.

Credit: Official White House Photo by Shealah Craighead

Why Did Chinese Firms Get U.S. Bailout Funds?

American-based affiliates of Chinese companies, including at least one firm with ties to the Chinese military, received millions of dollars in loans from a federal program aimed at keeping small businesses afloat during the global pandemic, according to data released this week. The Wire searched government filings for well-known Chinese firms operating in the U.S. and found nine affiliates of Chinese firms that received as much as $34 million in bailout funds in all, including grants to two affiliates of the HNA Group, the huge Chinese airlines to hotels conglomerate that has been hurtling toward bankruptcy.

Subscribe today for unlimited access, starting at only $19 a month.