Good evening. As U.S.-China relations become increasingly strained, the U.S. government is flexing just about every tool it has in the name of protecting U.S. interests. On Friday, President Trump announced new measures aimed at Chinese nationals who study at U.S. universities. New legislation is also threatening to delist foreign companies on U.S. exchanges. And, more and more, the Commerce Department is using the Entity List (which we introduce in this week’s Big Picture) in a novel way to sanction Chinese companies, including AI startup SenseTime, the subject of this week’s cover story. The efficacy of these measures, however, remains open to debate, and in some cases, there are unintended consequences. If you’re not already a paid subscriber to The Wire, please sign up here to read the full issue.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

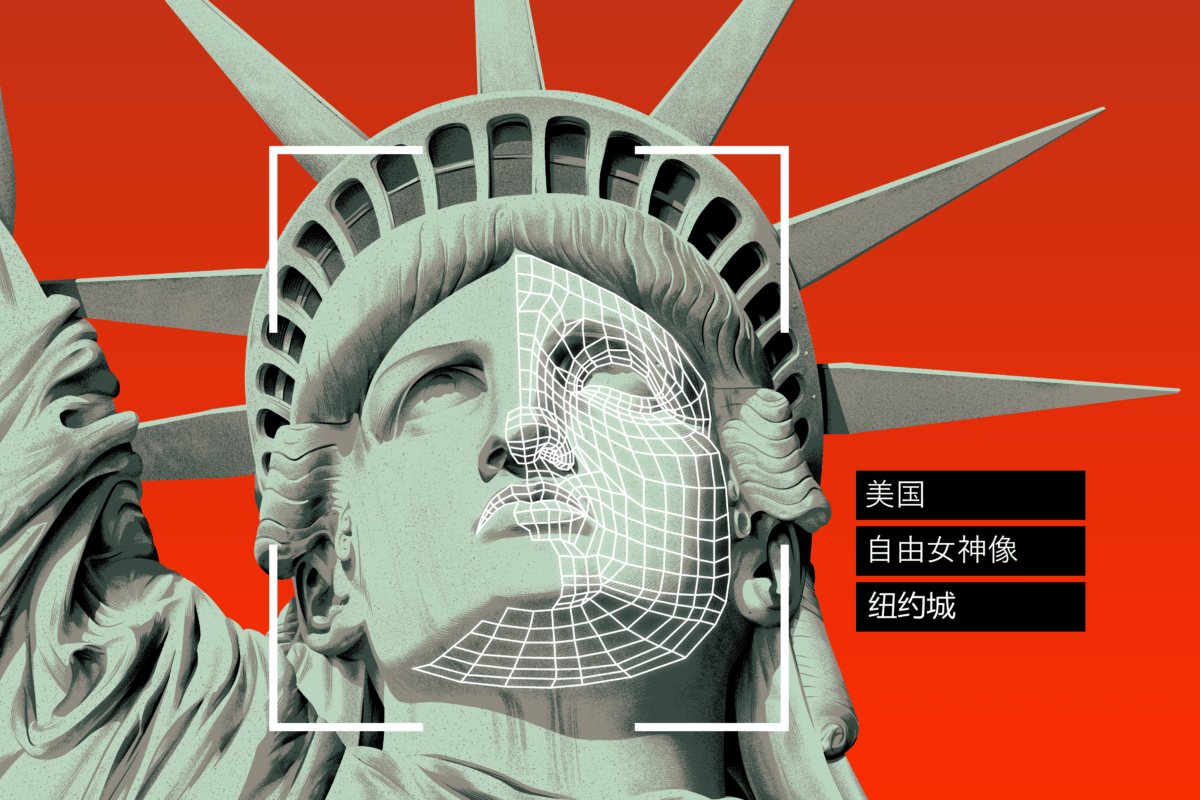

SenseTime’s American Axis

Now valued at more than $7 billion, the Chinese company SenseTime is one of the world’s hottest AI startups. It has high-profile research partnerships with MIT as well as big-name U.S. investors and suppliers. But while its facial recognition technology can be used for retail marketing and silly social media filters, it is also used to help the Chinese government’s burgeoning surveillance state, including tracking and controlling Uighur Muslims. For this human rights abuse, the U.S. blacklisted SenseTime last year. But, as reporter Amy Hawkins shows in this week’s cover story, that hasn’t deterred many of its American partners.

Credit: Lutsenko_Oleksandr, Shutterstock

What is the U.S. Entity List?

In recent years, the U.S. has added a growing number of Chinese companies, including some leading tech companies, to the U.S. Entity List, which makes it harder for those companies to do business with Americans. The list has been an ongoing source of tension in U.S.-China relations, and this month, China’s state-backed Global Times reported that China “is ready to take a series of countermeasures,” including adding American companies such as Apple, Boeing, and Cisco to its own list — an “unreliable entity list.” It remains to be seen what, exactly, that means, but in this week’s Big Picture, we explain how the American Entity List started, why it matters to U.S.-China relations, and introduce some of the key Chinese companies on the list.

John Phelan, Creative Commons

Trump Curb on Chinese Student Visas Raises Campus Fears

American universities have become a key battleground in the rivalry between the U.S. and China, and on Friday, President Trump fired the latest shot, announcing new measures that would bar Chinese nationals who have an affiliation with the People’s Liberation Army from receiving visas to study or conduct graduate or post-doctoral research in the United States. While the measures are aimed at rooting out espionage, The Wire‘s David Barboza and Eli Binder report that some observers say they could backfire everywhere from college campuses to Silicon Valley.

Credit: Ekso Bionics

U.S. Invokes National Security To Keep ‘Iron Man’ Outfit At Home

Exoskeletons, basically robotic mechanical suits, were once hailed as the future of the military — like ‘Iron Man’ suits for soldiers. In the past few years, that application has mostly fizzled out, and the technology has moved into the medical industry, where the suits can, for example, help recovering stroke victims learn to walk. But for U.S. robotics companies hoping to move exoskeletons into China’s growing medical market, The Wire‘s Eli Binder shows that the technology’s military roots are a challenge — as one small U.S. company learned the hard way.

America’s Delisting Threat Could Pay Off

The Holding Foreign Companies Accountable Act, which requires that all companies listed on U.S. stock exchanges submit to audits reviewable by the U.S. Public Company Accounting Oversight Board, will likely be signed it into law. Some observers have questioned the wisdom of the legislation, arguing that it could cause Chinese firms to vanish from U.S. exchanges and hurt the global competitiveness of U.S. stock exchanges. But while these are legitimate concerns, Columbia Business School professor Shang-Jin Wei argues in this op-ed that the legislation could, perhaps surprisingly, lead to more listings by high-quality Chinese private-sector firms.

A Q&A With Yuen Yuen Ang

Yuen Yuen Ang is an associate professor of political science at the University of Michigan and author of, most recently, China’s Gilded Age: The Paradox of Economic Boom & Vast Corruption. In this informative interview with The Wire’s David Barboza, she explains why China’s economy has boomed despite massive corruption as well as her key insight, which she calls “the steroids of capitalism.”

Yuen Yuen Ang

Illustration by Kate Copeland

Subscribe today for unlimited access, starting at only $19 a month.