Good evening. Did you know that there is a casino in Cambodia that, thanks to Chinese patrons, out-earns The Bellagio in Las Vegas? Or that the Mayo Clinic is exporting its brand of medicine to Hangzhou, China? What about the billions of dollars from outside China now flowing into Chinese ‘A’ shares, the once heavily sequestered, largely state-owned stocks? Our latest issue explains all this for you, and more. Much more, in fact, since our Q&A this week features Steve Bannon, a known China hawk who is not one to mince words — whether they be about H.R. McMaster, Wall Street, or the recent news out of Hong Kong. If you’re not already a paid subscriber to The Wire, please sign up here to read the full issue.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The China Jackpot

Singapore’s Marina Bay Sands, Macau’s Wynn Palace, and…Cambodia’s NagaWorld? Although little known outside of Phnom Penh, NagaWorld is one of the gambling world’s biggest money-making machines. In 2018, it raked in more than $500 million in profits, propelling a casino based in one of the world’s most impoverished countries into the ranks of Asia’s elite gambling emporiums. The Wire‘s cover story this week takes you inside the unlikely juggernaut and explains the unique forces that have shifted the casino world’s center of gravity to China’s border countries as well as China’s role in facilitating that shift.

Credit: Sean Pavone, Shutterstock

The Big Picture: If You Build Casinos, China Will Come

In this week’s cover story, we introduce readers to NagaWorld, a casino complex in Cambodia that is booming thanks to Chinese gamblers. And it’s not the only one; since casino gambling is illegal in mainland China, casino developments in a number of China’s border countries are all vying for Chinese clientele. In the Big Picture, we share infographics that show where Chinese citizens go to gamble, and which casinos are the biggest players in the industry.

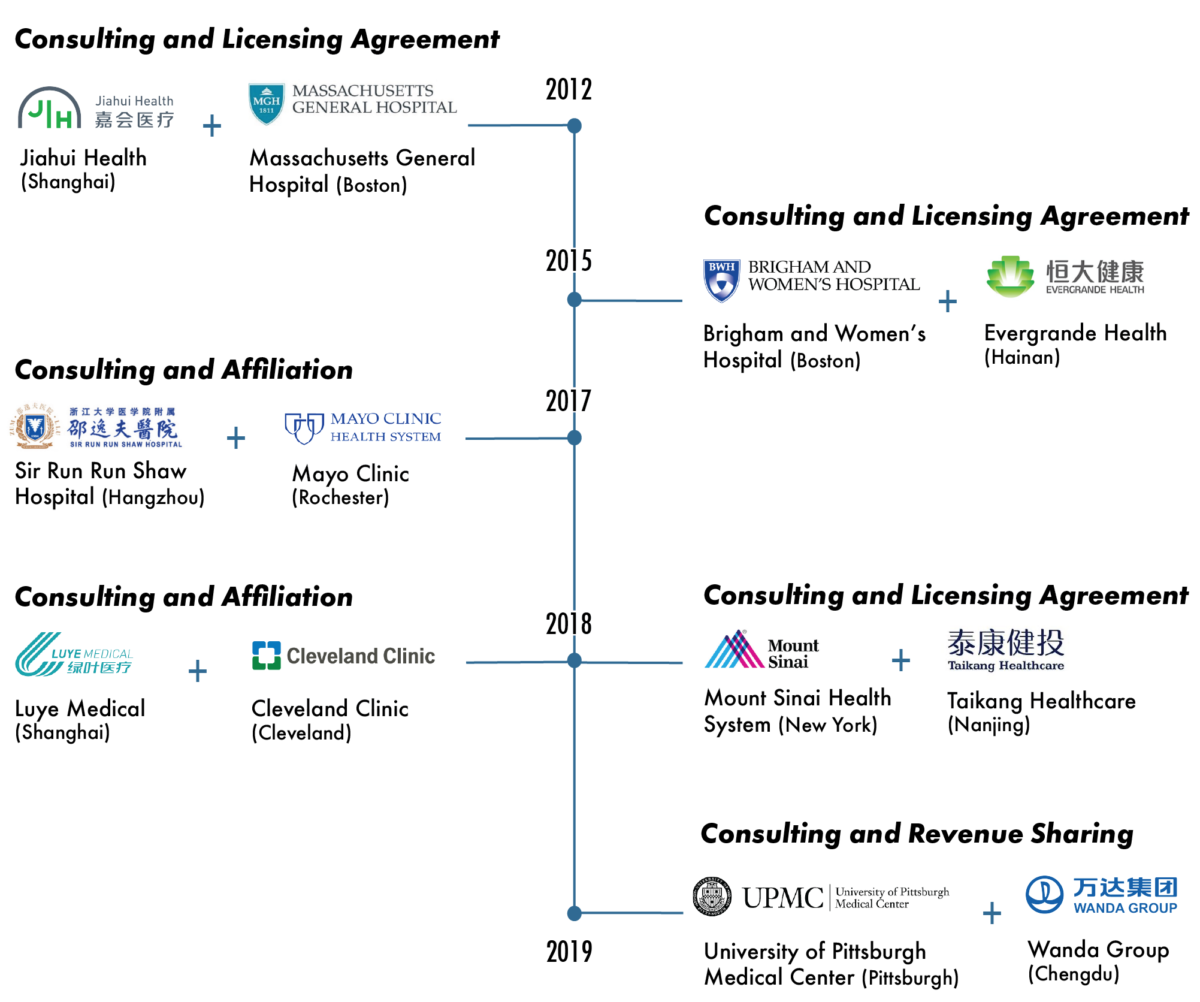

American Hospitals Take the China Road

Brigham and Women’s Hospital, Mount Sinai Health System, the Cleveland Clinic, and the Mayo Clinic — all part of a growing group of world-renowned American hospitals planting their flags in China and tapping into one of the world’s fastest growing health-care markets, one that is on track to spend $2.4 trillion annually on medical services by the year 2040. But despite the dollars added to the bottom line, The Wire reporter Katrina Northrop shows that American hospitals face significant challenges in their collaborations with Chinese hospitals.

Credit: Bart Sadowski, Shutterstock

Bears on the Potomac

Washington is taking steps to delist Chinese stocks trading in the U.S. and to keep a federal retirement fund from investing in China, citing concerns about human rights abuse and Chinese corporate transparency. But The Wire‘s Eli Binder reports on concerns that the moves could set back years of efforts to integrate China into the global capital markets and financial industry. That trend has included adding more China ‘A’ shares, or renminbi-denominated stocks listed on the Shanghai and Shenzhen stock exchanges, to U.S. investors’ portfolios via the widely followed indexes of MSCI Inc. Today, about $13 trillion in assets under management are benchmarked to the MSCI indices.

A Q&A With Steve Bannon

Since leaving the White House, Bannon has been sounding the alarms on what he says is a war with China that has already begun. In this pull-no-punches interview with The Wire’s David Barboza, he discusses everything from Hong Kong and Covid-19, to why the world needs Nancy Pelosi’s leadership and expertise on China right now. “If we blink,” he warns, “we’re heading on a path to war, to a kinetic war.”

Steve Bannon

Illustration by Lauren Crow

Subscribe today for unlimited access, starting at only $19 a month.