For decades, David Webb has been on a one-man crusade to expose corporate wrongdoing and demand greater transparency in Asia’s largest financial market.

Now, the voice of this self-appointed guardian of the Hong Kong investing world is fading out. In February, the 59-year old Webb announced he has only months to live, having run out of treatment options for metastatic prostate cancer. In March, he stepped down from his advisory role at market regulator the Securities and Futures Commission (SFC), after 24 years.

Yet on Monday he drew a full house at Hong Kong’s famed Foreign Correspondents’ Club for one of his last public appearances. Some 230 people packed in to hear him live; many more tuned in online.

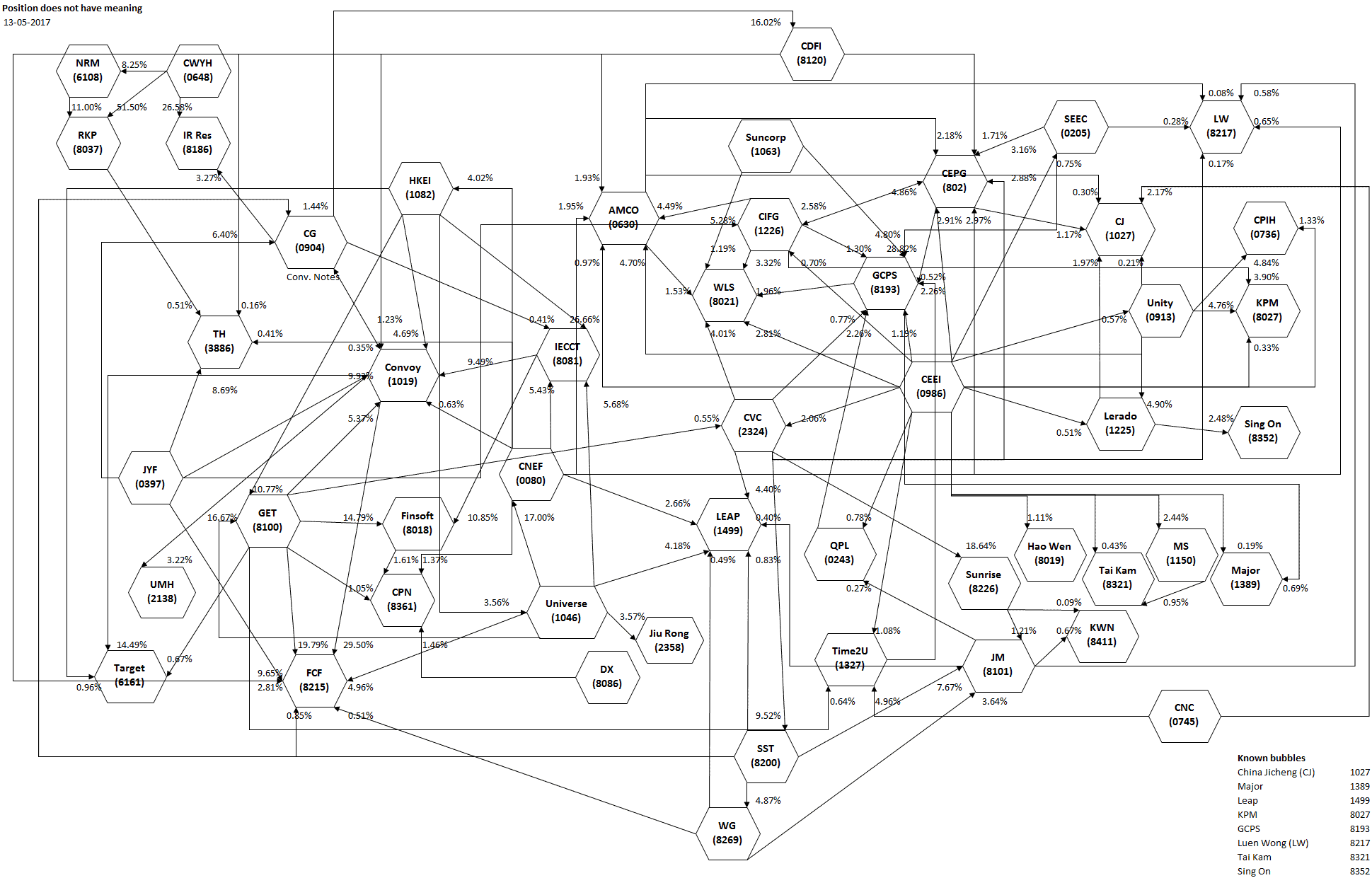

Webb’s activism rests on the simple idea that transparency of data leads to healthier and fairer markets, benefiting investors and ordinary people. What has set him apart, however, is the single-minded dedication and fierce intellect he has applied to his task. Over the years this has enabled him to reveal instances of egregious corruption, most notably in 2017 when he exposed a network of cross-shareholdings that had allowed a few Hong Kong investors to exert substantial influence over scores of listed companies.

He fought tirelessly for the rights of ordinary investors in companies controlled by powerful interests who disliked the idea of being held to account by public, independent minority shareholders.

Ashley Alder, former chief executive officer of the Securities and Futures Commission

Even after an MRI scan for arm pain revealed tumours along his spine in 2020, he has kept up his work, tracking the Hong Kong government’s reckless cash handouts to business during Covid and the growing share of unconvicted prisoners in the city, as well as starting a crowdsourcing project to map corporate directors’ pay.

“It’s deeply impressive to see someone come to this moment in his life and still have the ability to give back,” says Melissa Brown, a partner at the investment advisory firm Daobridge Capital who has known Webb since the 90s. “And that’s something that makes a huge difference in a place like Hong Kong.”

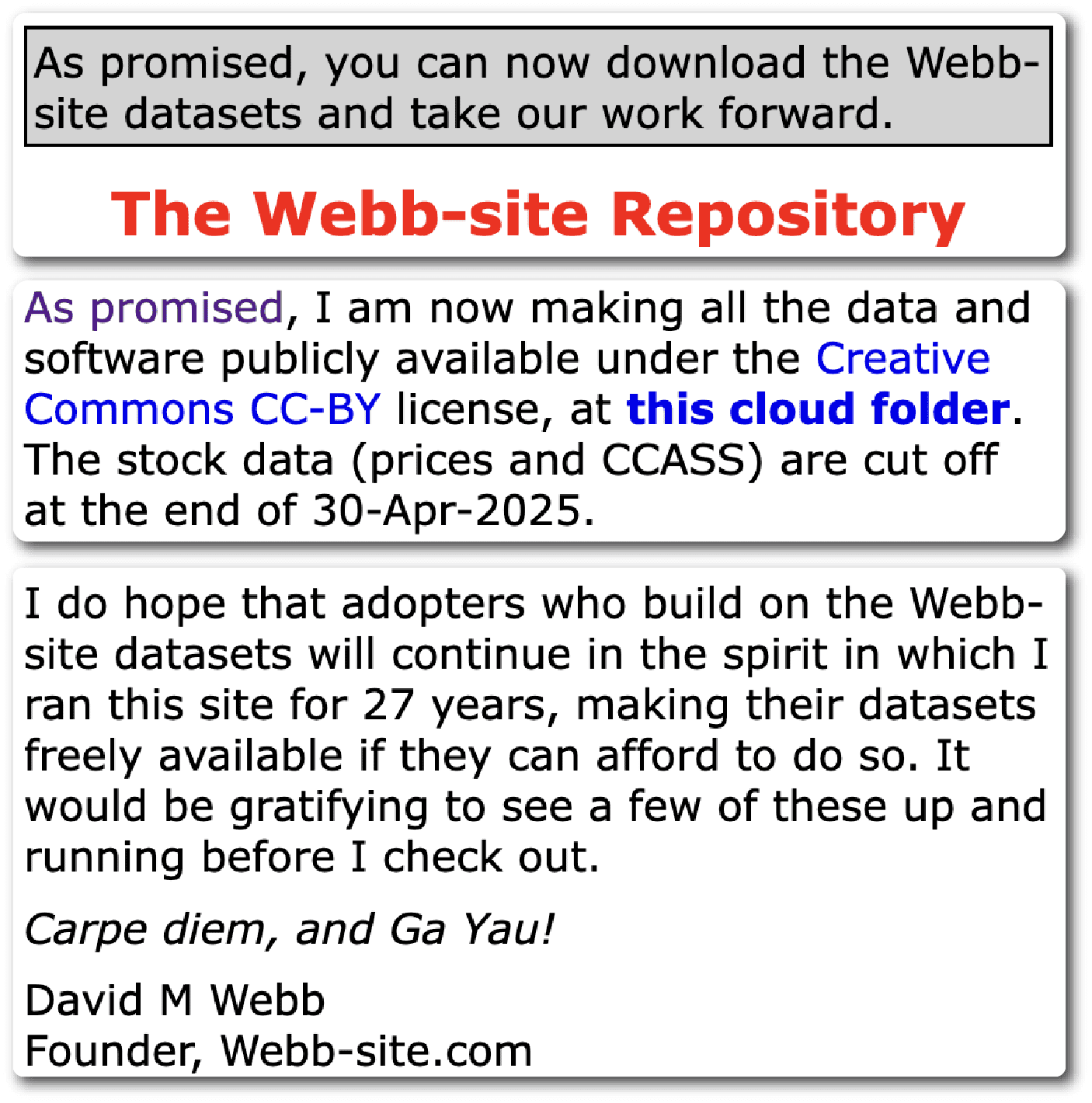

More recently, Webb has made available a vast repository of corporate and other records he has collected on his platform Webb-site. “I left all of my data sets open in the hope that there will be some groups that don’t just commercialize it, but keep it open to the public and build on that,” he told the press on Monday.

Webb’s retirement comes at a time when concerns over the health of Hong Kong’s markets — and of the city’s broader political situation — run deeper than ever. The city has never been fully democratic, either under British rule or since its handover to China in 1997. But its financial market for years benefited from the existence of an independent legal system and a largely free press, both of which are now hanging in balance under Beijing’s tightening grip.

“It’s very sad that Hong Kong has moved away from the laissez faire economy that made it so successful,” Webb told the crowds on Monday. “It got much worse in the last few years…and now we’ve moved to a system which is closer to the mainland in terms of central planning.”

Chinese companies accounted for nearly 80 percent of the Hong Kong stock market’s total market capitalization last year, compared to 60 percent a decade ago, while a growing number of international businesses and banks have retreated from the city.

“What made Hong Kong special was differentiation,” said Webb. “I hope that Hong Kong can hold the line against further weakening of rules, but we’re heading down that track.”

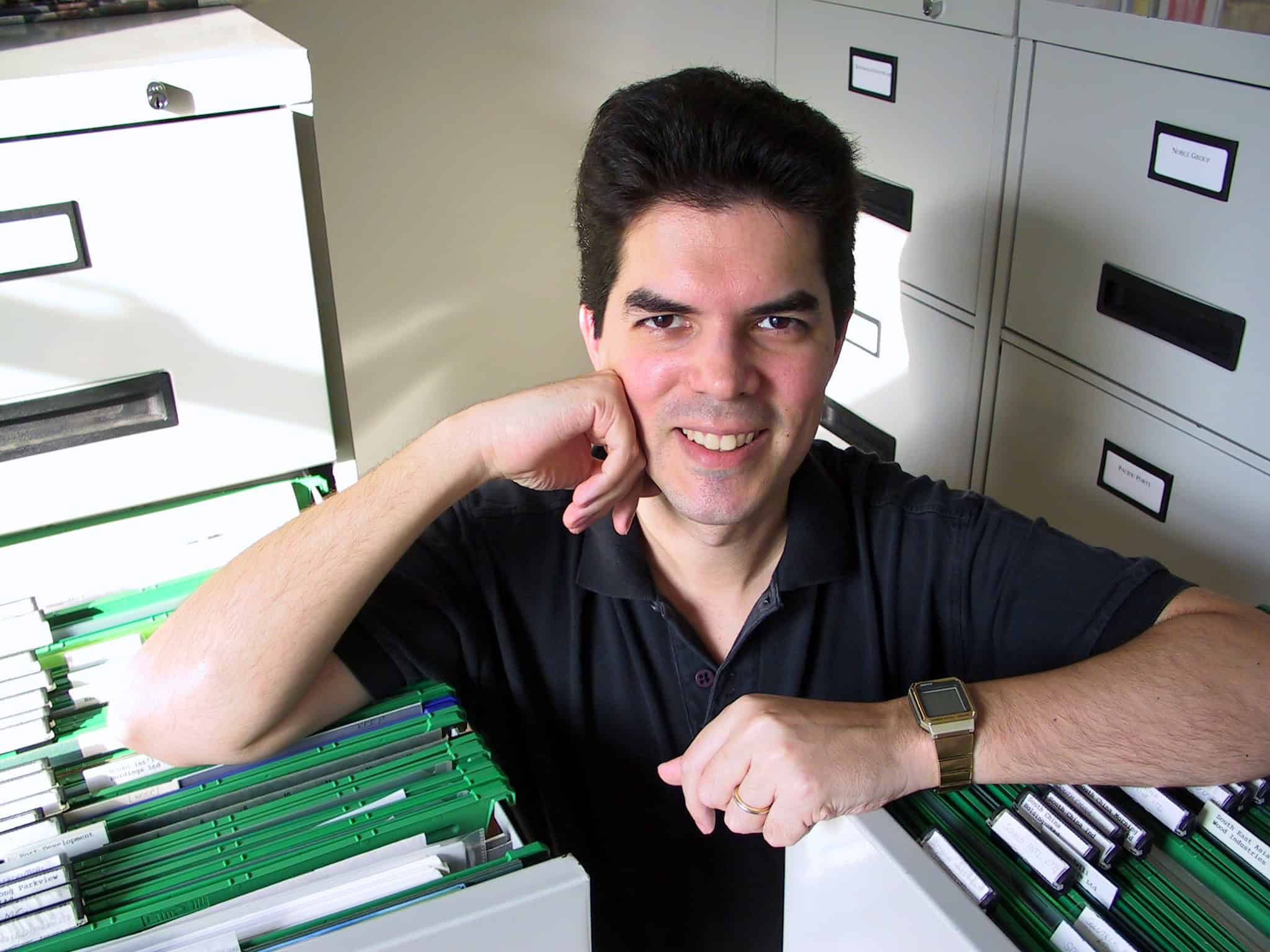

British-born Webb, first arrived in Hong Kong in 1991 as a young investment banker, when the city was still a U.K. colony. After a few years in the corporate world, he made a decisive career pivot.

“I’d made enough money to be fairly certain I wouldn’t need to work again so I could offend whoever I liked in Hong Kong,” he said. “I’d learnt about how the local business community dodges around the regulations [and] exploits the system, and I thought I should put all that to good use.”

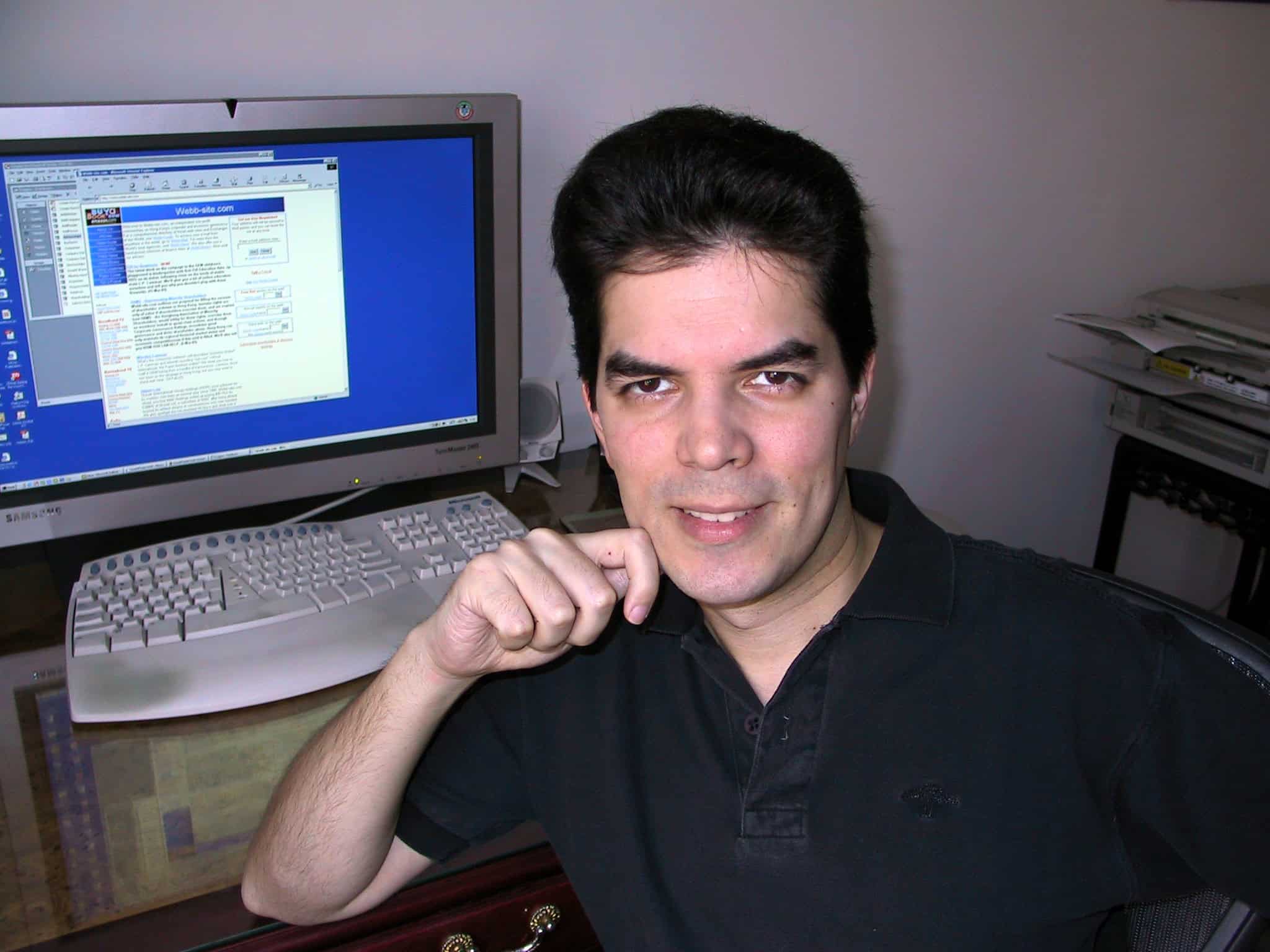

In 1998, the same year Google launched its search engine, he started Webb-site to collect public records and advocate for better corporate governance. By his own estimates, Webb has devoted half of his time and over HK$10 million ($1.3 million) in the last two decades to operate the database, which has become an invaluable tool for journalists, researchers, and investors alike. He spent the rest of his time investigating shocking cases of corporate malfeasance.

“He was able to see the misconduct and exploiting of loopholes that the market regulators missed through his dissection of corporate announcements and detective work as to who the unnamed parties are,” says retired barrister John Brewer, who has known Webb since the early 90s.

The best-known example was a report he published eight years ago, uncovering what he called the “Enigma Network.” Webb spent months in research, mapping out the substantial overlap in ownership between 50 publicly traded Hong Kong companies, with investors allegedly colluding to manipulate their valuations.

The shares of many companies named in the report crashed in the aftermath, prompting an investigation by SFC that led to the market suspension and liquidation of some of the firms.

“David might be described as the ‘conscience’ of Hong Kong’s financial markets,” says Ashley Alder, former chief executive officer of the SFC. “He fought tirelessly for the rights of ordinary investors in companies controlled by powerful interests who disliked the idea of being held to account by public, independent minority shareholders.”

The activism is far more rewarding to me emotionally to look back and say, however long or short my life is — and unfortunately it’s shorter than I expected — I will die confident that I did my best.

David Webb

Webb has also helped push forward rule changes to make the market more open and fair. “There haven’t been a lot of people, especially in technical areas of the Hong Kong government, who were coming forward with proposals and reforms,” says Daobridge Capital’s Brown, who sat alongside Webb on the SFC’s Takeovers Panel. “And that was David.”

David Webb discusses petitioning for voting by poll at shareholders meetings during his talk at Hong Kong’s Foreign Correspondents’ Club, May 12, 2025. Credit: The Foreign Correspondents’ Club, Hong Kong

For instance, in 2009, after six years of petition, he successfully made voting by poll — instead of a show of hands — mandatory at shareholders meetings. Still, many of his other proposals, such as a push for companies to issue quarterly reports, and the introduction of a class action regime for the city, were never adopted. In 2008, he resigned from the board of bourse operator Hong Kong Exchanges & Clearing Ltd, frustrated by what he saw as government interference.

Even so, some say Webb has had substantial influence, perhaps beyond what he realized.

“I think David may not be aware of some of the changes that he’s been instrumental in germinating,” says Nial Gooding, who serves on the Hong Kong Stock Exchange’s listing review committee. “I know that policymakers, investors, and high-ups in Hong Kong listen closely to him, appreciating his independence, sincerity, and the high level of smarts that underpin his conclusions.”

Nearly everyone who crossed paths with Webb was struck by his intellect. “I must confess I was pretty intimidated by David at first,” says Jamie Allen, former and founding secretary general of the Asian Corporate Governance Association, who served on a SFC committee with Webb in the 2000s. “He has got vast knowledge of securities law, corporate governance and regulation. He seemed to know as much about the issues as everybody else in the room altogether.”

Those who know Webb more intimately saw his lesser-known side, including a love for astronomy that sent him chasing solar eclipses and a fondness for the Hong Kong Philharmonic Orchestra’s concerts — though he ceased his sponsorship of the orchestra when it refused to reform its governance structure, Webb added in an email to The Wire China.

In his talk, Webb acknowledged that not all of his campaigns have succeeded, but said part of being an activist is knowing which doors have shut and where to keep pushing. That was why he has kept speaking out, even after his diagnosis and the introduction of Hong Kong’s National Security Law in 2020 that has helped to stifle dissent in the city.

“I could have just carried on investing in the markets, focusing solely on that and died a rich man,” he said. “The activism is far more rewarding to me emotionally to look back and say, however long or short my life is — and unfortunately it’s shorter than I expected — I will die confident that I did my best.”

If anything, he remains optimistic that Hong Kong has hit “peak authoritarianism” and that a more open and democratic system will eventually prevail in the city as well as China.

“Nobody lives forever,” he said. “I know that, and you know that, and so there will be a better time.”

An earlier version of this article incorrectly stated that Hong Kong has never passed a competition law. It did so in 2012.

Rachel Cheung is a staff writer for The Wire China based in Hong Kong. She previously worked at VICE World News and South China Morning Post, where she won a SOPA Award for Excellence in Arts and Culture Reporting. Her work has appeared in The Washington Post, Los Angeles Times, Columbia Journalism Review and The Atlantic, among other outlets.