When Xiaomi boss Lei Jun took to the stage at the end of March to launch the company’s first electric vehicle, it was the climax of a three-year journey on which he has bet his professional legacy. In March 2021, he had called the Xiaomi EV project his last major professional venture, raising the stakes for the 54-year-old billionaire entrepreneur who built his company’s fortune by selling millions of budget smartphones.

“I have realized that it’s so hard to make a car,” admitted Lei. “It’s so hard [but] I didn’t expect Apple to quit.” He was reacting to news, reported by Bloomberg in February, that U.S. tech giant Apple was abandoning its EV project after 10 years.

This week, The Wire traces Xiaomi’s path in entering the EV market, and assesses its chances for success as a latecomer to an already saturated market.

FROM SMARTPHONES TO AUTOS

Xiaomi released its first smartphone in 2011 and grew its business by offering quality products at budget prices, with profit margins of below 5 percent. These margins were among the thinnest in the industry, according to a study of Xiaomi in Harvard Business Review.

The tactic worked, helping Xiaomi to grow rapidly over the last decade or more. In 2023, it reported global revenue of 271 billion renminbi ($38.2 billion), with nearly 60 percent of that revenue coming from its smartphone sales.

“Lei Jun and the company itself was able to predict the trends as to how the smartphone would evolve and what consumers would want,” says Abhishek Murali, senior analyst for electric vehicles at Rystad Energy, an independent research and business intelligence company.

“They have a history of being the ‘flagship killer,’” adds Murali, referring to Xiaomi’s ability to release a product that matches its competitors on quality but is offered at a lower cost.

Any personal equipment and home appliances powered by electricity can be Xiaomi-branded and connected. As the future comes, we will see more focus shifting on this kind of connectivity and software-enabled features.

Yu Yang, principal analyst on automotive semiconductors at Yole Group

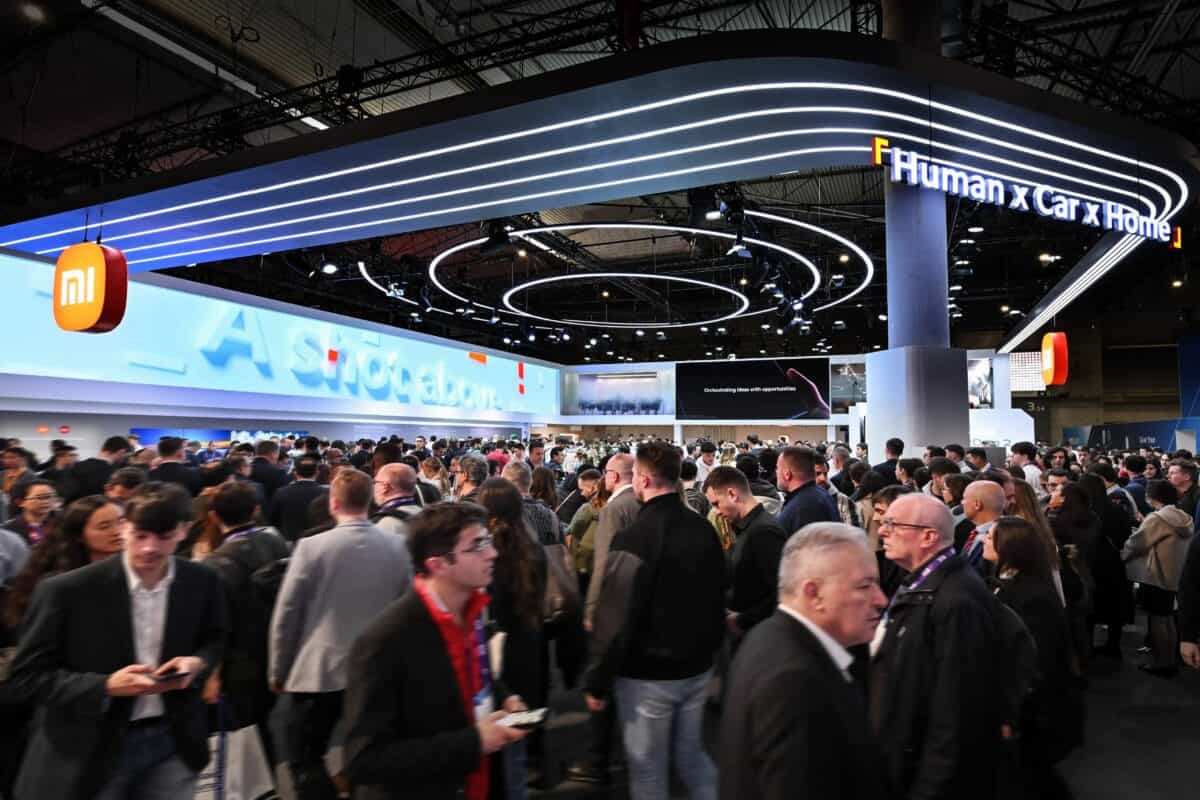

Xiaomi presents its EV, named the Speed Ultra 7 (SU7), as part of its Human x Car x Home ecosystem. It’s an ambitious plan to provide Xiaomi-branded products for its customers’ personal devices, household appliances and cars.

Xiaomi presents its Human x Car x Home ecosystem at Mobile World Congress (MWC) Barcelona, February 2024. Credit: Xiaomi News.

“Any personal equipment and home appliances powered by electricity can be Xiaomi-branded and connected,” says Yu Yang, principal analyst on automotive semiconductors at Yole Group, a market research and strategy consulting company. “As the future comes, we will see more focus shifting on this kind of connectivity and software-enabled features.”

The Xiaomi SU7’s starting price is 215,900 renminbi (approximately $30,300), with the most advanced model reaching 299,900 renminbi (approximately $42,000). The price for the standard SU7 undercuts the Tesla Model 3, which starts at 245,900 renminbi ($34,500) in China. Check out the graphic below for a specs comparison between the SU7 and its leading rivals.

The SU7’s price is “between the mass and premium market,” says Murali from Rystad Energy. “Even if you have a fanbase that is loyal to you, you still need to establish some form of trust.”

“Once the market tests it and realizes that this is an EV that we’re willing to pay more money for, they [Xiaomi] will definitely have to raise prices, because at these prices they will never be able to turn a profit,” adds Murali.

The Xiaomi SU7 being assembled at Xiaomi’s factory in Beijing. Credit: Lei Jun via X

Xiaomi could sell as many as 60,000 SU7s in its first year on the market, research firm CreditSights projects, based on first-year sales for similar EV brands. A Xiaomi spokesperson told The Wire that more than 100,000 people had placed refundable deposits on SU7 orders by April 3, and the number of non-refundable orders was more than 40,000. CreditSights reckons the SU7 could add 6 percent to Xiaomi’s total revenue in 2024, although its profits are likely to suffer from the first-year cost burden of producing the car.

Xiaomi says that the standard SU7 can charge up to 350 kilometers (km) in 15 minutes at a rapid charging station. Check out the graphic below to learn more about the companies Xiaomi has partnered with to realize its EV ambitions:

Analysts say that access to a mature EV ecosystem in China helps to explain why Xiaomi was able to bring a vehicle to the market while Apple gave up.

“If you’re in China, it is a great time for a tech company to enter the EV space,” says Murali from Rystad Energy. “What differentiates working in China for such a company is that they’re able to access a very good value chain and market base. You’ve got a great battery supply chain, you’ve got players that are ready to partner with you.”

Xiaomi’s choice of battery suppliers is an example of the company using established partners rather than trying to develop in-house expertise too early, analysts say.

“They are using batteries from BYD and also from CATL, even though Xiaomi itself has investments in four different battery companies,” says Yang from Yole Group. “Xiaomi wants to play safe for the first vehicle and I’m quite confident that in the future they will increase the [battery] share of their invested companies.”

Check out the graphic below for a detailed timeline of Xiaomi’s three-year path from announcing the SU7 to launching it.

Aaron Mc Nicholas is a staff writer at The Wire based in Washington DC. He was previously based in Hong Kong, where he worked at Bloomberg and at Storyful, a news agency dedicated to verifying newsworthy social media content. He earned a Master of Arts in Asian Studies at Georgetown University and a Bachelor of Arts in Journalism from Dublin City University in Ireland.