Good evening. Mintz Group, Bain & Company and Capvision — all of these consultancies have been raided or investigated recently, causing many to group them together. But as our cover story this week shows, Beijing’s crackdown on Capvision deserves a closer look on its own terms — not least because its shareholders and investors are surprisingly high profile. Elsewhere, we have infographics on CNE Express, the delivery service of choice for Temu and Shein; an interview with Keyu Jin on her new book and why China’s economy needs to change; an op-ed from Andrew Cainey on foreign businesses in China working together; and an op-ed from Yu Yongding, a Chinese economist, on China’s road back to growth. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

The Consultant Crackdown

At first glance, the recent raid on Capvision, a Shanghai consultancy, looks similar to the raids on foreign firms Mintz Group and Bain & Company. But there are reasons to separate Beijing’s crackdown on Capvision. For starters, as Grady McGregor and Katrina Northrop report, Capvision is Chinese and its shareholders and investors include a network of remarkably high profile and state-connected individuals and companies.

The Big Picture: Express Delivery

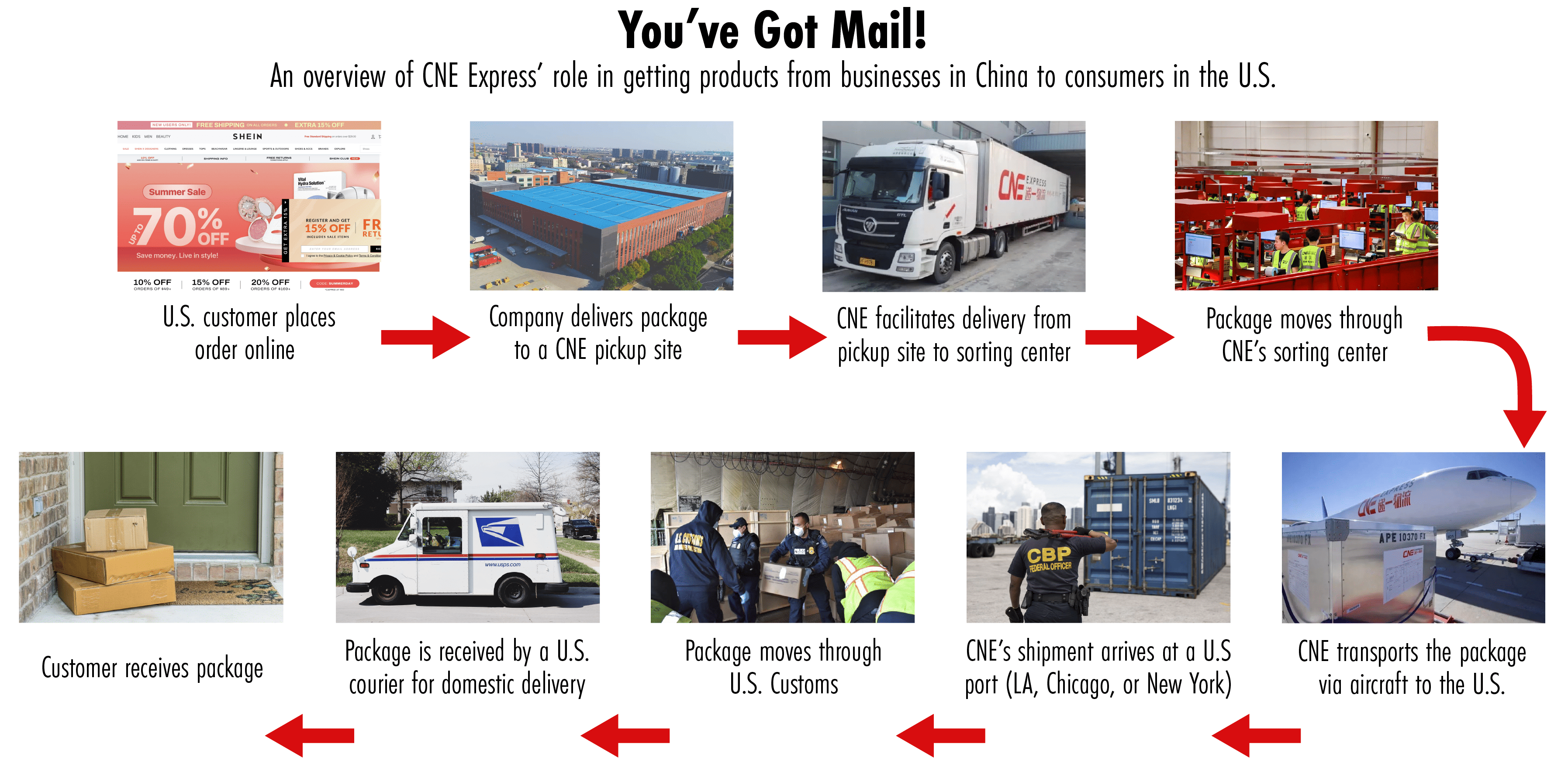

If you order from Temu or Shein, you’ll likely find CNE Express’s logo (递一物流) on the package’s shipping label. This week’s infographics by Ella Apostoaie look at CNE Express’s story so far, including its global goals and its potential hurdles ahead as it becomes entangled in the clampdown on fast-fashion’s forced labor practices.

A Q&A with Keyu Jin

Keyu Jin is a tenured professor of economics at the London School of Economics who has previously worked with the World Bank, International Monetary Fund and the China Banking Regulatory Commission. Her new book, The New China Playbook, argues for a new model of growth for the Chinese economy better suited to the needs of the country’s younger generations. In this week’s Q&A with Andrew Peaple, she talks about why China’s current model has run its course and why the country needs speedier political development.

Keyu Jin

Illustration by Kate Copeland

Foreign Business in China: Safe and Secure?

In this week’s op-ed, Andrew Cainey argues that companies operating in China need to work together to get better information on the government’s intentions. China’s welcome will always be on China’s terms, he writes. But whether foreign business finds it warm or cold matters too.

The Road Back to Growth in China

Barring a “black swan” event, China can achieve 6 percent GDP growth this year, thereby ending a 12-year slowdown. The key ingredient, says Yu Yongding, a former president of the China Society of World Economics, in this week’s op-ed, must be carefully planned and prudently funded infrastructure investment.

Subscribe today for unlimited access, starting at only $19 a month.