Good evening. Ever since FDR’s tenure, the U.S. government has periodically questioned, and then affirmed, its hands-off approach to American universities. Even during the Cold War, the U.S. government clearly stated that maintaining an open atmosphere at universities remained crucial to national strength. But, as our cover story this week shows, China’s rise changed all that — and many universities are now questioning the best way forward. Elsewhere, we have a Q&A with Matteo Maggiori, the finance professor and VIE expert, on who really owns listed Chinese companies; infographics on Suncity, the Macau casino empire that just saw its head boss arrested; a reported piece on the talent shortage facing Chinese companies in science and tech fields; and an op-ed about why a new proposed tax in Europe should have China very, very worried. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

America’s Open Secret

Universities across the country are demanding a reckoning with the so-called ‘China Initiative’ — the Department of Justice’s three-year-old program to stop China’s espionage efforts and intellectual property theft. Critics point to its flawed prosecutions of professors and a seeming focus on clerical errors instead of matters of national security. But as Matt Schiavenza reports in our cover story this week, the perceived failures of the China Initiative are also calling into question larger assumptions about the nature of U.S.-China competition — and where exactly U.S. strengths really lie.

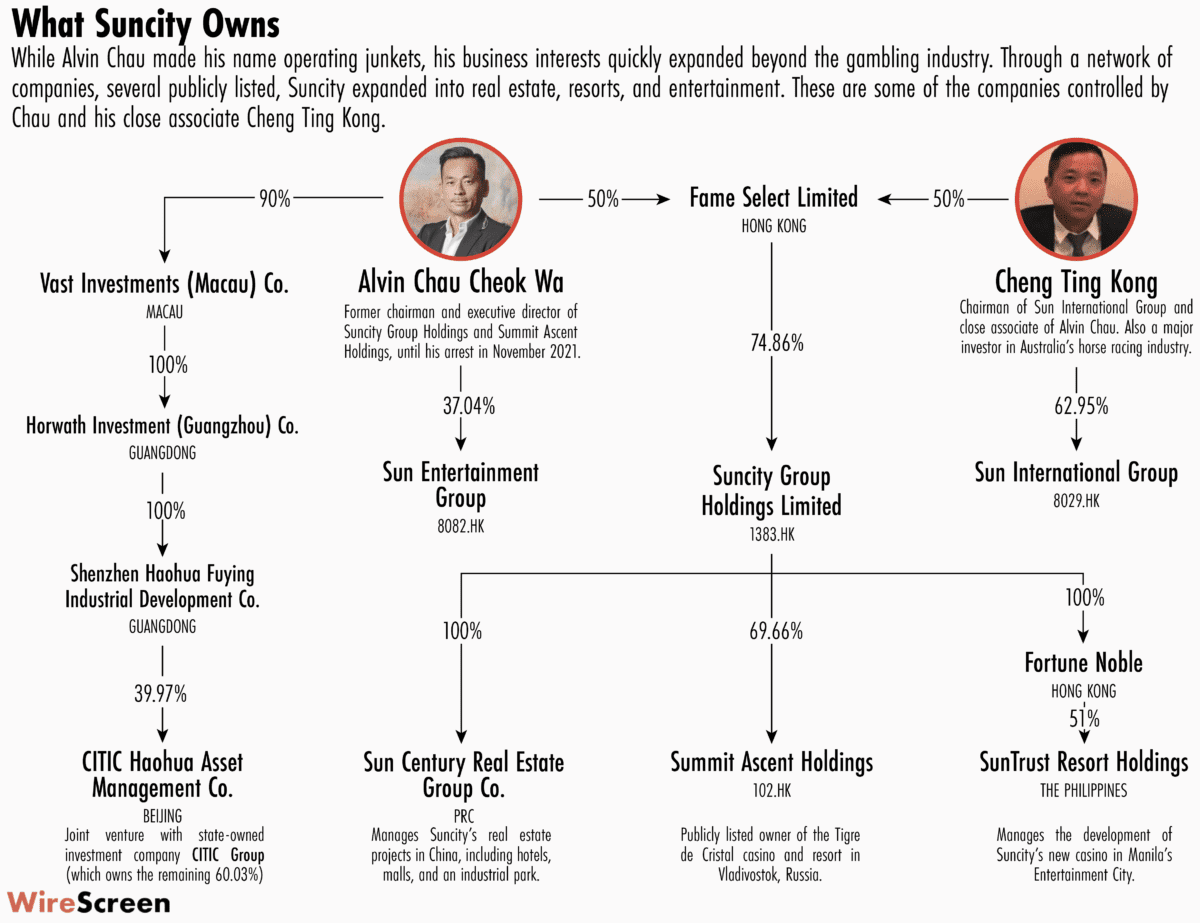

The Big Picture: Sundown for Suncity

Macau’s junket king has fallen. Now that Suncity’s Alvin Chau has been arrested, The Wire’s infographics take a look at how his empire touched casinos from Vladivostok to Melbourne, and what his downfall signifies for the casino industry, the future of Macau, and China more broadly.

A Q&A with Matteo Maggiori

Matteo Maggiori is a professor of finance at the Stanford Graduate School of Business and an authority on global capital flows. In this week’s Q&A with David Barboza, he talks about who really owns listed Chinese companies, the rise of China in the offshore world, and why its ‘mind-boggling’ that international investors have accepted China’s VIE structures.

Matteo Maggiori

Illustration by Lauren Crow

Help Wanted

For decades, China’s ambition to become a leader in science and technology has made attracting and nurturing talent one of the country’s top priorities. Yet, as Anastasiia Carrier reports this week, China is suffering from a shortage of high-skilled labor that seems to be worsening. As one HR executive puts it, for companies large and small, recruiting and retaining candidates right now is “an absolute nightmare.”

Carbon Border Adjustment is China’s Worst Nightmare

The EU has long had a carbon pricing mechanism in place, but it is now taking steps that might strengthen its decarbonization efforts. And as Elettra Ardissino and Eyck Freymann argue in this op-ed, a proposed new tax called the Carbon Border Adjustment Mechanism (CBAM) would hit imports from China especially hard.

Subscribe today for unlimited access, starting at only $19 a month.