Good evening. Do you know what Joe Biden’s China policy is? Because many China experts, according to our cover story this week, have a real hard time describing it. And in some corners, patience is wearing thin. Elsewhere, we have a Q&A with Angela Zhang, the Chinese law expert, on how China regulates; infographics on Tsinghua Unigroup, the embattled chip maker that may be sold to Alibaba; a reported piece on why the WTA’s decision to pull out of China could have implications well beyond the sporting world; and an op-ed about how companies can help reduce U.S.-China tensions. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Biden’s Beijing Bind

When Joe Biden entered office, many China watchers expected great things: the foreign policy veteran had a surprisingly deep history with Xi Jinping, and he fielded an all-star team of advisors with a very clear view of China. But, almost a full year later, criticism of his China policy, such as it exists, is rampant. Katrina Northrop reports this week on the political constraints, the competing priorities, and the deeply held beliefs that have conspired to make for a very elusive policy.

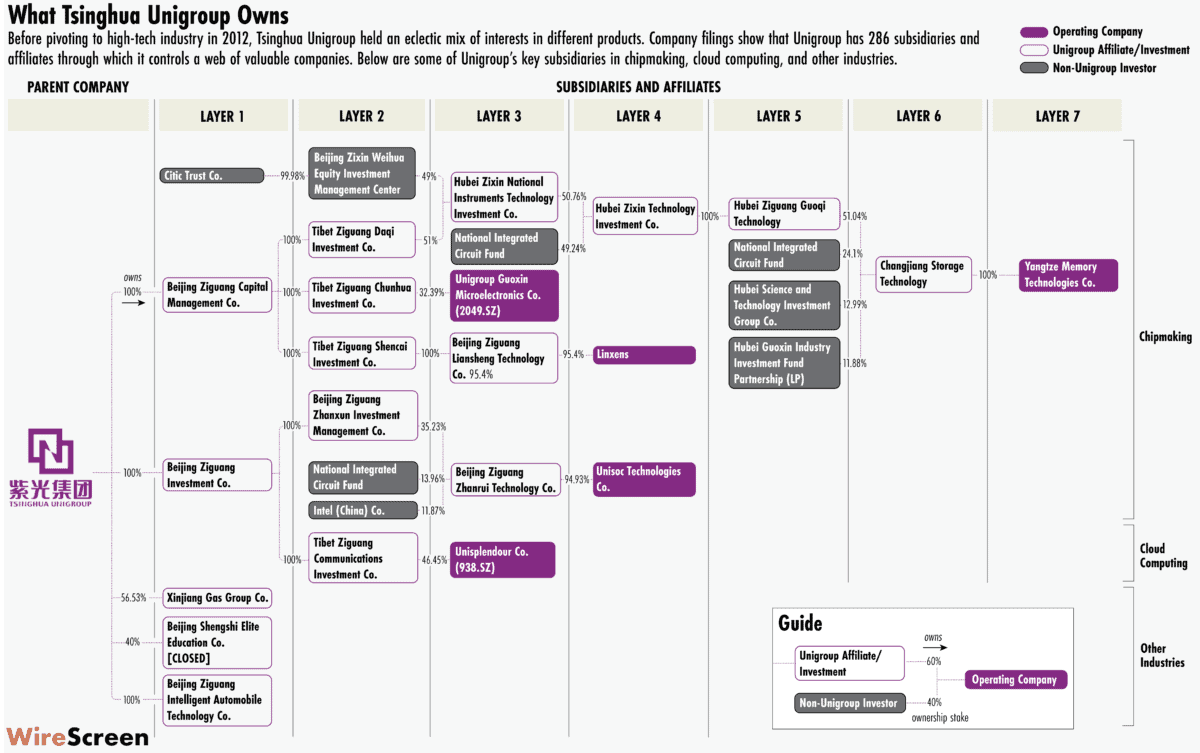

The Big Picture: The Unigroup Bargaining Chip

Alibaba is the frontrunner to take over Tsinghua Unigroup, the debt-saddled semiconductor manufacturer. This week, infographics by Eliot Chen look at Unigroup’s rapid debt-fueled expansion, its many investments, and what a deal could mean for its future.

A Q&A with Angela Huyue Zhang

Angela Huyue Zhang is an expert in Chinese law at the University of Hong Kong and the author of Chinese Antitrust Exceptionalism: How the Rise of China Challenges Global Regulation. In this week’s Q&A with David Barboza, she talks about how China regulates, the advantages of spying, and the value of the Chinese saying: if you loosen up, there will be chaos.

Angela Huyue Zhang

Illustration by Kate Copeland

China’s Double Fault?

The Women’s Tennis Association has suspended all its tournaments in China after the apparent disappearance of former world No. 1 Chinese doubles player Peng Shuai. While the move has earned widespread praise, it is unclear whether increased support for the WTA’s stance on China can compensate for lost revenue there. As Katrina Northrop reports this week, the financial fallout for the WTA will be a matter of keen interest to many other organizations.

The Dutiful Company

Western firms are stuck between a rock and hard place on China. But, as David Hoffman, of the China Center for Economics & Business, argues in this week’s op-ed, U.S. lawmakers need to update their assumptions. The notion that American companies are selling out to China solely in the pursuit of profit, tossing their values to the wind, he says, simply isn’t true nowadays.

Subscribe today for unlimited access, starting at only $19 a month.