Good evening. In 2017, Ethiopia was the world’s fastest growing economy — in large part thanks to its China-built transport and industrial parks. At least on paper, it looked like China’s dragon had stirred Africa’s sleeping lion. But today, with Ethiopia on the brink of collapse and its massive debts to China still unpaid, a different narrative is emerging, and for once, according to this week’s cover story, it has nothing to do with debt traps. Elsewhere, we have a Q&A with Daniel Rosen, the co-founder of Rhodium Group, on how to situate yourself on the China Bull-Bear spectrum; a reported piece on how the global supply chain bottleneck has been a boon for Chinese shipbuilders — and potentially the Chinese Navy; infographics on the companies behind China’s Poverty Alleviation Campaign; and an op-ed from Matt Turpin, a former National Security Council Director for China, about why the U.S. is, in fact, in a cold war with China. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Stalled Dreams

When China loaned Ethiopia more than $2.5 billion to build the Addis-Djibouti Railway, it was cultivating a unique relationship in Africa that it hoped would unlock enormous economic potential. In fact, as Sean Williams reports in this week’s cover story, Beijing’s investments in Ethiopia were supposed to be the crown jewel of its Belt and Road Initiative in Africa. But now, with the railway mostly unusable, massive debts unpaid and Ethiopia on the brink of collapse, China’s decades-old Africa strategy may be starting to change.

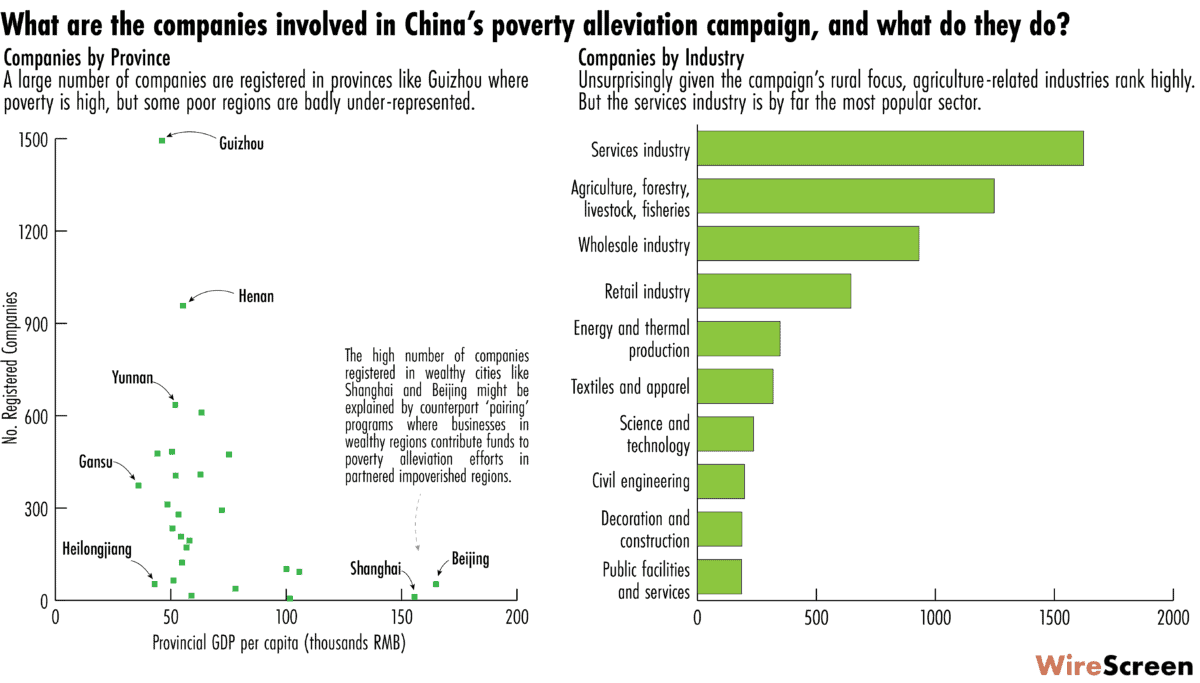

The Big Picture: The Trickle-Down Economics in China’s Poverty Alleviation Drive

Companies, not individuals, have arguably benefited the most in financial terms from Xi Jinping’s signature policy initiative. A review of company registrations carried out by The Wire found thousands of Chinese companies, ranging widely in value, with apparent links to the poverty alleviation campaign. This week, infographics by Eliot Chen examine what they reveal about how China’s anti-poverty effort has worked in practice.

A Q&A with Daniel Rosen

Dan Rosen is a founding partner of Rhodium Group, where he leads the China research team. He has nearly three decades of experience analyzing China’s economy and investment environment. In this week’s Q&A with Andrew Peaple, he explains how he gets situated on the China Bull-Bear spectrum, why money flows into China are increasingly short-term, and why Beijing desperately needs Wall Street firms to stay in the game.

Daniel Rosen

Illustration by Lauren Crow

Shaping Up and Shipping Out

Thanks to the supply chain bottleneck, China’s shipbuilders are in high demand — a potential boon to the country’s Navy. As Anastasiia Carrier reports this week, state-owned companies like China State Shipbuilding Corporation (CSSC) — the world’s biggest shipbuilder — have taken a leading role in commercial shipbuilding while also playing a vital role in making China’s navy the world’s largest. Now, as orders for Chinese-built ships pour in this year, some are wondering how much the Chinese Navy is benefiting.

Yes, This is a Cold War

The similarities between the ‘Cold War’ (a long-term, strategic competition between the Soviet Union and the United States that spanned more than four decades) and the current ‘cold war’ (a long-term, strategic competition between the People’s Republic of China and the United States of America) are much closer than many admit, argues Matt Turpin, a former National Security Council Director for China, in this week’s op-ed. This is more than just an academic debating point. We risk serious errors as a nation if we shy away from reality because we find it distasteful.

Subscribe today for unlimited access, starting at only $19 a month.