Good Morning. Welcome to The Wire’s daily news roundup. Each day, our staff gathers the top China business, finance, and economics headlines from a selection of the world’s leading news organizations.

The Wall Street Journal

Global Stocks Slide on Fears Over Fresh Virus Outbreaks — Stock futures and international indexes fell, as investors questioned whether fresh outbreaks of the new coronavirus could hold back global economic recovery.EV Battery Makers’ Euro Trip Could End in

LISTEN NOW

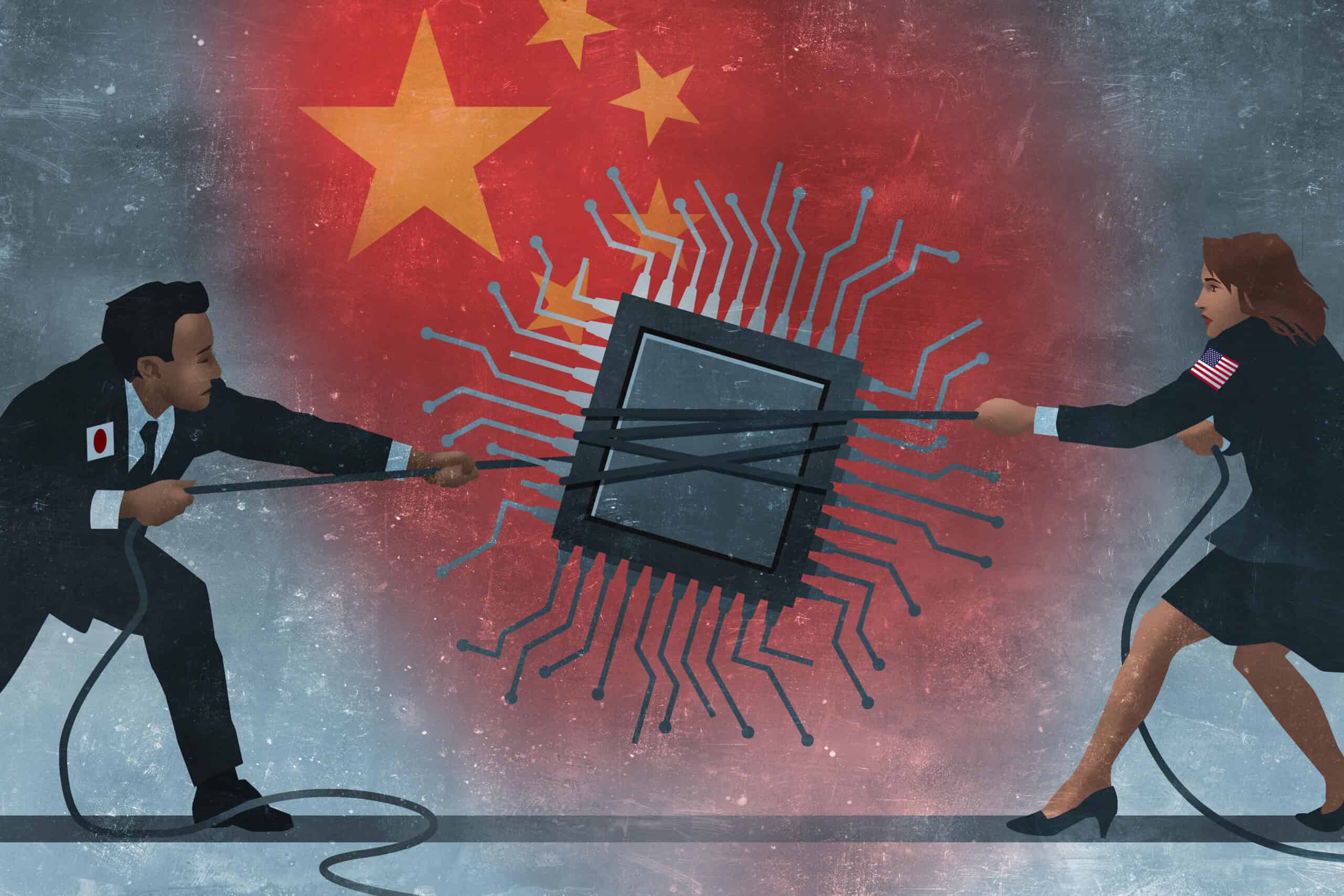

Face-Off: U.S. vs. China

A podcast about how the two nations,

once friends, are now foes.