Earlier this month, the ratings agency Moody’s cut its outlook on China’s sovereign credit rating to negative, citing risks from a deepening property crisis and a prolonged growth slowdown. In fact, Moody’s now predicts that annual economic growth will fall to 4 percent in 2024 and 2025, before slowing further, to 3.8 percent, on average, for the rest of the decade. Potential growth will decline to 3.5 percent by 2030. A major driver of this slowdown will be “weaker demographics.”

Not surprisingly, China’s leaders said they were “disappointed” with the downgrade, claiming that the economy still has “huge development resilience and potential” and will remain a powerful engine of global growth. But China’s assessment of its potential growth is based on deeply flawed forecasts.

A CGTN video on the symposium on economic and social work, attended by Justin Yifu Lin, Beijing, August 24, 2023. Credit: CGTN

On August 24, 2020, Chinese President Xi Jinping convened nine economists – including former World Bank Chief Economist Justin Yifu Lin – for a symposium that would guide the 14th Five-Year Plan for economic and social development. Based on that discussion, Xi declared that it was “completely possible” for China to double its GDP per capita over the next 16 years.

Lin explained the logic behind this optimistic forecast. In 2019, China’s GDP per capita was only 22.6 percent of the level in the United States (calculated by purchasing power parity). Germany was at the same level in 1946, Japan in 1956, and South Korea in 1985, and their economies grew at an average rate of 9.4 percent, 9.6 percent, and 9 percent, respectively, over the subsequent 16 years.

Even hampered by low population growth and a trade and technology war with the U.S., Lin concluded, China’s potential annual growth – 8 percent in 2019-35, and 6 percent in 2036-50 – could easily translate into real annual growth of 6 percent and 4 percent, respectively. Per this forecast, China’s GDP would surpass that of the U.S. in 2030, and be twice as large by 2049, at which point there would be four times as many Chinese as Americans.

For the country’s sake, the decisions made at the upcoming Third Plenum of the Communist Party of China must reflect reality, not more pie-in-the-sky predictions.

Lin had previously made even more optimistic predictions. In 2005, he forecast that China’s economy would be 1.5-2 times larger than America’s by 2030, and that there would be five times as many Chinese. In 2008, he was even more sanguine, predicting that China’s economy would be 2.5 times the size of America’s by 2030. In 2011, he was back to forecasting that China’s economy would be twice as large as that of the U.S. in 2030, and in 2014, he returned to his 2005 forecast that China’s economy would be 1.5-2 times larger.

Over the years, China’s leaders have embraced Lin’s forecasts as a kind of vindication of their political system and governance model. “The world is undergoing profound changes unseen in a century,” Xi declared in 2021, “but time and situation are in our favor.” Similarly, Ma Zhaoxu, the vice minister for foreign affairs, pledged last year that, in the face of efforts to impede China’s rise, Chinese diplomats would uphold the “spirit of struggle” to ensure the country’s continued development. During the COVID-19 pandemic, leaders eagerly presented China’s response as a reflection of its “institutional advantage.”

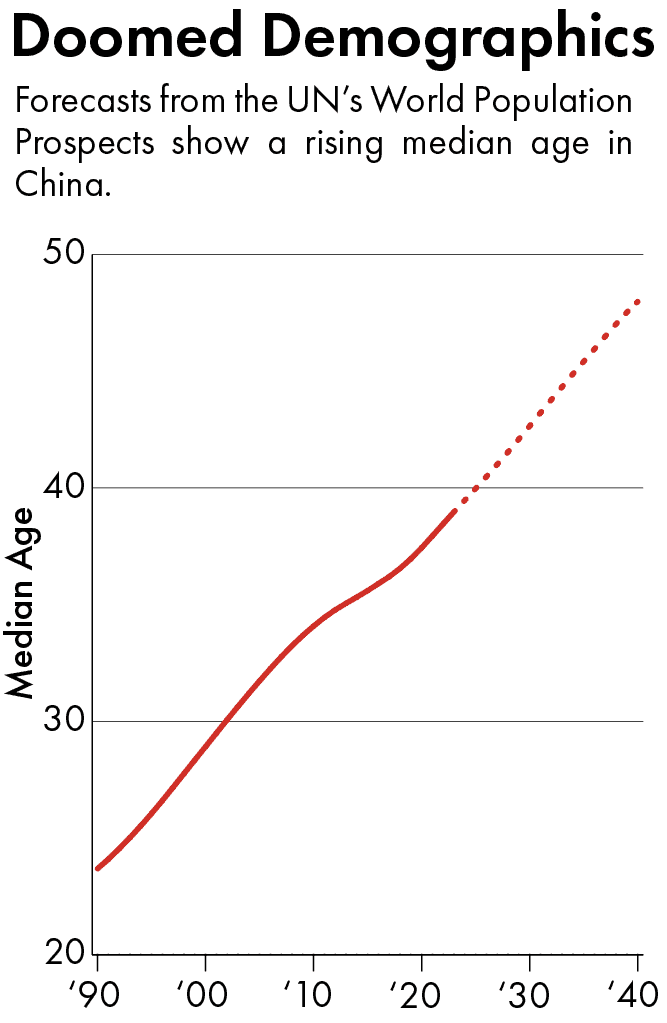

But, however appealing to China’s leaders Lin’s economic forecasts may be, they have proved wildly wrong, not least because they fail to account for China’s bleak demographic outlook. Both a higher median age and a higher proportion of people over 64 are negatively correlated with growth, and on both points, China is doing far worse than the three countries to which Lin compares it.

When Germany’s GDP per capita was equivalent to 22.6 percent that of the U.S., its median age was 34. In Japan and South Korea, the median age was just 24. After those 16 subsequent years of strong growth, the median age in the three countries stood at 35, 30, and 32, respectively. Contrast that with China, where the median age was 41 in 2019, and will reach 49 in 2035.

Likewise, at the beginning of the 16-year period to which Lin refers, the proportion of people over 64 in Germany, Japan, and South Korea was 8 percent, 5 percent, and 4 percent, respectively; at the end, it stood at 12 percent, 7 percent, and 7 percent. In China, that proportion was 13 percent in 2019 and will be 25 percent in 2035. In the 16 years after the proportion of people over 64 reached 13 percent in Germany (in 1966) and Japan (in 1991), these economies’ average annual growth was only 2.9 percent and 1.1 percent, respectively.

Moreover, in Germany, Japan, and South Korea, the labor force (aged 15-59) began to decline in the 12th, 38th, and 31st years after their per capita GDP equaled 22.6 percent that of the U.S.. China’s began to decline in 2012.

If one imagines China’s economy as an airplane, the 1978 launch of the policy of reform and opening up would have been what ignited the fuel – the young workers – that enabled the economy to take off and fly at high speeds for three decades. But, in 2012, the fuel began to run low, causing the plane to decelerate.

Instead of adjusting to their new reality, the Chinese authorities – heeding the advice of economists like Lin – continued to lean on the throttle by investing heavily in real estate, thereby creating a massive property bubble. It is obviously dangerous to continue flying at a high speed without enough fuel, which is one reason why some economies are attempting to “de-risk” their trade by shifting supply chains away from China, which is currently more than 140 economies’ main trading partner.

Western observers tend to focus on criticizing Chinese leaders’ rhetoric and decisions. But pointing out the errors in the forecasts that form the basis of Chinese policy may be more constructive. For the country’s sake, the decisions made at the upcoming Third Plenum of the Communist Party of China must reflect reality, not more pie-in-the-sky predictions.

Copyright: Project Syndicate, 2023.

Yi Fuxian, a senior scientist at the University of Wisconsin-Madison, spearheaded the movement against China’s one-child policy. His book Big Country with an Empty Nest, initially banned, now ranks first in China Publishing Today’s 100 Best Books of 2013 in China.