Credit: DCSX

When Water Years Holdings, a small Chinese firm that sells wine and candy made from blueberries, was looking to go public in 2017, there were few options. The company, which had earned a profit of less than $50,000 in the prior year, was too small to qualify for a listing on the Shanghai or Hong Kong stock exchanges. New York and Singapore were also out of the question.

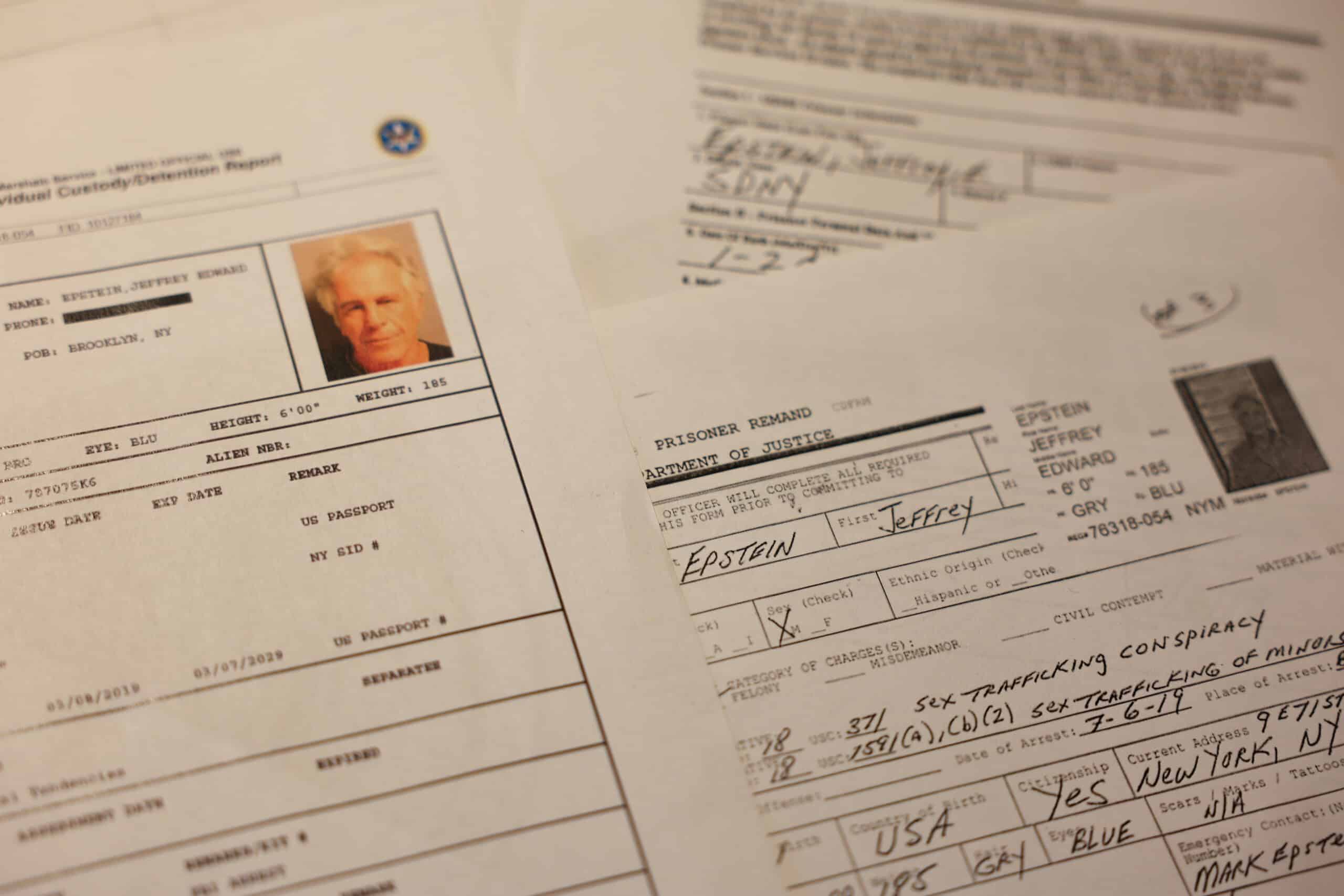

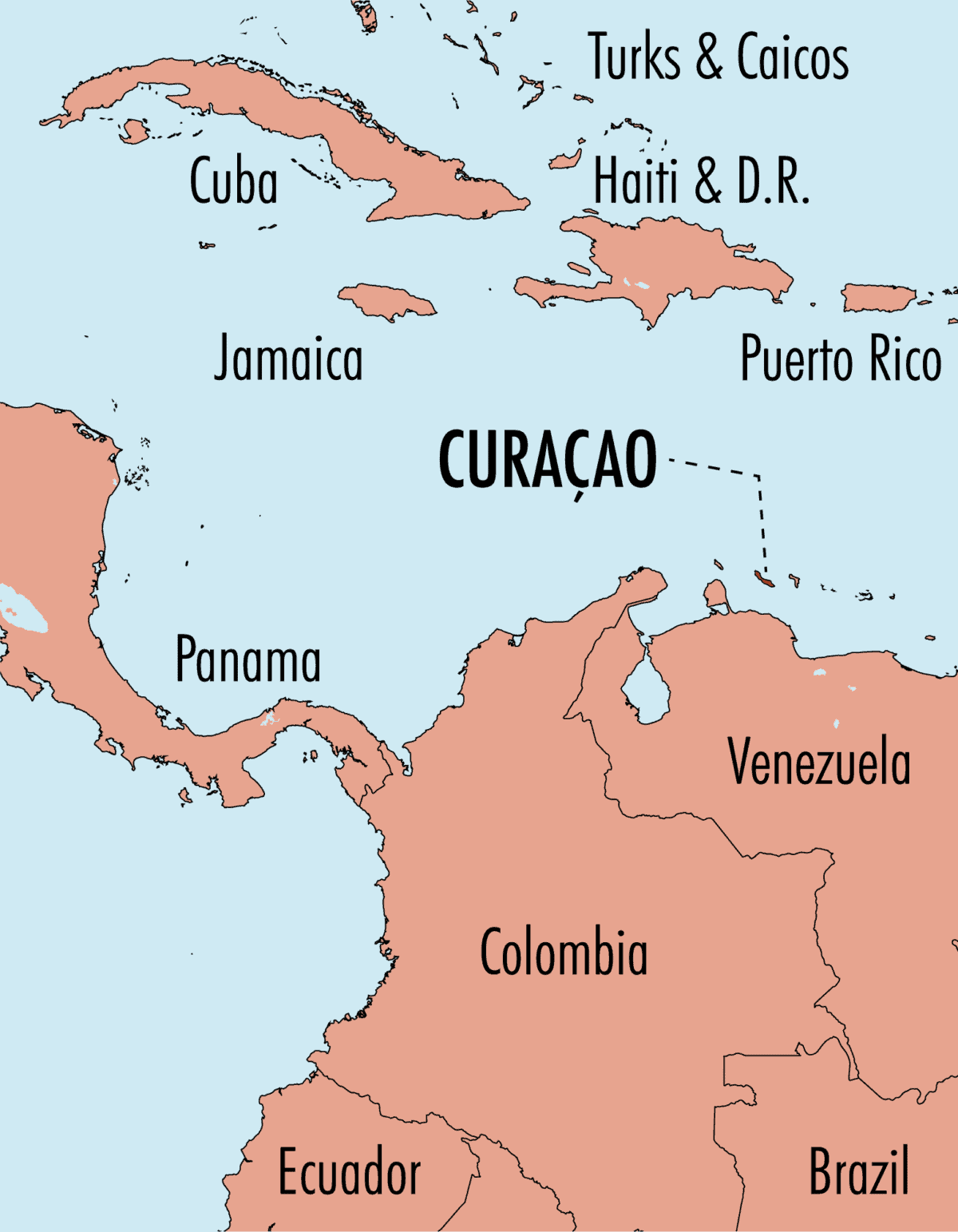

So company executives hopped on a flight to Curaçao, a small Dutch territory about 40 miles off the coast of Venezuela, to join the Dutch Caribbean Securities Exchange (DCSX). It was one of the island’s first Chinese listings, and in the bourse’s ceremonial hall, executives banged a ceremonial gong and exchanged champagne toasts with Curaçao power brokers, such as the territory’s minister of finance.

“In the future, there will be a steady flow of Chinese companies entering Europe’s capital market,” Liu Yang, the chairman of Water Years, said at a press conference held in Beijing a month after the listing. “For companies that need financing or to standardize their management, I think this is a big positive.”

Since then, 30 other Chinese firms have listed in Curaçao, including China Metro Rural Holdings, an agricultural logistics firm that at one time was listed on the New York Stock Exchange before going private in 2016. In fact, nearly two-thirds of the 50 companies listed on this fledgling South American stock exchange are headquartered in China. It’s a sign of just how far Chinese firms are willing to go to be listed on an overseas stock exchange.

“It’s likely a listing of convenience, because if you’re a listed security you have a bigger pool of investors capable of investing in your company,” says Fraser Howie, a Singapore-based financial analyst and co-author, with Carl E. Walter, of Privatizing China: The Stock Markets and their Role in Corporate Reform. “There are a number of these types of exchanges.”

While China boasts a thriving stock market of its own, with major exchanges in Shanghai and Shenzhen, listing in China isn’t so easy or even always preferred; many Chinese firms have sought overseas listings. Today, for instance, 241 Chinese firms are listed in New York, 46 trade in London, 32 in Singapore and 5 in Sydney, according to data from Capital IQ, a division of S&P.

Foreign listings appeal for a number of reasons, experts say. For one, they give Chinese firms the ability to circumvent Beijing’s strict capital controls and accumulate cash for overseas deals or acquisitions. They also represent a branding opportunity for a firm that wants to be seen as global. Also, many institutional investors outside of China set guidelines that require them to invest the majority of their capital in listed securities; and for that reason, listing on any legitimate exchange is helpful.

“The growth in China is phenomenal,” says Dylan Sutherland, a professor at Durham University Business School in the U.K. and an authority on Chinese firms. “There are so many successful businesses, but there are challenges in raising capital. So, many firms have to look elsewhere.”

For decades, companies eager for a lower cost stock listing overseas, with relatively loose requirements, turned to the Luxembourg Stock Exchange, and more recently the Bermuda Stock Exchange. For $3,000 in listing fees, or even $350, a firm could acquire a listing. And in this obscure world of finance, the listed company did not necessarily need to raise capital in the listing, like an IPO, or even have shares trade on the exchange. A listing alone is sufficient to do business with major banks and global investors. The DCSX, in other words, is really following in the footsteps of the Bermuda Stock Exchange, seeking to build an offshore financial center.

DCSX and the Water Years Holdings celebrated the listing in 2017.

Still, Curaçao would seem to be an unlikely place for Chinese listings. The South American territory has just 160,000 residents and is better known for its coral reefs and colonial style architecture. In fact, the developers of the island stock exchange say they had no intention of luring Chinese firms.

Rene Romer, the senior commercial advisor for the Curaçao exchange, says that when it began operating in 2017, the bourse hoped the territory’s historic ties to the Netherlands would attract Latin American companies seeking to raise money from European investors. Instead, Chinese firms came.

It’s likely a listing of convenience, because if you’re a listed security you have a bigger pool of investors capable of investing in your company.

Fraser Howie, an authority on Asian stock markets

Many came because of China’s growing presence in the world of offshore finance. A large number of Chinese firms, including Alibaba and Tencent, are domiciled offshore, in the Caymans or British Virgin Islands. And corporate service firms that specialize in offshore structures helped promote the new exchange in China, boasting listing fees as low as $10,000. Before long, a stream of small and medium sized Chinese firms began arriving in Willemstad, the capital.

Like many securities listed on the Bermuda and Luxembourg stock exchanges, there is little or no share trading. In fact, in recent weeks, only a handful of securities on the DCSX have traded at all.

Now, Curaçao lays claim to the only China-dominated stock exchange outside of China. Alongside a Colombian banana company and a Panamanian pharmaceutical firm are Chinese firms like MC Agro International Holdings, which makes plastic nets for bales of hay (ticker symbol MCAG). The company, which says its market value is about $60 million, says it is a “national high tech enterprise.”

Eli Binder is a New York-based staff writer for The Wire. He previously worked at The Wall Street Journal, in Hong Kong and Singapore, as an Overseas Press Club Foundation fellow. @ebinder21